The accounting tech scene is worth more than $12 billion globally in 2020 and is predicted to increase to almost $20 billion by 2026, stating pretty loud and clear that such tools are a must-have for any business, no matter its size. If you are looking for alternative solutions, know that you are in good company.

You might be just a few clicks away from creating a QuickBooks account when someone tells you about Wave. You start doubting what you were thinking the whole time. Choosing the proper accounting software should not be a risk, especially when that tool is your practical, everyday transaction helper.

Recently, they have both been capable of keeping alive the feud amongst their fans, but differently oriented businesses with dissimilar needs have to choose between them. A study on micro, small, and medium enterprises (MSMEs) found that accounting software plays a crucial role in managing daily business transactions, highlighting the importance of selecting software that best fits your workflow.

This comparison examines each platform’s features, pricing, and performance to determine which one is the most suitable for your needs. If you are a freelancer or the leader of a growing team, you will ultimately determine which accounting system is best suited to your requirements and budget.

TL;DR: Quick Verdict

Wave would be the best choice for freelancers and microbusinesses located in the US and Canada that require affordable and straightforward invoicing and bookkeeping, without the complications of inventory management.

QuickBooks Online is a more suitable option for small businesses that are well-established and need an inventory management system, advanced features, detailed reporting, and easy collaboration with their accountant.

Which Platform Serves The Best

Wave Is Built For:

- Freelancers, solopreneurs, and microbusinesses with straightforward finances

- Service-based businesses that don’t track inventory or handle complex accounts payable

- US and Canada-based small business owners seeking a free or ultra-affordable accounting app

- Business owners without extensive accounting experience who value simplicity

QuickBooks Online Is Built For:

- Established small businesses with growing operational complexity

- Product-based companies needing inventory tracking and cost of goods sold (COGS) calculations

- Teams collaborating with external bookkeepers and accountants

- Businesses requiring project management, job costing, or detailed financial statements

- Companies operating outside North America

At-a-Glance Comparison

| Feature | Wave | QuickBooks Online |

| Starting Price | Free (Starter) | $35/month (Simple Start) |

| Best For | Freelancers, microbusinesses | Growing small businesses |

| Invoicing | Basic templates, recurring invoices | Highly customizable, AI-powered |

| Bills & AP | Basic tracking only | Full AP with bill pay |

| Bank Feeds | Manual (Free), Auto (Pro) | Automatic with AI categorization |

| Inventory | Not available | Full tracking (Plus and above) |

| Time Tracking | None (requires third-party apps) | Built-in timesheets, GPS tracking |

