Let’s talk about retail media – the fastest-growing force in advertising right now. In a nutshell, it’s all about brand advertising within a retailer’s ecosystem – on websites, apps, and even in-store digital screens – right when shoppers are ready to buy.

And yes, it’s booming. Global retail media ad spending is projected to top $178 billion, outpacing even TV ad spending. Why? Because it’s hitting shoppers at the moment of intent, which is gold for marketers.

This isn’t just a trend – it’s being called the third wave of digital advertising, following search and social. But this wave is different. It’s smarter, more targeted, and built on first-party data. That’s why retail media is rapidly evolving into a larger ecosystem called commerce media – a mix of onsite and offsite retail media, data, and full-funnel strategy that achieves meaningful outcomes.

What is Retail Media?

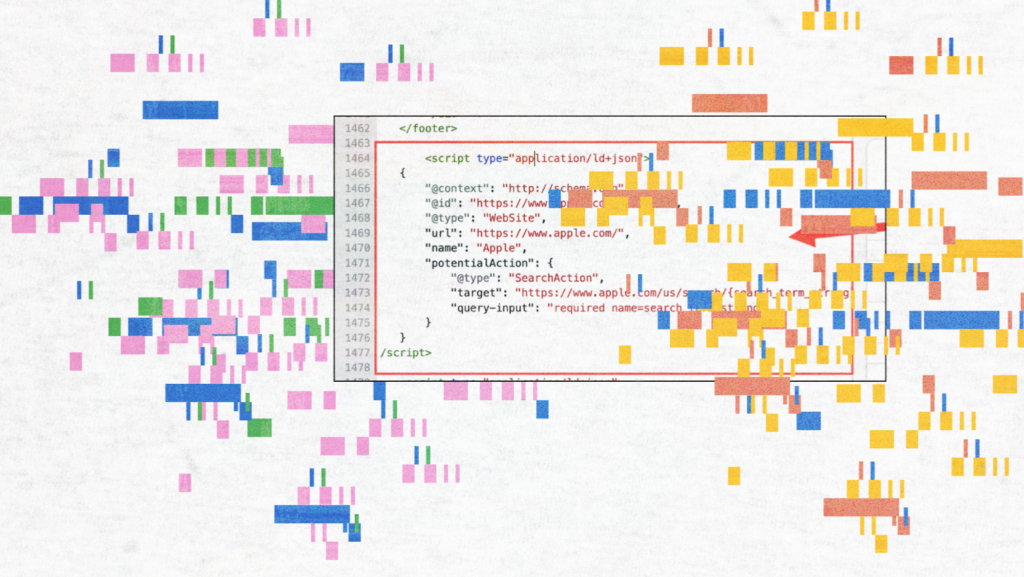

Let’s be honest – retail media isn’t just having a moment. It’s taking over. One big reason? Retailers are sitting on a goldmine of what is known as first-party data – stuff like past purchases, loyalty behavior, and what shoppers are searching for. Now, with third-party cookies on their way out, brands are rushing to figure out how to reach a target audience otherwise without losing precision. And guess what? Retail media networks have the solution.

This isn’t just about banner ads anymore. We’re talking smarter retail media campaigns that tap into retailer first-party data to deliver targeted ads across both onsite retail media and off-site placements – like display ads across the web or even connected TV platforms.

Add in the rise of digital commerce and the fact that brands want to show up right where the buying happens, and you’ve got a perfect storm. Retailers also see this as a serious business opportunity – many are turning into full-blown media companies, building out retail media platforms, and partnering with media owners to scale faster.

We’re no longer just talking about ads next to products. We’re talking about a full retail media ecosystem that includes in-store ads, digital ads, and smart targeting strategies that drive real results.

What Is a Retail Media Network (RMN)?

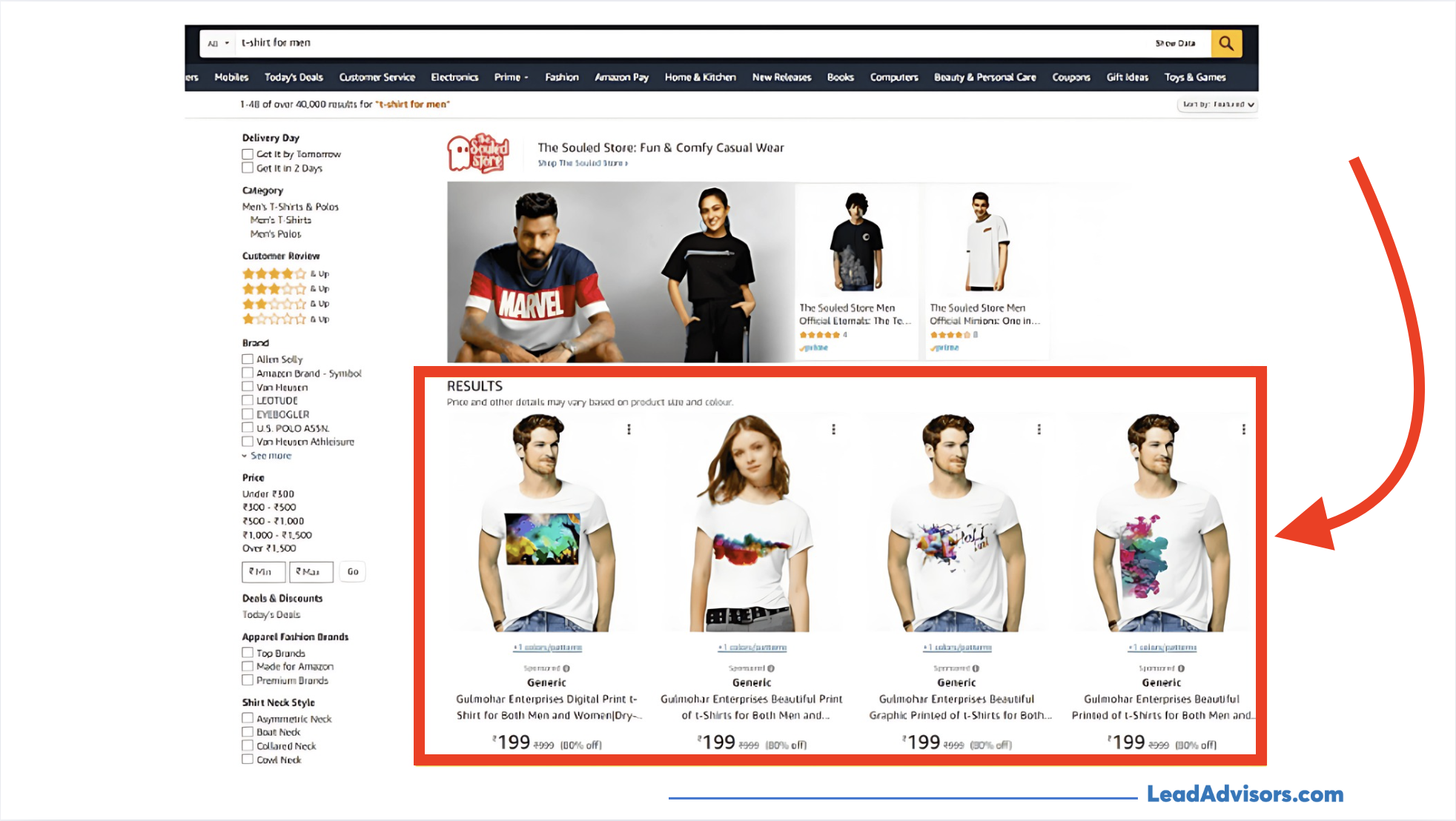

The retail media network is a retailer’s ad platform, a place where brands can pay to promote products front and center across onsite, offsite, and in-store touchpoints. These retailer-owned platforms are meant to help brands reach shoppers using the retailer’s data on its customers and ensure that the ad placements are both smarter and more relevant as a result.

