Most debt lead generation methods are broken. Cold form fills, recycled leads, and delayed callbacks result in low contact rates, wasted ad spend, and sales teams chasing prospects who are not ready or willing to talk. In debt relief, timing is everything.

When motivated consumers do not get immediate help, they lose interest, choose a competitor, or abandon the process entirely. Poorly sourced leads can also expose your business to TCPA violations, compliance risks, and long-term brand damage.

Debt live transfers solve this by connecting pre-qualified, consented consumers directly to your sales team in real time at the exact moment they are seeking debt relief. When executed correctly, live transfers deliver higher conversion rates, shorter sales cycles, better consumer experiences, and stronger compliance protection.

TL;DR

- What it is: A real-time phone handoff of a pre-qualified consumer actively seeking debt relief

- Why it works: Speed plus intent leads to higher conversions

- Who it’s for: Debt settlement, consolidation, tax debt, and credit repair companies

- Key benefits:

- Higher close rates

- No cold calling

- Reduced lead waste

- Stronger TCPA compliance when done correctly

- Bottom line: Debt live transfers are one of the highest-performing, 2026-ready lead sources in debt relief if they are built on quality, consent, and compliance.

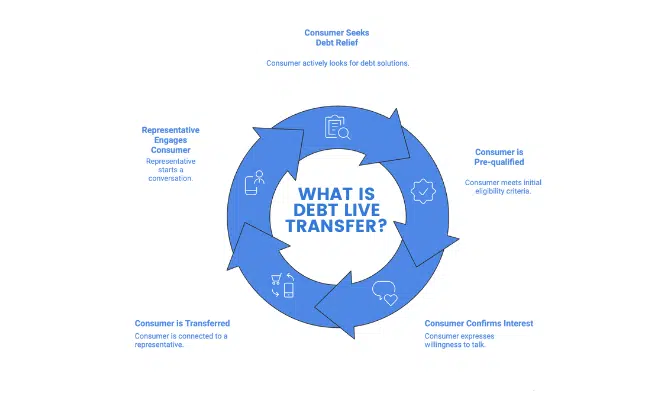

What Is a Debt Live Transfer?

A debt live transfer is a real-time lead delivery method where a pre-qualified consumer who is actively seeking debt relief is connected by phone directly to a debt settlement or financial services representative.

Unlike traditional leads that are sent by email or form submission, a live transfer happens while the consumer is engaged and ready to talk. The prospect is screened for eligibility, confirms interest, and then is immediately transferred to your team to continue the conversation without delay.

This model removes guesswork from the sales process. Your representatives are not calling cold lists or waiting hours to follow up. They are speaking with someone who has already expressed intent, meets minimum qualification criteria, and has given consent to be contacted.

As of early 2026, debt live transfers are gaining momentum due to two major market forces:

- Total U.S. consumer debt is approaching $18.4 trillion, increasing demand for debt relief solutions

- Lead qualification is increasingly AI-vetted, improving accuracy and conversion rates

How Debt Live Transfers Differ From Traditional Leads

Traditional debt leads often rely on form fills or database purchases. These leads may be:

- Reached hours or days after submission

- Contacted by multiple companies

- Unqualified or no longer interested

Debt live transfers eliminate these issues by focusing on timing and intent. The prospect is engaged at the moment of need, transferred live, and typically delivered exclusively to one business.

Speed plays a critical role. More than 75% of sales go to the first company to contact a prospect, and live transfers guarantee this first-mover advantage.

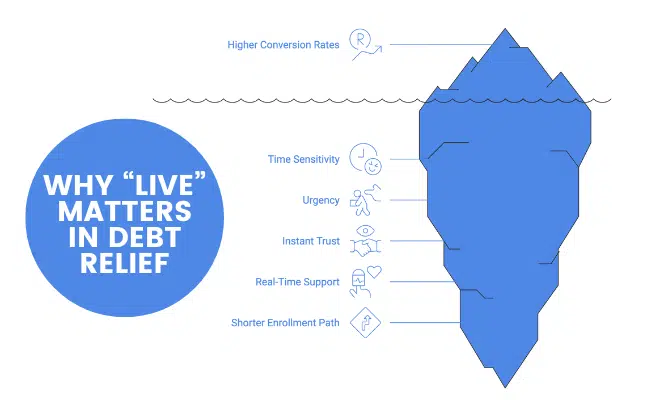

Why “Live” Matters in Debt Relief

Debt relief is time-sensitive and emotionally driven. Consumers seeking help are often overwhelmed and motivated to act immediately. The longer it takes to reach them, the lower the likelihood of conversion.