| Reporting | Basic P&L, balance sheet | 100+ customizable reports |

| Payroll | Limited state coverage | Comprehensive across all states |

| Geography | US/Canada only | Available globally |

| Users | Unlimited (Pro plan) | Limited by tier |

Pricing Reality: What You’ll Actually Pay

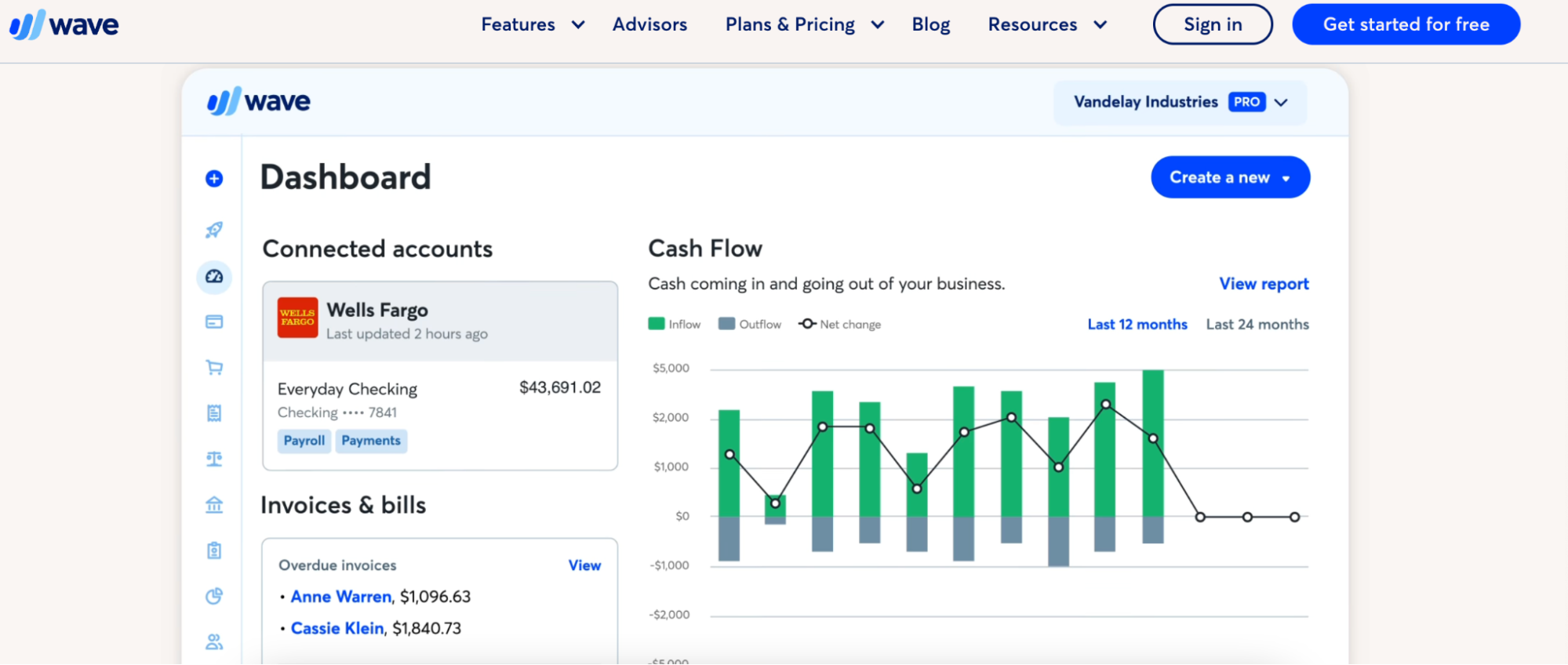

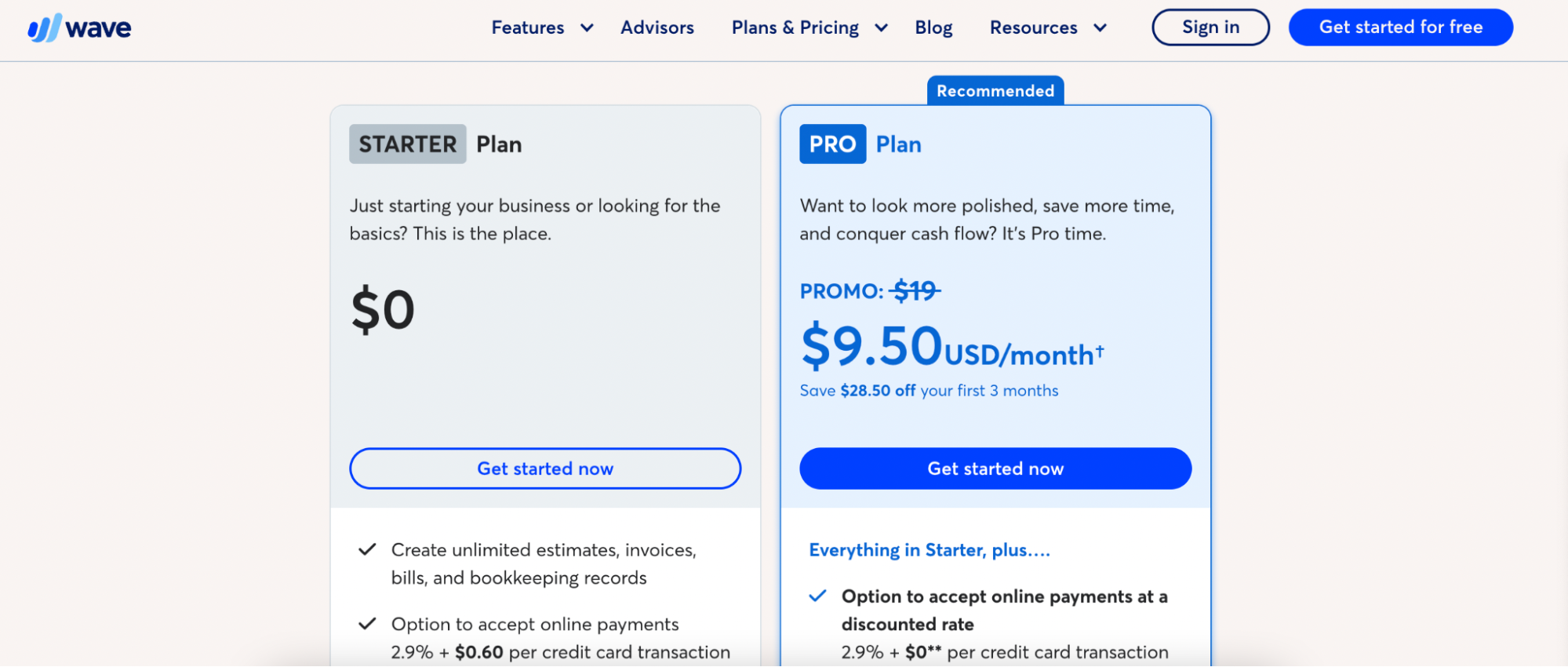

Wave’s Pricing Structure

Starter Plan (Free Forever)

- Core accounting and unlimited invoicing

- Manual bank reconciliation

- Basic financial statements (P&L, balance sheet)

- Standard payment processing fees apply

Pro Plan ($16/month)

The paid plan unlocks automation features that save hours each month, including automatic bank imports for easier