Let’s break it down:

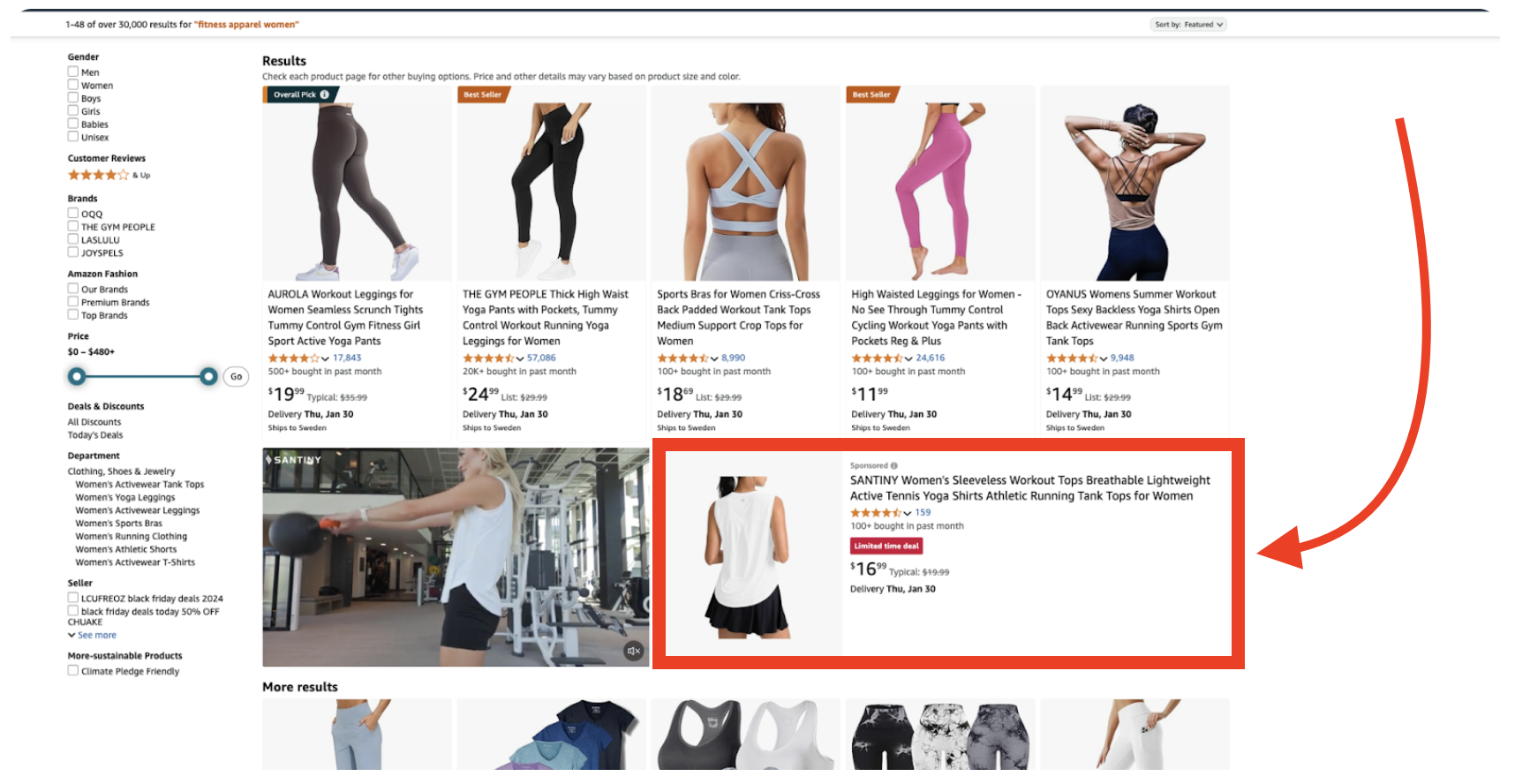

- On-site retail media refers to ads that appear directly within the retailer’s website or app, such as sponsored product listings, home page carousels, and category banners. These advertisements target shoppers while they are already looking and spending.

- Offsite retail media (or simply offsite, if you prefer) extends and reaches past the walls of the retailer. Here, brands use the retailer’s first-party data to execute targeted ads on external sites, social networks, and connected TV, but retain the ability to zero in on that one consumer.

- And then there is in-store retail media, which ranges from digital endcaps to digital signage near the checkout. Combining a brick-and-mortar store feel with a digital ad campaign level of targeting, these placements.

Many retail media networks in place today provide an array of advertising targeting options to align with brand objectives, from building awareness to delivering a direct sale. Featuring capabilities such as shoppable video, real-time data analytics, and precise targeting, these media networks are being embraced as valuable assets to any modern retail media program.