Live transfers capitalize on this urgency by allowing your team to:

- Build trust instantly

- Address hardship in real time

- Shorten the path from interest to enrollment

This is why debt live transfers consistently outperform form leads and call-back-based campaigns.

How Debt Live Transfers Work: Step-by-Step

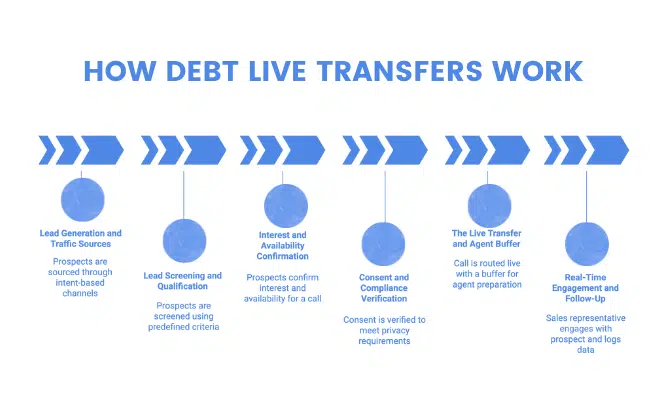

Debt live transfers follow a structured process designed to connect only qualified, motivated consumers to your sales team. Each step is critical to conversion quality, compliance, and overall campaign performance.

1. Lead Generation and Traffic Sources

The process begins with intent-based lead generation. Prospects are sourced through channels where consumers are actively seeking debt relief, including:

- Paid search and display advertising

- Social media campaigns

- Inbound call campaigns

- Native and content-driven traffic

Unlike volume-based lead buying, debt live transfers focus on consumers who are already researching solutions to their financial hardship.

2. Lead Screening and Qualification

Before a transfer occurs, prospects are screened using predefined criteria. Common qualification standards in 2026 include:

- Minimum unsecured debt amount, often $10,000 or more

- Employment or income status

- No active bankruptcy

- Willingness to explore debt relief options

This step ensures that only viable prospects are passed to your team.

3. Interest and Availability Confirmation

Once qualified, the prospect is asked two critical questions:

- Are you interested in speaking with a debt relief specialist right now?

- Do you have time to continue this call?

Only consumers who confirm both are eligible for a live transfer. This reduces hang-ups and improves call quality.

4. Consent and Compliance Verification

Before the call is transferred, consent is verified to meet TCPA and state privacy requirements. This includes:

- Prior express written consent

- Confirmation of the specific company receiving the call

- Documentation through digital consent tools

Compliance verification protects both the lead provider and the buyer.

5. The Live Transfer and Agent Buffer

Once approved, the call is routed live to your sales team. Most systems provide a short buffer period, often around 30 seconds, allowing the agent to review:

- Basic consumer information

- Debt type and range

- Location and hardship context

This preparation improves the quality of the initial conversation.

6. Real-Time Engagement and Follow-Up

After the transfer, the sales representative continues the conversation, evaluates eligibility, and guides the prospect toward enrollment or next steps. Call data and outcomes are logged in the CRM for:

- Conversion tracking

- Quality assurance

- Ongoing optimization

What Data Is Shared During a Debt Live Transfer (2026 Standards)

A debt live transfer shares essential consumer information in real time so sales representatives can engage effectively while maintaining compliance. This data is delivered through two channels: a data screen that appears for the agent and the live phone handoff.

Understanding what data is shared is critical for compliance, sales readiness, and trust.

1. Consumer Contact and Routing Information

This information ensures the call reaches the correct representative and meets licensing requirements:

- Full name verified during screening

- Active phone number being transferred

- City, state, and ZIP code for geographic routing

Accurate location data is especially important for state-level debt relief regulations.

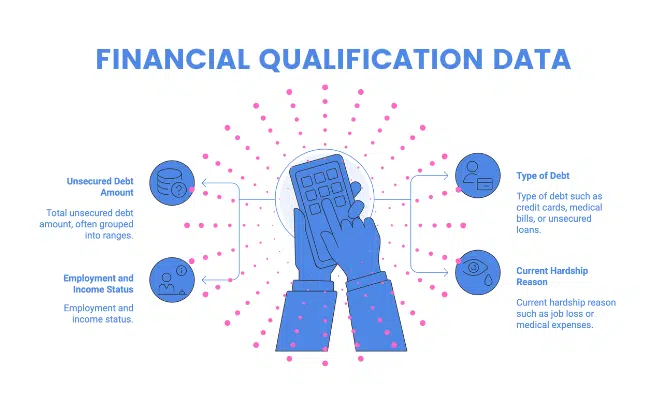

2. Financial Qualification Data

Financial context helps agents determine program eligibility and guide the conversation:

- Total unsecured debt amount, often grouped into ranges

- Type of debt such as credit cards, medical bills, or unsecured loans

- Employment and income status

- Current hardship reason such as job loss or medical expenses

This information allows agents to lead with empathy while staying focused on viable solutions.