reconciliation, receipt capture through the mobile app, automated invoice reminders to eliminate manual chasing, and unlimited user access for your entire team.

Where Costs Add Up:

- Credit card payments: 2.9% + $0.60 per transaction (Visa/Mastercard/Amex)

- ACH bank payments: 1% per transaction with $1 minimum (no cap, which hurts on large invoices)

- Payroll: Full-service in select states ($40/month + $6/employee); self-serve elsewhere ($20/month + $6/employee)

According to Intuit’s data, over 7 million small businesses worldwide use QuickBooks, making it the dominant player in small business accounting software.

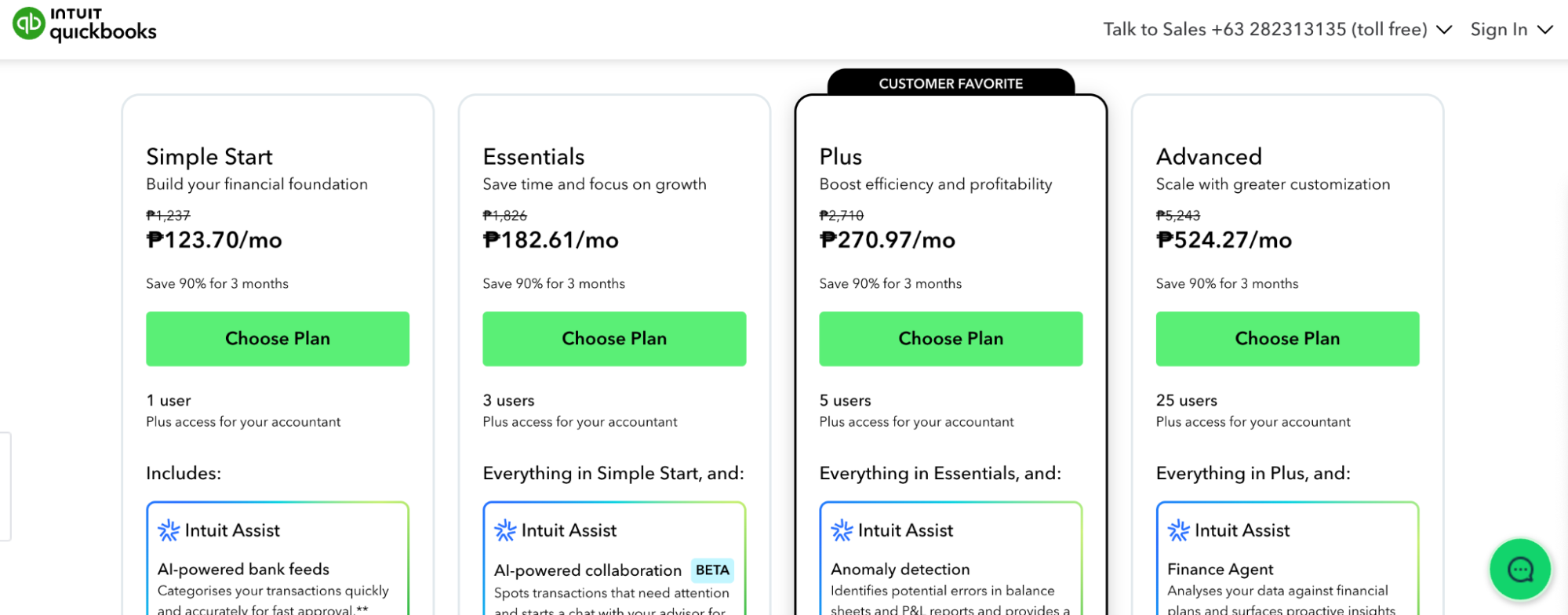

QuickBooks Online Pricing Plans

Simple Start ($123.70/month)