Retail Media vs. Commerce Media

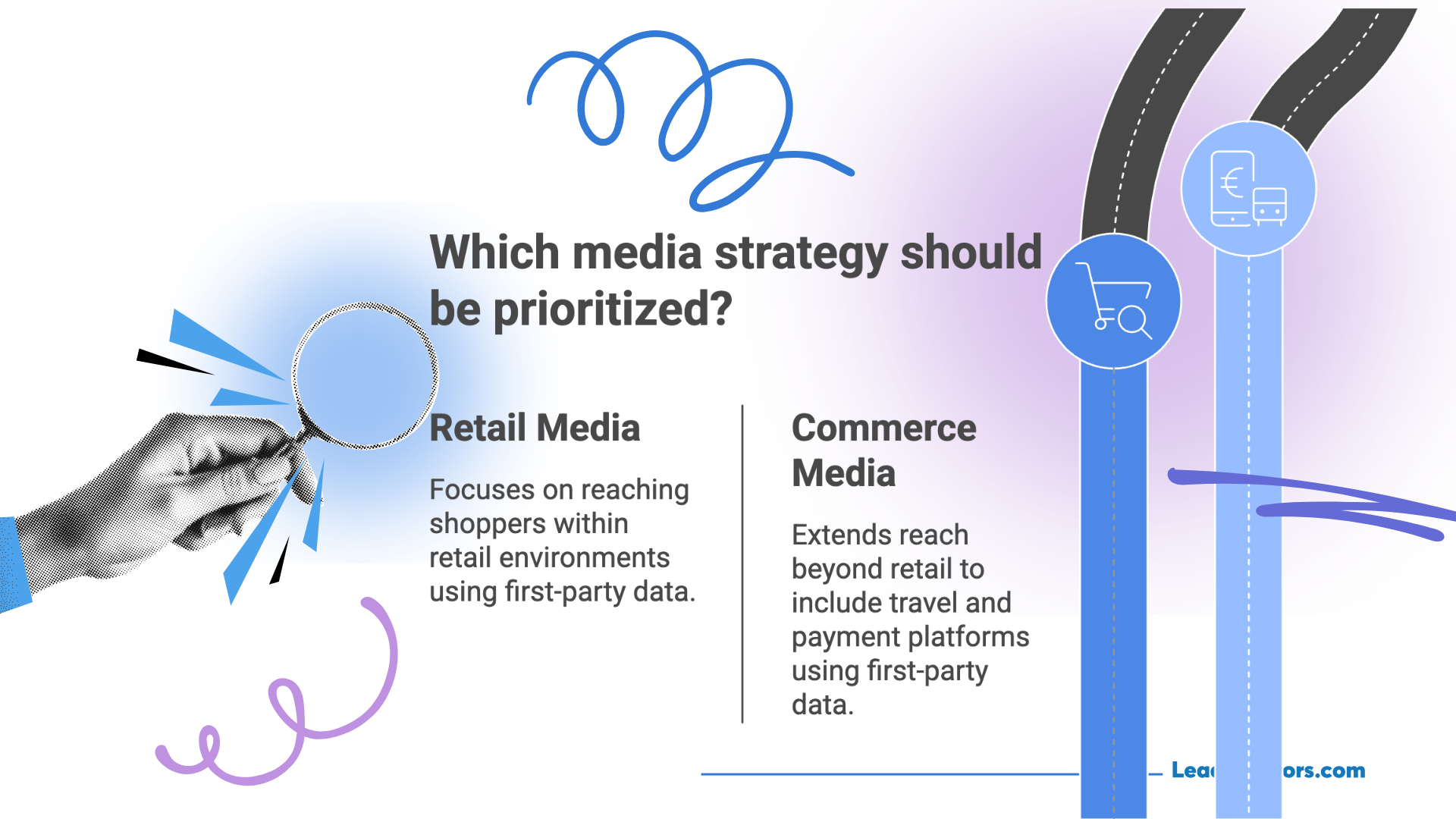

Let’s break down the difference between retail media and commerce media because while they’re closely related, they’re not the same thing.

Retail Media: Focused on the Retail Environment

Retail media lives inside the world of traditional retail – places like Target, Walmart, or your favorite grocery app. Brands advertise through retail media networks using onsite, offsite, and in-store formats. The goal? Reach shoppers right as they consider a purchase, using precise first-party shopper data and retail media solutions built for the retail environment.

Commerce Media: Expanding the Playing Field

Simply put, commerce media extracts all that is great about retail media advertising – the data, the targeting, the impact – and applies it to the world beyond retail. Think of apps like Instacart, payment services like Klarna, or hotel chains like Marriott.

These platforms continue to leverage rich first-party data, though the ads are now targeted at consumers in moments that extend beyond shopping, such as booking travel or processing payments.

Industry Convergence: Data, AI, and Programmatic Power

Here’s where it gets exciting. Retail and commerce media are beginning to merge, and tech is fuelling both. I’m talking about commerce data combined with AI, programmatic buying, and smarter media ad spend strategies. It’s not simply the placement of ads but the identification of the right ads, for the right people, at the exact right moment.

Why Retail Media Is Gaining Popularity

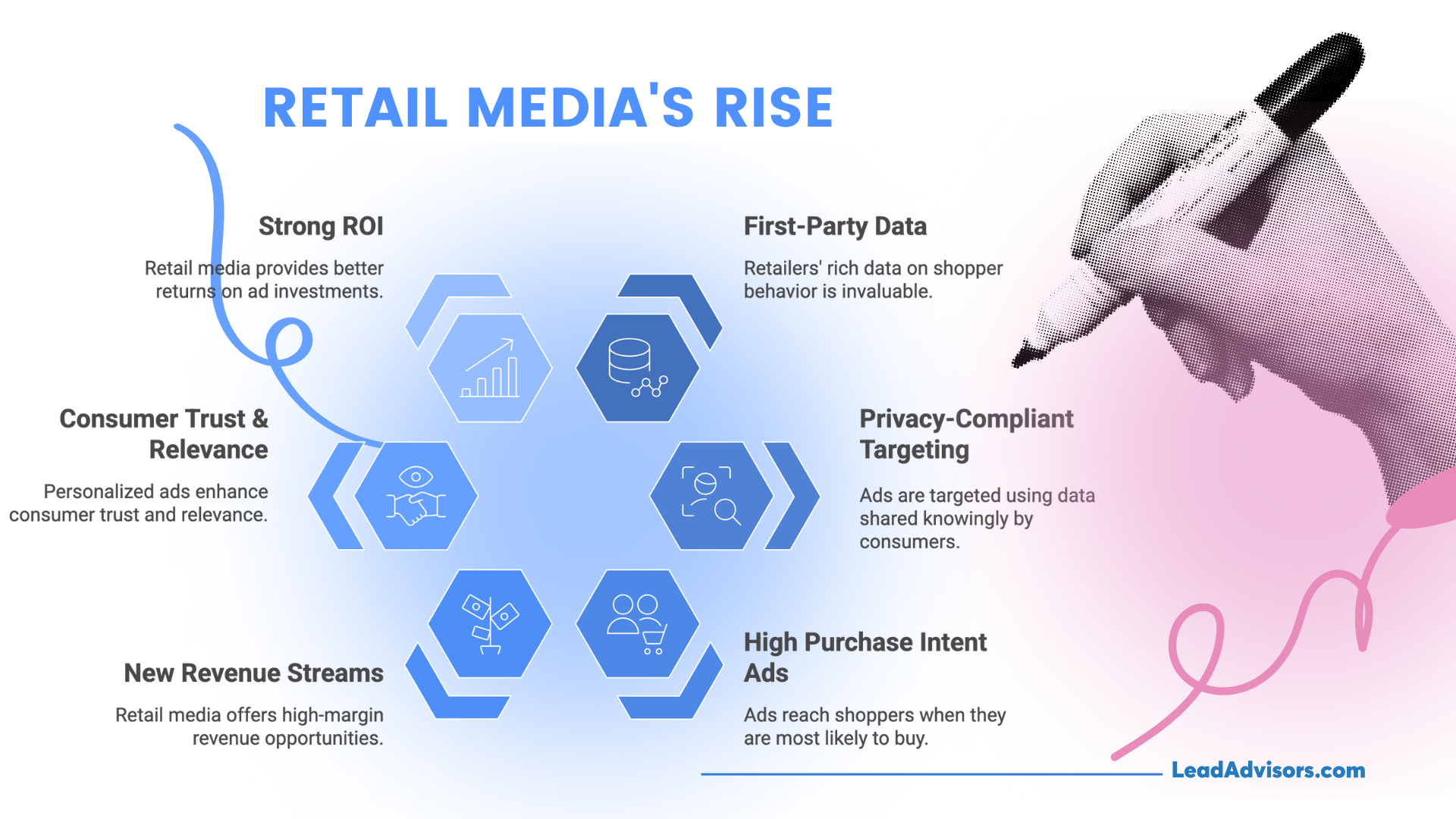

So what explains the meteoric rise of retail media? It’s no fad – it’s the future of digital advertising. This is why brands, retailers, and advertisers are betting big on it:

- First-party data is gold

As third-party cookies disappear, brands rely even more on first-party data, and retailers have much of it. They know what consumers purchase, how frequently they buy, and their behavior online and in-store. - Privacy-compliant targeting that actually works

Rather than sketchy tracking techniques, retail media networks provide targeted ads based on information people voluntarily share. This translates into more accuracy and less guesswork and trust. - Ads that meet high purchase intent

Whether it’s an on-site retail media banner, a shoppable video, or an off-site campaign powered by retailer data, these placements reach shoppers when they’re most likely to convert. - Retailers need new revenue streams.

Let’s be real – retail profit margins on product sales are razor-thin (we’re talking 3–4%). But retail media ad spend? That can bring in up to a 90% margin. No wonder more media owners are entering the game. - It boosts consumer trust and relevance.

Because the ads are personalized using true behavior data, shoppers see products that actually make sense for them. This supports a seamless media journey online or in brick-and-mortar stores. - Strong ROI makes it a no-brainer.

Brands investing in retail media advertising see better returns. Thanks to more accurate targeting and measurable impact, every dollar of ad spend works harder. This aligns perfectly with growth marketing strategies focused on long-term, scalable ROI.

It’s easy to see why the retail media market is gaining momentum – it simply works better for everyone involved.

Benefits of Retail Media Networks

Retail media networks aren’t just a win for advertisers – they’re changing the game for everyone involved, from brands and retailers to everyday shoppers like you and me. Let’s break it down:

For Advertisers

- Reach high-intent shoppers when they are in buying mode, when they purchase with onsite, off-site, or in-store retail media.

- Leverage the power of first-party data for privacy-compliant ‘one-to-one’ targeted advertising in a post-cookie world.

- Track what worked, what converted, and how to improve your next ad campaign with closed-loop measurement.

- Stay safe – retail media advertising happens in trusted, brand-safe environments that protect your reputation.

For Retailers

- Unlock new, high-margin revenue from retail media ad spend – far more profitable than just selling products.

- Monetize everything from your website to your in-store ads and mobile apps – your entire retail environment becomes valuable ad space.

- Get smarter with shopper data. You gain better data analytics, loyalty insights, and tools to personalize offers across media channels.

- Stand out in the crowded ecommerce world by offering brands a full suite of advertising capabilities and retail media solutions.

For Consumers

- See more relevant ads based on real shopping habits, not random targeting.

- Enjoy better deals through sponsored discounts or promotions that brands fund via retail media programs.

- Take advantage of retailers that offset costs with ad revenue, which means they don’t have to mark up the price of the product.

If you’re buying, selling, or overseeing a platform, retail media networks present a potent way of transferring value end-to-end.

Challenges in the Retail Media Landscape

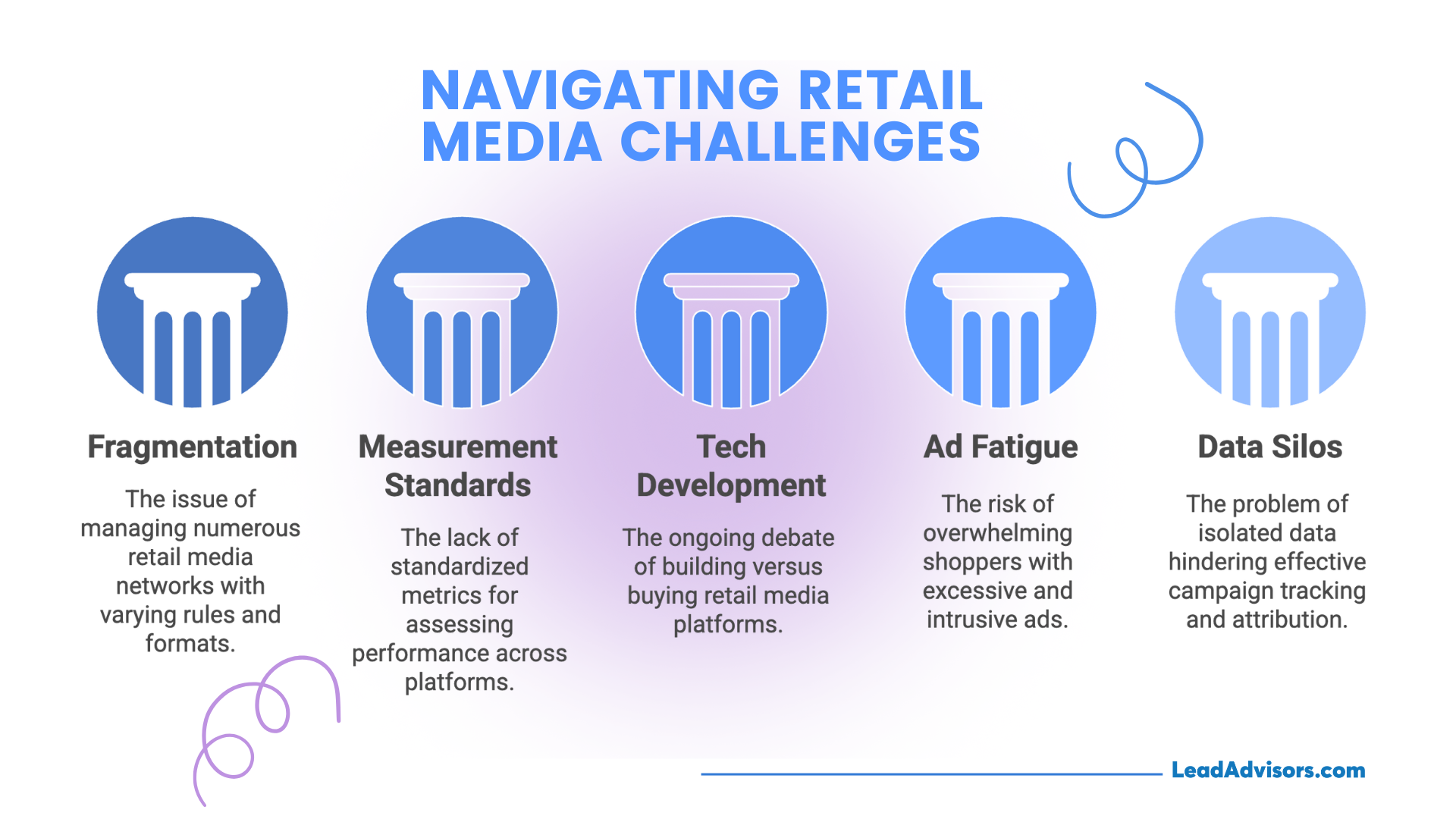

As much as we love the momentum around retail media, it’s not without its growing pains. Here are the biggest roadblocks brands and retailers are navigating right now:

1. Too Many Networks, Too Much Chaos

Fragmentation is a significant issue. The ANA found that some advertisers are juggling 15+ different retail media networks, each with its own rules, formats, and dashboards. It’s no wonder many brands now want to consolidate down to 5–10 RMNs to simplify planning and get more value from their media ad spend.