3. Compliance and Verification Data

Compliance data is a core component of modern debt live transfers:

- TCPA consent records, including digital proof such as Jornaya LeadiD or TrustedForm

- Identity verification indicators when applicable

- IP address and device data used for fraud prevention

These records help protect buyers in the event of audits or legal disputes.

4. Real-Time Call Intelligence

Live call data improves agent performance and accountability:

- Call duration tracking

- IVR selections passed through to the agent

- Transfer timestamps

This intelligence supports quality assurance and campaign optimization.

Privacy and Disclosure Requirements

In 2026, privacy laws such as CCPA and emerging state regulations require that consumers receive clear notice about:

- What data is being shared

- Which specific third parties will receive it

Failure to disclose this information can result in compliance violations and loss of consumer trust.

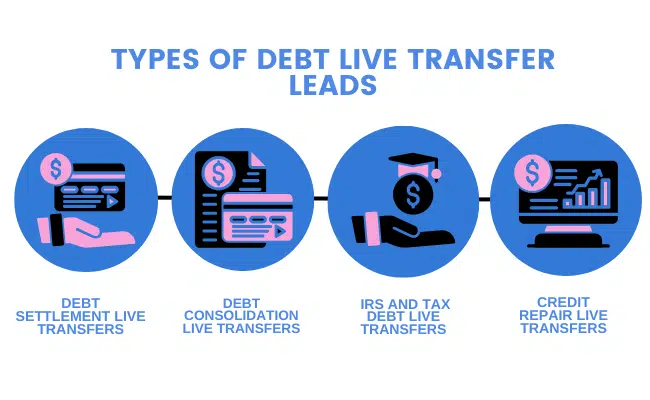

Types of Debt Live Transfer Leads

Debt live transfers can be tailored to different financial needs and programs. Understanding the types of debt leads available helps businesses align campaigns with their services and qualification requirements.

1. Debt Settlement Live Transfers

These leads connect consumers who want to reduce their total debt balance through negotiation. They typically involve:

- Unsecured debt such as credit cards or medical bills

- Minimum debt thresholds, often $10,000 or more

- Consumers experiencing financial hardship

Debt settlement live transfers are the most common and highest-converting category in debt relief marketing.

2. Debt Consolidation Live Transfers

Debt consolidation leads focus on consumers looking to combine multiple debts into a single monthly payment. These prospects may:

- Have steady income

- Be less delinquent than settlement leads

- Seek lower interest rates or simplified payments

Qualification standards are often stricter due to underwriting requirements.

3. IRS and Tax Debt Live Transfers

These leads connect individuals or businesses facing tax liabilities with professionals who specialize in tax resolution. Common traits include:

- Notices from the IRS or state tax agencies

- Wage garnishments or liens

- Urgent need for compliance or negotiation

Tax debt live transfers require strong compliance and specialized handling.

4. Credit Repair Live Transfers

Credit repair live transfers connect consumers with specialists who help improve credit profiles. These prospects may:

- Have lower debt balances

- Be earlier in the financial recovery process

- Seek guidance before pursuing settlement or consolidation

These leads are often used as an entry point into broader financial services.

Choosing the Right Debt Lead Type

Selecting the right live transfer type depends on:

- Your service offerings

- Minimum qualification criteria

- Sales team expertise

- Compliance requirements

Aligning lead type with your business model improves close rates and customer satisfaction.

Key Benefits of Debt Live Transfers for Businesses

Debt live transfers are one of the highest-performing lead sources in the debt relief industry because they combine speed, intent, and qualification. When executed correctly, they improve both efficiency and profitability.

Higher Conversion Rates

Live transfers connect your sales team with consumers at the peak of intent. The prospect has already expressed interest, met qualification criteria, and agreed to speak in real time. This results in:

- Fewer unproductive calls

- Higher close rates

- More predictable performance

Many businesses report live transfers as their top converting lead source.