- Single-user access for solopreneurs

- Income and expense tracking with bank account connections

- Send invoices and track payments

- Basic financial statements and sales tax tracking

Essentials ($182.61/month)

- Up to three users

- Bill management and accounts payable

- Time tracking capabilities

- Recurring invoices automation

Plus ($270.97/month)

- Up to five users

- Inventory management with automatic COGS

- Project profitability tracking

- 1099 contractor management

Advanced ($524.27/month)

- Up to 25 users with custom permissions

- Advanced reporting and custom workflows

- Dedicated account team

- Enhanced automation features

Add-On Costs:

- QuickBooks Payroll: $45-$125/month, depending on tier

- QuickBooks Payments: 2.9% + $0.25 (card-present), 3.4% + $0.25 (online/keyed)

- QuickBooks Checking Account: Free with QuickBooks Payments

- Live Bookkeeping: Starting at $200/month

- QuickBooks Time: $20/month + $10/user

Real-World Cost Scenarios

Solo Graphic Designer (5-10 clients monthly)

- Wave: Free + occasional card payment fees = ~$15-30/month

- QuickBooks: $35/month + payment fees = ~$50-70/month

- Winner: Wave saves $300-480 annually

Small Marketing Agency (8 employees, 30 clients)

- Wave Pro: $16/month + payments + payroll (~$88) = ~$104/month

- QuickBooks Plus + Payroll: $99 + $85 = $184/month

- Winner: Wave saves nearly $1,000 annually, but lacks time tracking for billable hours

E-commerce Shop (Physical products, inventory)

- Wave: Not feasible—no inventory management

- QuickBooks Plus: $99/month (includes inventory tracking)

- Winner: QuickBooks by necessity

International Consultant

- Wave: Not available outside US/Canada

- QuickBooks: Accessible globally with localized versions

- Winner: QuickBooks is the only option

Feature Showdown: Where Each Platform Excels

Invoicing & Accounts Receivable

QuickBooks Online dominates the invoicing game with highly customizable templates, custom fields for service dates and SKUs, and AI-powered invoice autofill that extracts data from uploaded documents.

You get granular payment controls, including tipping options, partial payments, deposit requirements, shipping adjustments, and automated late fees with customizable grace periods.

Wave keeps invoicing straightforward. You can add your logo, apply percentage or fixed discounts, and set up recurring invoices through the Pro plan.

The interface is clean and meets basic needs, but it lacks advanced scheduling options and built-in time tracking. For multi-currency scenarios, Wave only processes credit card payments in your base currency—international clients often need Stripe payment links as a workaround.

Quick Comparison:

| Capability | Wave | QuickBooks Online |

| Custom invoice templates | ✓ Basic | ✓ Advanced |

| Partial payments | ✗ | ✓ |

| Deposit requirements | ✗ | ✓ |

| Automated late fees | ✗ | ✓ |

| Multi-currency processing | Limited | ✓ Full support |

| Client portal | ✗ | ✓ |

| AI data extraction | ✗ | ✓ |

Bills, Vendors & Accounts Payable

Wave handles basic vendor tracking and bill recording but stops short of full AP functionality. You can’t easily print checks, create purchase orders, or use automated bill pay services. If you regularly pay vendors by check, expect time-consuming manual reconciliation.

QuickBooks treats accounts payable as a first-class citizen. Create purchase orders that automatically convert into bills with one click, print checks for vendors who prefer them, set up automated bill pay through QuickBooks Bill Pay (an additional fee applies), and maintain detailed vendor histories with 1099 tracking. For businesses juggling multiple suppliers and recurring expenses, this depth matters.

Expense Tracking & Bank Reconciliation

Wave’s Approach:

The free Starter plan requires manual bank reconciliation—you’ll need to download CSV files from your bank and match transactions manually. Upgrade to Pro ($16/month) and you unlock automatic bank feeds that pull transactions daily, plus intelligent categorization that learns your patterns.

One advantage beginners appreciate: Wave’s interface makes fixing mistakes painless. Miscategorize something? Two clicks and it’s corrected. The learning curve is gentle, which matters when you’re handling your own books without accounting knowledge.