2. No Standard Way to Measure Success

Every media network seems to have its playbook, making it challenging to compare results. Without standard measurement, marketers can’t trust performance across platforms. That’s why the IAB and MRC are coming in to try to establish common metrics and reporting formats.

3. Retailers Are Still Building the Plane Mid-Flight

Many retailers are still figuring out the tech side. Do they build a custom retail media platform, or do they buy from a third-party provider? There’s no one-size-fits-all answer, and the tech stack can make or break the retail media solutions offered to advertisers.

4. Cluttered Pages = Ad Fatigue

There’s a fine line between monetizing a site and ruining the shopping experience. Too many retail media ads can lead to ad fatigue, especially if the placements feel forced. Retailers need to protect their platform integrity while still delivering value to advertisers.

5. Siloed Data and Sketchy Attribution

Today, the database silos are holding marketers hostage. Most retail media campaigns are siloed with patchy tracking and limited cross-platform visibility. Which is shuttled off into lost insights and messy attribution, and missed opportunities to tap first-party data more effectively.

Full-Funnel Retail Media Strategy

A successful retail media strategy is most effective when it supports the whole shopper journey, from awareness to purchase. Here’s how brands can map their ad formats to each stage of the funnel:

| Funnel Stage | Ad Format | Retail Analogy | Goal |

| Upper Funnel | Off-site display/retargeting | TV ads / outdoor signage | Awareness + traffic |

| Mid Funnel | On-site display | In-aisle branding | Consideration + engagement |

| Lower Funnel | Sponsored products | Endcaps/shelf tags | Conversion at the point of purchase |

These formats cover the entire retail media ecosystem from off-site outreach with first-party data, to onsite placements and sponsored products to close the deal. It’s like replicating the in-store shopping experience – but smarter, faster, and entirely measurable.

How to Choose or Launch a Retail Media Network

Whether you’re an advertiser deciding where to invest your retail media ad spend or a retailer looking to launch your own retail media network, the right strategy can make or break your results. Here’s how to approach it from both sides of the table:

For Advertisers: Picking the Right RMN

Choosing among many retail media networks isn’t just about size – it’s about fit. Here’s what to consider:

- Audience alignment: Does the network reach your target audience? And does it reflect your brand values?

- Channel mix: Seek strong on-site, off-site, and in-store retail media options to create a full-funnel campaign.

- Inventory depth: The best RMNs offer premium placements like search pages, homepage banners, and product detail pages (PDPs) – all proven high-ROI zones.

- Reporting and attribution: Go with networks that offer solid closed-loop measurement and transparency in their media ad spend tracking.

Smart advertisers know it’s not just about volume—it’s about precision, performance, and partnership. A well-aligned RMN helps you maintain consistent brand positioning while maximizing campaign performance.

For Retailers: Launching Your RMN

Are you thinking of becoming a media network yourself? Retailers can choose from three primary models, each providing varying degrees of speed, control, and first-party data ownership.

Plug-and-Play Platforms

Such features quickly launch with third-party vendors such as CitrusAd or PromoteIQ. They’re perfect if you plan to get to market quickly and with limited technical overhead. The trade-off? Less customization and shared advertising revenue with your media partners.

Build In-House

This is the power move – retail giants like Amazon and Walmart Connect have built their retail media platforms from scratch. This option allows you to have complete control over retailer data, ad formats, and the shopper experience, but it does require serious time, tech investment, and organizational resources.

Hybrid Models

Newer players like Kevel’s Retail Media Cloud™ offer flexible solutions that combine the benefits of both models. You can have a fast, scalable implementation with more control over features and first-party data, and you don’t have to build everything from scratch.

When evaluating options, consider:

- How fast do you need to launch?

- How much control do you want?

- Are you optimizing your retailer data and ad inventory effectively?

- What does the ad revenue-sharing model look like?

Launching a retail media platform is more than a tech decision – it’s a long-term business play. Get it right, and you’re not just a retailer anymore. You’re a media company.