Reduced Sales Friction

Traditional lead generation requires follow-up, repeated dialing, and extended sales cycles. Debt live transfers remove these obstacles by:

- Eliminating cold outreach

- Reducing time spent chasing leads

- Allowing reps to focus on qualified conversations

This improves productivity and morale across sales teams.

Improved Cost Efficiency and ROI

Although live transfers often cost more per lead than form fills, they typically deliver a lower cost per enrollment. Key factors include:

- Pay-per-call pricing models

- No charge or credit policies for invalid calls

- Less wasted spend on unresponsive prospects

The result is stronger ROI despite higher upfront costs.

Better Consumer Experience

Consumers seeking debt relief are often stressed and overwhelmed. Live transfers improve their experience by:

- Providing immediate assistance

- Reducing repetitive explanations

- Creating a more personal interaction

A better experience leads to higher trust and stronger long-term outcomes.

Compliance Requirements for Debt Live Transfers in 2026

Debt live transfers operate in a highly regulated environment. Compliance is not optional, and failures can expose both lead generators and buyers to serious legal and financial risk. Understanding the core requirements is essential before launching or scaling any campaign.

Prior Express Written Consent (PEWC)

To legally contact consumers using automated or prerecorded systems, businesses must obtain prior express written consent. In 2026, this requires:

- Active opt-in checkboxes that consumers manually select

- Clear and conspicuous disclosure language

- Consent granted for a specific company, not a generic group of partners

Pre-checked boxes or vague disclosures are non-compliant and increase TCPA exposure.

Digital Consent Documentation

Modern lead providers use third-party verification tools to create a defensible record of consent. These records typically include:

- A unique consent ID

- Timestamp and IP address

- The exact disclosure text the consumer saw and accepted

Platforms such as Jornaya LeadiD and TrustedForm are commonly used, and records are usually retained for at least five years to defend against litigation.

Do Not Call and Registry Scrubbing

Before any transfer occurs, lead data must be scrubbed against multiple registries:

- National and state Do Not Call lists

- Known TCPA litigators

- Reassigned Number Database records

This process reduces the risk of calling individuals who did not provide valid consent.

Call Timing and Revocation Rules

Compliance systems enforce operational safeguards such as:

- Blocking calls outside of legal hours, typically 8 AM to 9 PM local time

- Processing opt-out requests through any reasonable method

- Updating revocation requests within required timeframes

Failure to honor revocation requests is a common source of TCPA complaints.

Privacy and Data Disclosure Obligations

State privacy laws require transparency around data sharing. Consumers must be informed of:

- What personal data is collected

- How it is used

- Which specific third parties receive it

Clear disclosure builds trust and reduces regulatory risk.

Why Businesses Choose LeadAdvisors for Debt Live Transfers

When evaluating debt live transfer providers, experience, compliance standards, and operational transparency matter. LeadAdvisors is an example of a provider that aligns with what high-performing debt relief companies look for in a long-term partner.

LeadAdvisors specializes in verified, high-intent debt live transfers designed to connect businesses with consumers who are actively seeking debt relief and are ready to speak in real time.

What Sets LeadAdvisors Apart

Verified and Qualified Transfers

All debt live transfers are screened against defined qualification criteria, including debt thresholds, financial status, and consumer intent. This ensures sales teams spend time speaking only with viable prospects.

Compliance-First Approach

LeadAdvisors emphasizes TCPA and privacy compliance by:

- Collecting prior express written consent

- Providing digital consent records

- Supporting one-to-one consent standards

- Enforcing call timing and opt-out controls

This reduces legal risk while protecting consumer trust.

Real-Time Call Delivery and Tracking

Live transfers are delivered instantly, with supporting call data and tracking tools that allow businesses to monitor performance, review calls, and optimize campaigns in real time.

No-Charge Policies for Invalid Calls

Businesses are not charged for missed or invalid calls, ensuring budgets are spent only on successful, connected conversations.

Scalable Campaigns Across Financial Verticals

In addition to debt settlement live transfers, LeadAdvisors supports multiple financial services verticals, allowing businesses to scale and diversify without switching providers.

Campaign Operations and Best Practices

Running a successful debt live transfer campaign requires more than good leads. Operational discipline, agent readiness, and ongoing optimization play a major role in results.

Campaign Setup and Launch

Most debt live transfer campaigns can be launched within a few business days once requirements are finalized. Best practices include:

- Defining qualification criteria upfront

- Setting daily and hourly volume caps

- Aligning call delivery with staffing capacity

Starting with controlled volume helps prevent missed calls and quality issues.