QuickBooks’ Approach:

Bank feeds connect automatically across all paid plans, featuring robust matching rules and AI-powered categorization that becomes increasingly accurate over time. QuickBooks handles timing differences between your books and bank statements more efficiently, automatically accounts for bank service charges and interest, and supports manual CSV/PDF uploads if you prefer not to connect directly.

Real Talk: If you’re new to bookkeeping and expect to make mistakes early on, Wave’s forgiving interface feels less intimidating. As your transaction volume grows and complexity increases, QuickBooks’ sophisticated reconciliation tools become a worthwhile investment of time and effort.

Inventory Management & Project Accounting

This is where the two platforms diverge dramatically.

Wave:

- Zero inventory tracking capabilities

- No automatic COGS calculations

- No native project or job costing features

- Workarounds involve creating custom accounts or exporting to spreadsheets

QuickBooks (Plus tier and above):

- Track stock quantities, reorder points, and SKU details

- Create and receive purchase orders

- Automatic COGS posting when inventory items are sold

- Handle returns, adjustments, and inventory reports

- Full project profitability tracking

- Job-based income and expense categorization

- Project-specific reports for client billing

If you sell physical products or need to track project profitability, QuickBooks isn’t just better—it’s essential. According to research from SCORE, 82% of small businesses fail due to cash flow problems, and proper inventory management plays a crucial role in maintaining healthy cash flow.

Time Tracking, Mileage & Payroll Software

Wave:

- No built-in time tracking whatsoever

- No mileage tracking features

- Must integrate third-party apps or switch to alternatives like FreshBooks

Payroll Limitations: Wave offers direct deposit for employees and contractors; however, its full-service payroll option is only available in certain states. Elsewhere, you’re stuck with self-serve payroll that has drawn complaints about incorrect tax calculations and limited tax deposit support.

QuickBooks:

- Basic timesheets are included in Essentials and above

- QuickBooks Time (formerly TSheets) is available as an add-on: GPS-based tracking for field teams, real-time clock in/out, employee scheduling, and seamless integration with invoicing

Mileage tracking lives in the QuickBooks mobile app—categorize trips as business or personal, view total miles driven, and calculate estimated tax deductions automatically.

QuickBooks Payroll offers comprehensive coverage across all 50 states with multiple tiers:

- Automatic tax calculations and filings

- Direct deposit and same-day deposit options

- HR support and employee self-service portal

- Benefits administration on higher tiers

- Workers’ comp management

| Feature | Wave | QuickBooks |

| Built-in time tracking | ✗ | ✓ Basic |

| Advanced time tracking | ✗ | ✓ With QuickBooks Time |

| GPS tracking | ✗ | ✓ |

| Mileage tracking | ✗ | ✓ Built-in |

| Payroll availability | Limited states | All states |

| Payroll tax filing | Manual/limited | Fully automated |

Financial Reporting & Dashboards

Wave covers the essentials: profit and loss statements, balance sheets, cash flow reports, customer/vendor summaries, and basic tax reports. The templates work fine for microbusinesses filing simple tax returns or applying for basic loans, but customization options are minimal.

QuickBooks boasts 100+ built-in report templates organized by category—business overview, sales performance, expenses by vendor, payroll summaries, and accountant-specific reports. The custom report builder lets you filter by class, location, project, product, or service, save custom views for recurring use, and schedule automatic report delivery to stakeholders.

Higher-tier plans include an AI-enhanced “business feed” that surfaces insights, such as unusual spending patterns, cash flow warnings, and recommended actions based on your financial data. These proactive nudges help you identify problems before they escalate into crises.

Learning Curve & Daily Experience

Getting Started

Wave greets you with a clean dashboard using business-friendly language instead of accounting jargon. Labels like “Receipts” and “Purchases” make intuitive sense, even if you’ve never taken an accounting class. Most users can send their first invoice within 15 minutes of signing up.

QuickBooks Online packs significantly more power into its interface, which means more menus, more options, and more initial confusion. Setting up your chart of accounts, configuring sales tax rules, or handling owner equity transactions can feel overwhelming without accounting experience. Expect to spend time on YouTube tutorials or calling support during your first month.

The payoff? Once you understand QuickBooks’ logic, you can handle sophisticated scenarios that would require multiple tools or manual workarounds elsewhere.