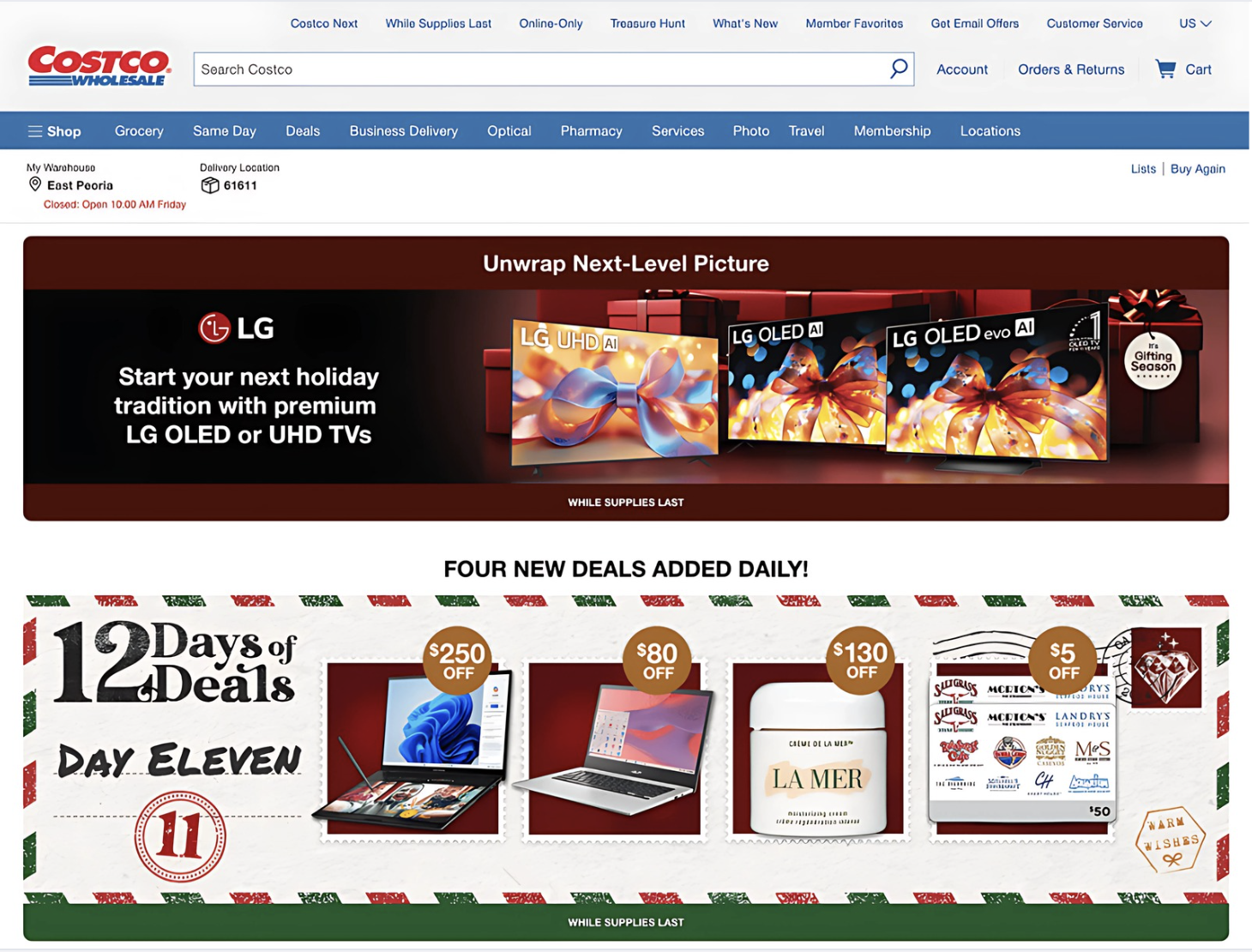

Top Retail Media Networks in 2025

With the rapid rise of retail media, several retail media networks have emerged as industry leaders. Each one brings unique strengths – whether it’s unmatched first-party data, massive reach, or innovative retail media solutions. Here are the major players shaping the landscape in 2025:

Amazon Ads

The undisputed heavyweight of the retail media ecosystem, Amazon offers robust targeting via its own DSP and a vast mix of digital advertising formats. As a bonus, you can access Prime Video inventory and retailer customer data across thousands of product categories.

Curious how customer feedback plays into Amazon’s ecosystem? Learn more about the role of an Amazon product reviewer and how it shapes retail perception.

Walmart Connect

Walmart continues to grow through its partnership with The Trade Desk, blending off-site retail media with strong in-store placements. It’s a go-to for brands looking to activate across multiple media channels, from digital screens to sponsored products.

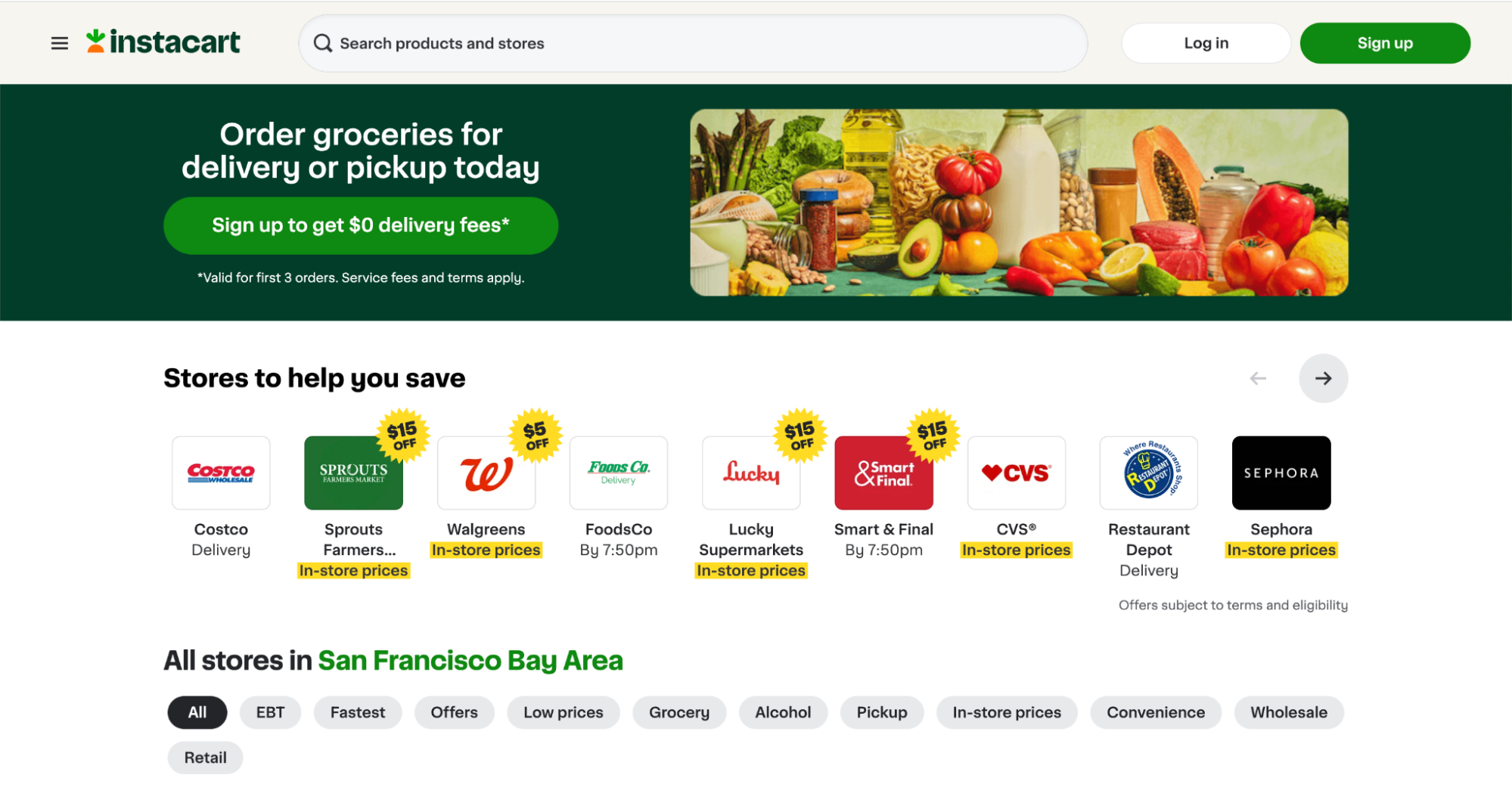

Instacart Ads

Instacart is leaning hard into commerce media, with shoppable video, recipe integrations, and seamless omnichannel ad formats. Its blend of first-party shopper data and grocery intent makes it a rising star in retail media advertising.