Agent Readiness and Call Handling

Live transfers perform best when agents are trained for inbound, high-intent conversations. Effective agents:

- Use a warm and professional tone

- Focus on evaluating eligibility before selling

- Avoid aggressive or scripted openings

- Build trust quickly by acknowledging the consumer’s situation

Poor phone etiquette is a common reason for hang-ups and refund disputes.

Managing Missed Calls and Hang-Ups

Missed calls reduce campaign efficiency and can affect billing outcomes. To minimize issues:

- Ensure calls are answered promptly

- Monitor ring times and agent availability

- Return missed calls quickly when permitted

Many providers offer clear policies on when calls qualify for credits, so understanding these rules is essential.

Reporting, QA, and Optimization

Ongoing performance management is key to scaling successfully. Best practices include:

- Reviewing call recordings regularly

- Monitoring conversion and disposition data

- Providing feedback to both agents and providers

Real-time reporting allows businesses to identify issues early and make data-driven adjustments.

The Future of Debt Live Transfers

Debt live transfers are not slowing down. As consumer behavior, regulation, and technology evolve, live transfer campaigns are becoming more intelligent, more compliant, and more efficient.

Smarter Lead Qualification With AI

Artificial intelligence is increasingly used before a live transfer ever occurs. AI-driven systems can:

- Pre-screen leads using behavioral signals

- Identify low-quality or fraudulent submissions

- Predict likelihood of enrollment based on historical data

This improves lead quality while reducing wasted transfers.

Automation Without Losing the Human Touch

Automation is enhancing, not replacing, live transfers. Examples include:

- Automated qualification questions before agent involvement

- Intelligent call routing based on debt type or geography

- CRM automation for tracking and compliance

Human agents remain essential, especially in sensitive debt relief conversations.

Stronger Compliance and Privacy Controls

Regulatory pressure continues to increase at the state level. Future-focused providers are investing in:

- More granular consent disclosures

- Enhanced data access controls

- Improved audit trails and reporting

Compliance will continue to be a differentiator between high-quality providers and volume-driven operations.

Better Sales and Marketing Alignment

As live transfer data becomes more detailed, businesses can:

- Refine targeting and qualification criteria

- Improve scripting and agent training

- Optimize campaigns based on real conversion data

This alignment leads to higher efficiency and better consumer outcomes.

Frequently Asked Questions

How do debt live transfers fit into the debt settlement sales process?

Debt live transfers support the debt settlement sales process by delivering real-time leads directly to your team once pre-qualifying leads meet certain criteria. This allows debt settlement companies to focus on speaking with qualified leads instead of spending time on outbound call efforts or low-intent debt leads. The result is smoother closing deals, higher conversion rates, and more efficient customer acquisition.

Can debt live transfers help identify the highest quality debt holders?

Yes. Through a structured pre-screening process, debt live transfers help identify debt holders with sufficient total debt, including credit card debt and medical bills, who are actively seeking debt relief. This ensures your team connects only with highly qualified leads who are more likely to enroll in a debt settlement program.

How do debt live transfers improve follow-up and reduce lead loss?

Because live calls connect prospective customers immediately, there is far less need for repeated follow-up. The quick response eliminates lead decay and ensures your sales team can connect, speak, and assist potential clients while interest is highest, leading to better closing rates and more sales.

Are debt live transfers effective for businesses looking to grow long-term?

Debt live transfers are highly effective for business growth strategies when combined with smart lead generation planning. By delivering high-quality leads through live transfer leads, businesses can scale volume responsibly while maintaining strong sales, consistent success, and predictable customer acquisition without relying on long-term commitments to low-performing channels.

How do debt live transfers compare to traditional debt lead generation methods?

Unlike traditional debt lead generation methods such as email marketing or list-based outreach, debt live transfers provide direct access to prospects through inbound calls and real-time engagement. This approach reduces wasted calls, improves conversion rates, and helps teams focus on resolving debt and delivering debt settlement services rather than chasing unresponsive customers.

Final Thoughts: Are Debt Live Transfers Right for Your Business?

Debt live transfers are one of the most effective lead generation methods available to debt relief companies in 2026. They combine real-time intent, qualification, and compliance into a single delivery model that outperforms traditional leads when executed correctly.

They are best suited for businesses that:

- Can handle inbound calls consistently

- Value quality over raw volume

- Prioritize compliance and consumer trust

- Measure success by enrollments, not lead count

When paired with the right provider, trained agents, and clear operational controls, debt live transfers can become a reliable and scalable driver of growth.

If your goal is to speak only with consumers who are ready for help and ready to talk, debt live transfers are worth serious consideration.