Working With Accounting Professionals

QuickBooks dominates the professional accounting world. The vast majority of bookkeepers and CPAs have experience with QuickBooks, many hold ProAdvisor certifications, and finding affordable help is straightforward. When tax season arrives or you need financial statements for a loan application, your accountant likely prefers QuickBooks.

Wave has supporters among accountants who work with microbusiness clients, especially those just starting out. However, many established accounting professionals either don’t work with Wave or charge higher rates due to unfamiliarity with the platform.

Before You Commit: Ask your current or future accountant which accounting tools they prefer supporting. Their answer might save you migration headaches later.

Ecosystem & Automation Capabilities

Integration Marketplaces

QuickBooks connects to hundreds of business apps through its marketplace:

- E-commerce platforms (Shopify, WooCommerce, BigCommerce)

- Payment processors (Stripe, Square, PayPal)

- CRM systems (HubSpot, Salesforce)

- Point-of-sale systems

- Specialized tools for industries like construction, real estate, and professional services

This ecosystem means you can likely find a pre-built integration for whatever niche need you have—whether that’s complex Stripe payout reconciliation or syncing inventory across multiple sales channels.

Wave offers bank connections and a handful of direct integrations, but for most third-party tools, you’ll need to use automation platforms like Zapier or build custom connections. The smaller ecosystem reflects Wave’s positioning as a straightforward and focused accounting solution.

AI & Automation Features

QuickBooks has invested heavily in AI throughout its product line. Depending on your pricing plan, you get AI-assisted transaction categorization that learns from your patterns, invoice data extraction from photos and PDFs, cash flow forecasting, and AI “agents” that answer accounting questions and suggest optimizations.

Many of these AI capabilities are only unlocked at mid-tier plans and above, but they represent where accounting software is heading—less manual data entry and more intelligent assistance.

Wave focuses on straightforward automation: bank feed categorization, recurring invoices, and payment reminders. You won’t find an AI assistant layer, but you also won’t feel overwhelmed by features you don’t need.

Popular Automation Workflows

Both platforms connect to Zapier, enabling workflows like:

- New Stripe payment → Create a receipt in QuickBooks or Wave transaction record

- Form submission → Add customer to accounting software

- New invoice created → Log details in Google Sheets for tracking

- Weekly summary → Push accounting metrics to Slack channel

- New deal in CRM → Create customer profile for future invoicing

These automations reduce manual data entry and keep your systems synchronized without constant copying and pasting.

Geography, Compliance & Security

Geographic Availability

Wave restricts access to the US and Canada. If you’re located elsewhere or move internationally, you’ll lose access to your account. The company has previously shut down services in other countries, making it unreliable for businesses with international operations.

QuickBooks Online operates in over 180 countries with localized versions for major markets. This global presence makes it the default choice for businesses operating across borders or planning international expansion.

Tax Handling & Compliance

Both platforms track sales tax, but QuickBooks offers more robust coverage for complex scenarios, including multiple tax jurisdictions, automated filing (with additional services), and better support for industry-specific tax requirements.

For payroll taxes, QuickBooks handles automatic calculations and filings across all 50 US states. Wave’s payroll tax support remains inconsistent, with full-service options available in limited states and self-service (manual filing) options elsewhere.

Security Measures

Early in Wave’s history, the lack of multi-factor authentication (MFA) raised concerns among security-conscious users. The company has since added MFA via authenticator apps, text messages, and Google sign-in.

Both platforms use bank-level encryption, secure data centers, and regular security audits. QuickBooks offers more granular user permission controls, letting you restrict access by feature, customer, vendor, or report type—crucial when multiple team members access sensitive financial data.

Best Practices:

- Enable MFA immediately on either platform

- Use strong, unique passwords (password manager recommended)

- Export backups of key reports quarterly

- Review user access permissions regularly

- Never share login credentials with contractors or employees

Support Quality & Getting Help

Wave Support Options

Free Starter Plan:

- Help center with articles and guides

- AI chatbot for basic questions

- Community forum (limited activity)

Pro Plan ($16/month):

- Email support (weekday business hours)

- Live chat support (weekday business hours)

- No phone support available

Wave Advisors (additional fee): One-on-one sessions with bookkeeping professionals for complex questions or cleanup work.

Many free users express frustration with the lack of human support when issues arise. The chatbot handles simple questions adequately but struggles with account-specific problems or billing disputes.