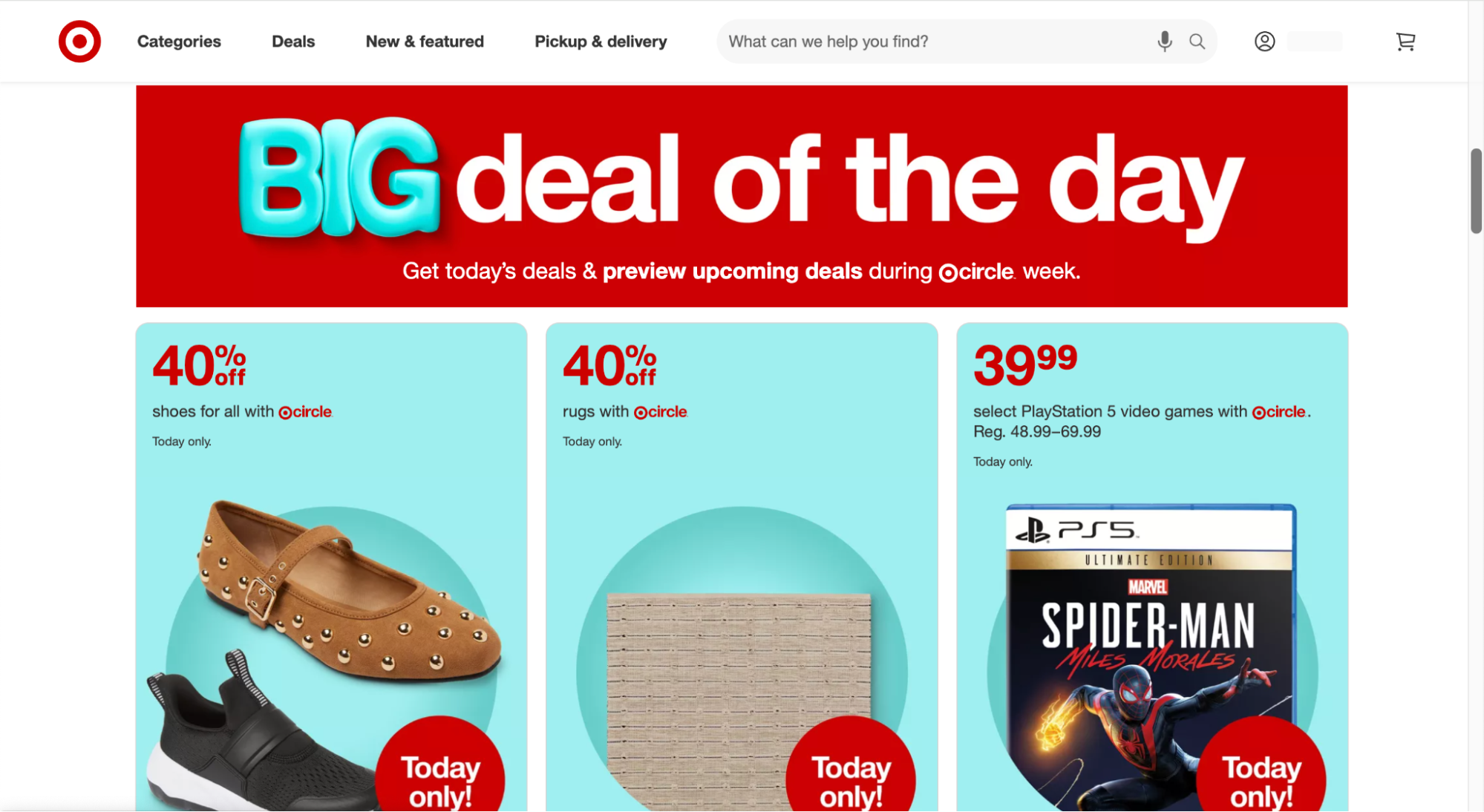

Target’s Roundel

Roundel distinguishes itself by combining connected TV (CTV) with influencer marketing and social media networks. It’s ideal for brands targeting millennial parents, home shoppers, and beauty buyers with engaging, high-touch formats.

Kroger Precision Marketing

This CPG-focused media network uses deep loyalty program data and predictive modeling to power precision-targeted advertising. Brands can reach high-value consumers through both onsite and off-site placements.

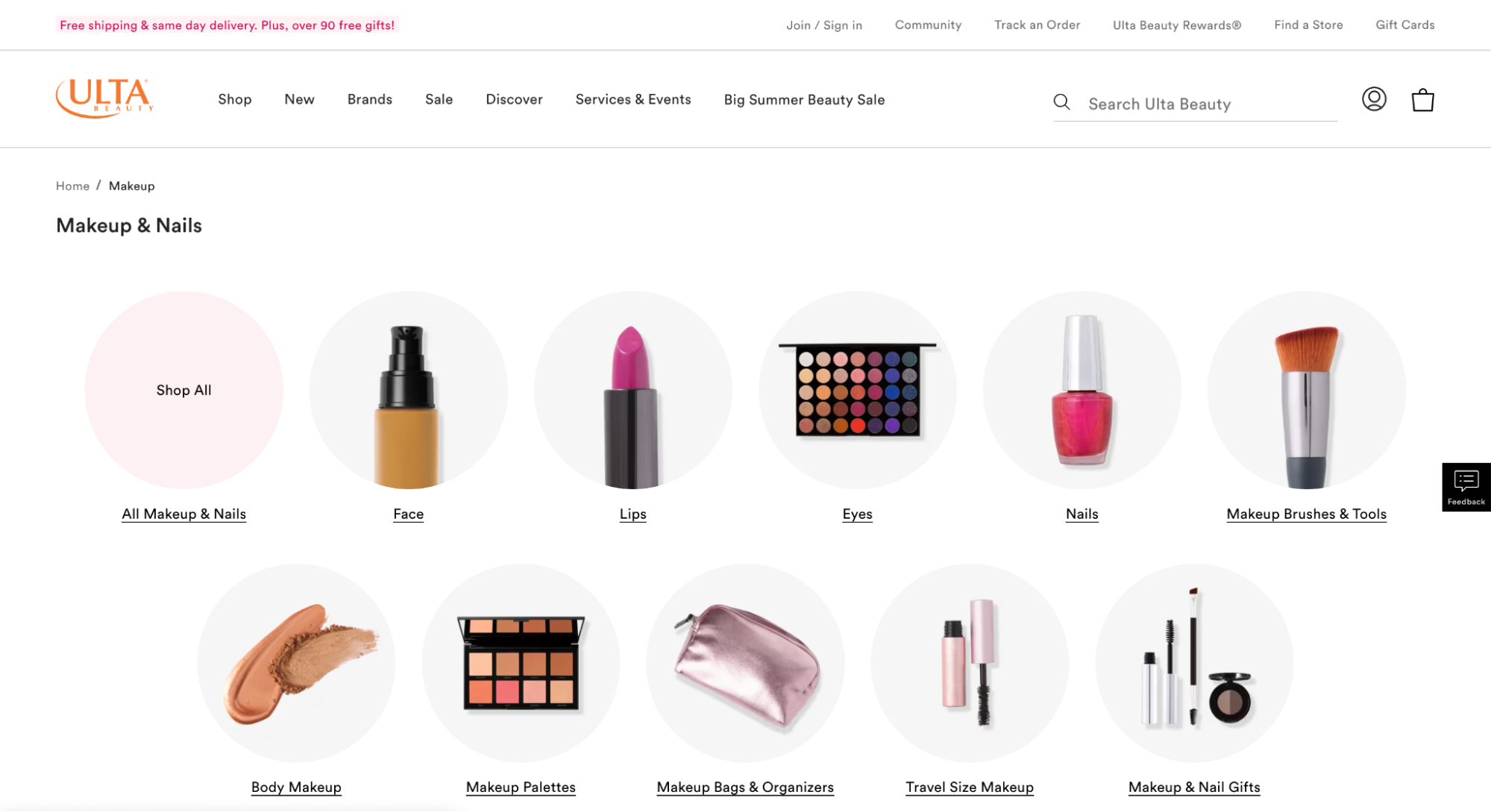

Ulta UB Media / Sephora

These beauty-focused retail media networks deliver unmatched engagement rates thanks to their curated audiences and content-rich platforms. Expect high performance across in-store ads, product tutorials, and influencer campaigns.