QuickBooks Support Options

All Paid Plans:

- Phone support (hours vary by region)

- Live chat support

- Help center with extensive documentation

- Community forum with active users

Higher Tiers:

- Priority support with shorter wait times

- Dedicated account team (Advanced plan)

QuickBooks Live: Add-on service providing monthly bookkeeping support, financial statement preparation, and tax readiness assistance.

Real-world experiences vary. Some users praise QuickBooks’ phone support for resolving complex issues quickly. Others complain about long hold times and inconsistent advice, particularly on lower-tier plans.

The Complete Pros & Cons

Wave Accounting: Strengths & Limitations

| Wave Strengths | Wave Limitations |

| Free plan that actually works for basic accounting needs without feature limitations that force upgrades | No inventory management makes it unsuitable for product-based businesses of any size |

| Genuinely simple interface designed for business owners without accounting knowledge — you can start invoicing clients in minutes | Missing time tracking forces service businesses to use separate tools or switch platforms entirely |

| Unlimited users on Pro plan ($16/month) without jumping to expensive tiers, perfect for small teams | Weak accounts payable means businesses with many vendors need workarounds or supplementary tools |

| Low barrier to entry for freelancers, testing whether they need accounting software at all | Limited reporting depth can hurt when applying for loans or seeking investors who want a detailed financial analysis |

| Clean mobile app for on-the-go receipt capture and invoice tracking | Geographic restrictions to the US/Canada only, with a history of shutting down international access |

| — | Minimal support on the free plan leaves users stranded when problems occur |

QuickBooks: Strengths & Limitations

| QuickBooks Strengths | QuickBooks Limitations |

| Comprehensive feature set handles everything from invoicing to inventory to project management in one platform | Expensive, especially once you add payroll, advanced time tracking, and upgrade to necessary tiers |

| Industry standard, making collaboration with accountants, bookkeepers, and financial advisors seamless | Steep learning curve for users without accounting experience or formal training |

| Massive integration ecosystem connects to virtually any business tool you’re already using | Feature bloat makes navigation overwhelming and cluttered for many users |

| Advanced reporting with 100+ templates and a custom report builder for deep financial analysis | Best features are locked behind higher-tier plans, forcing upgrades as businesses scale |

| Robust payroll with nationwide tax filing and HR support on higher tiers | Transaction fees on QuickBooks Payments add up, though comparable to Wave’s rates |

| AI-powered automation reduces manual data entry and highlights insights you may overlook | Support can be inconsistent despite paid plans, especially on lower tiers |