Home Depot’s Orange Apron Media

This RMN is perfect for reaching contractors, DIYers, and home improvement shoppers. It leverages physical stores, project-based targeting, and contextual retailer data to reach niche target consumers.

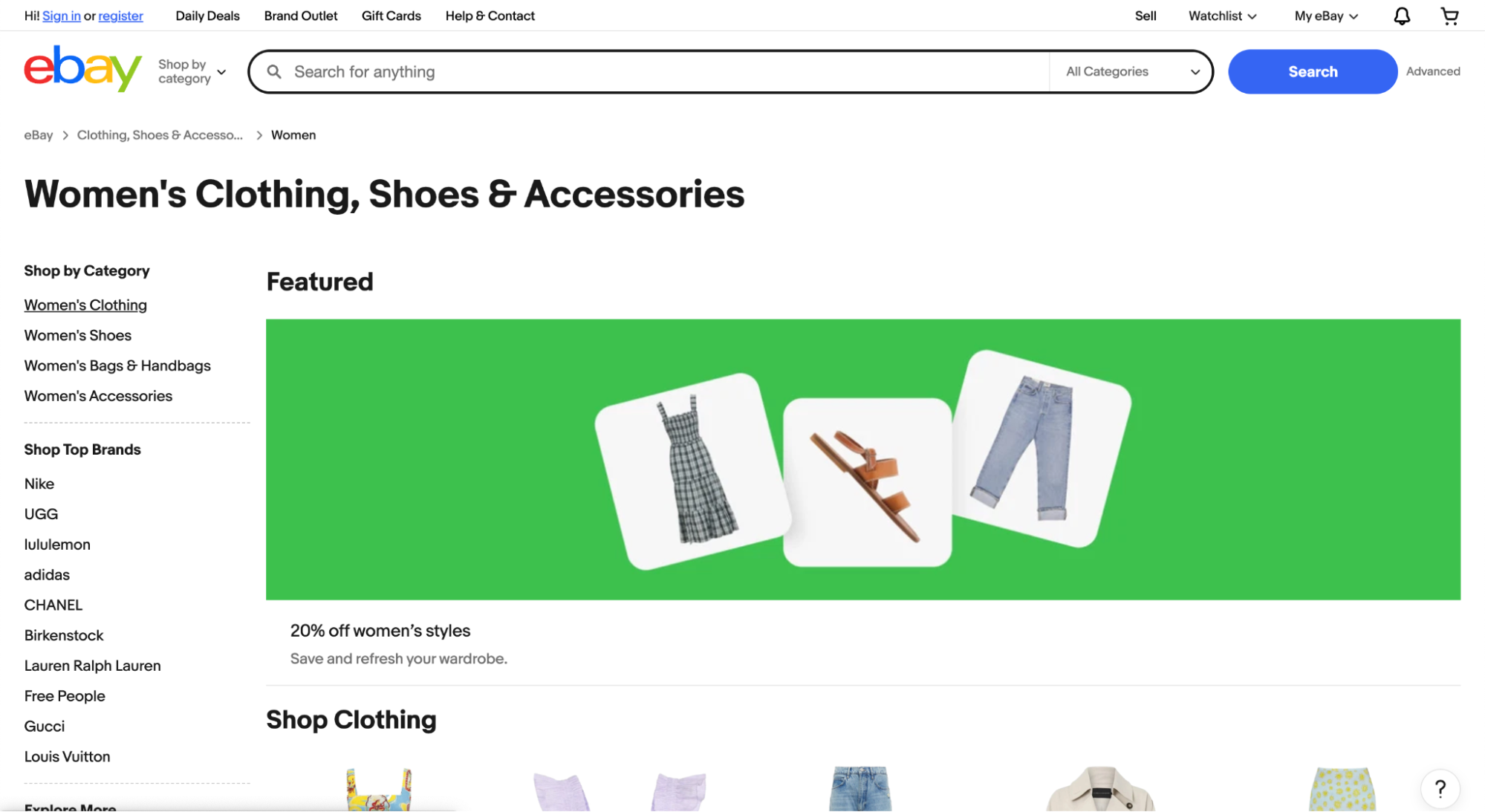

eBay Ads

eBay focuses on product listings and uses a CPC-only model, which is ideal for brands seeking low-friction entry into digital commerce without big upfront ad spend.

Wayfair Ads

Wayfair blends commerce with content using co-branded videos, digital catalogs, and onsite retail media formats. It’s a powerful option for home décor and lifestyle brands looking to tell a story while driving conversions.

Pro Tip: Want to compare networks at a glance? Consider building a quick table with columns for Reach, Strengths, Formats Offered, and Primary Audience. It’s a great way to evaluate fit before investing in your next round of media spend.

The Future of Retail Media

The next chapter of retail media is all about expansion and evolution.

We’re already seeing commerce media networks pop up in new spaces—fintech apps, QSRs, and even hospitality brands. These companies may not be traditional retailers, but they have what matters: first-party shopper data and strong consumer engagement.

Retailers are also beginning to offer data access without requiring ad placements, meaning brands can tap into retailer first-party data just for insights. That’s a major shift in how retail media solutions are packaged and sold.

Meanwhile, AI-driven personalization and predictive targeting make it easier to deliver smarter, more relevant ads across both on-site and off-site retail media. There is less guesswork and more precision.

As the space grows, we’ll see more standardization and consolidation. With so many retail media networks, unified metrics and tools will be key to managing media spending efficiently.

For brands looking to amplify their visibility beyond paid media, here’s how to get media coverage that complements your retail media strategy.

And who’s going to win? The platforms that combine traffic, data, trust, and tech. That’s the future of retail and commerce media – and it’s already on the way.

Frequently Asked Questions

What’s the difference between onsite and offsite retail media ads?

How is retail media different from traditional programmatic advertising?

Can small retailers benefit from retail media solutions, or is it only for giants like Amazon and Walmart?

How do retailers prevent ad fatigue for their shoppers?

What’s the best way to measure success in a retail media campaign?

Conclusion

Retail media isn’t just the next big thing – it’s officially the new normal. It’s where brands meet shoppers, where first-party data meets performance, and where every impression has the power to convert.

Whether you’re a retailer looking to launch your own retail media network, a brand trying to optimize your media ad spend, or an agency navigating a fragmented landscape, mastering the retail media ecosystem is now table stakes.

The key? Choose your retail media strategy wisely. Focus on networks that align with your goals, prioritize measurement and attribution, and stay flexible as commerce media continues to evolve.

This space is growing fast, and those who stay ahead will reap the biggest rewards.