| Strong security and granular user permissions for multi-user teams | — |

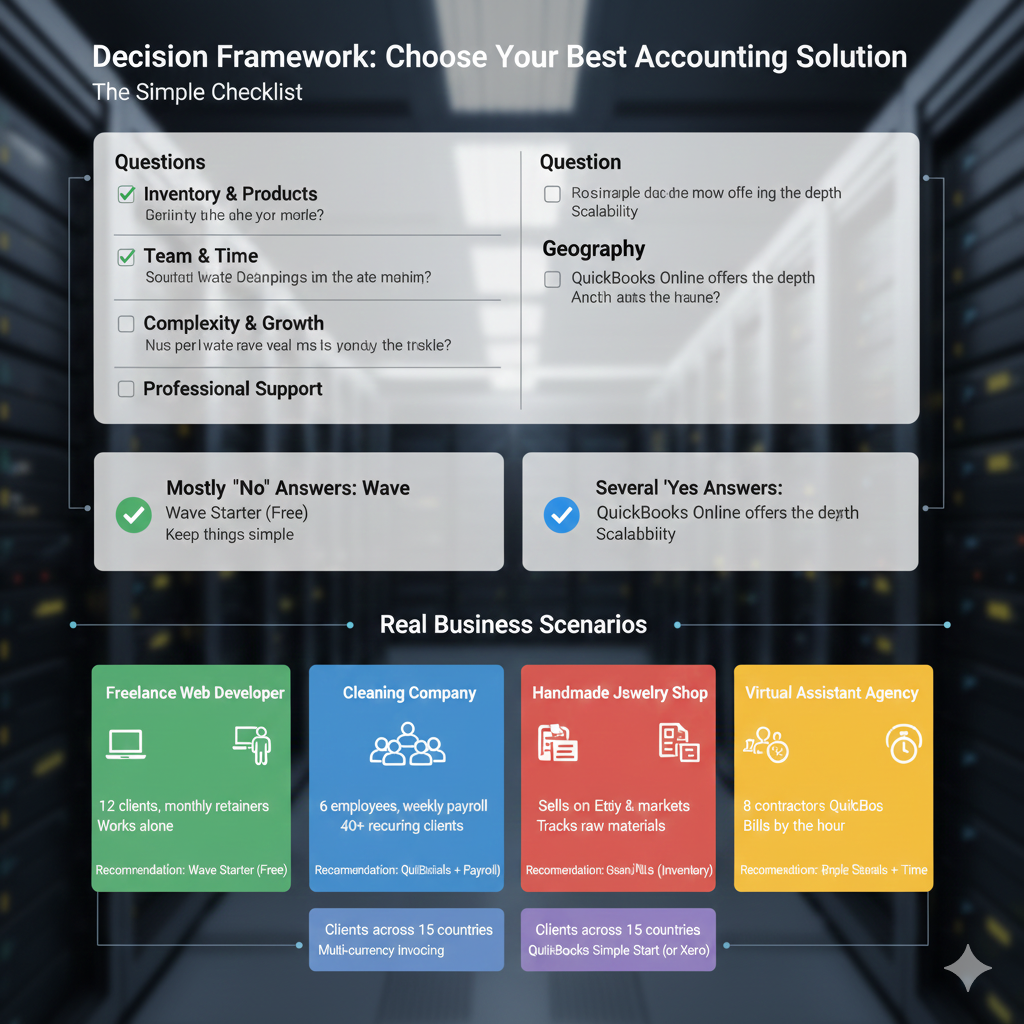

Decision Framework: Choose Your Best Accounting Solution

The Simple Checklist

Run through these questions honestly:

Inventory & Products

- [ ] Do you sell physical products requiring stock tracking?

- [ ] Do you need automatic COGS calculations?

Team & Time

- [ ] Do you have or plan to hire employees?

- [ ] Do you bill by the hour and need time tracking?

- [ ] Will multiple people need system access?

Complexity & Growth

- [ ] Do you need advanced financial statements for lenders or investors?

- [ ] Are you managing multiple projects with separate profitability tracking?

- [ ] Do you process more than 50 transactions monthly?

Professional Support

- [ ] Will you work with an accountant or bookkeeper regularly?

- [ ] Do you need someone else to handle payroll tax filings?

Geography

- [ ] Are you located outside the US or Canada?

- [ ] Do you have clients or operations in multiple countries?

Mostly “No” Answers: Wave likely provides everything you need without paying for unused features.

Several “Yes” Answers: QuickBooks Online offers the depth and scalability your business requires, justifying the higher cost.

Real Business Scenarios

Scenario 1: Freelance Web Developer

- 12 regular clients, monthly retainers

- Works alone from home office

- Simple income/expense tracking needs

- Occasional invoice to new clients

Recommendation: Wave Starter (Free) handles this perfectly. Upgrade to Pro ($16/month) only if automatic bank feeds save enough time to justify the cost. Keep things simple until your business grows more complex.

Scenario 2: Cleaning Company

- 6 employees on the weekly payroll

- 40+ recurring clients

- Supply inventory to manage

- Working with a bookkeeper for quarterly taxes

Recommendation: QuickBooks Essentials ($65) + QuickBooks Payroll ($85) = $150/month. The employee management, recurring invoice automation, and accountant collaboration justify the expense. The inventory features in the Plus tier ($99 base) might be worth it if supply tracking becomes important.

Scenario 3: Handmade Jewelry Shop

- Sells through Etsy, own website, and local markets

- Tracks raw materials and finished goods inventory

- Needs to understand per-product profitability

- Solo business owner doing their own books

Recommendation: QuickBooks Plus ($99/month) is essential here. The inventory management alone saves hours of spreadsheet work monthly, and project tracking helps identify which product lines are actually profitable. Wave simply can’t handle inventory needs.

Scenario 4: Virtual Assistant Agency

- Team of 8 contractors, no employees

- Bills clients by the hour

- Project-based work requires time tracking

- US-based with some international clients

Recommendation: QuickBooks Essentials ($65) + QuickBooks Time ($20 + $80 for users) = $165/month. Time tracking integration with invoicing is critical for accurate billing. Wave’s lack of time tracking creates too much manual reconciliation work between tools.

Scenario 5: International Consultant

- Works with clients across 15 countries

- Invoices in multiple currencies

- Solo consultant, simple business structure

Recommendation: QuickBooks Simple Start ($35/month) by default, since Wave isn’t available outside North America. However, also consider Xero as a QuickBooks alternative with strong international features if multi-currency handling is crucial.

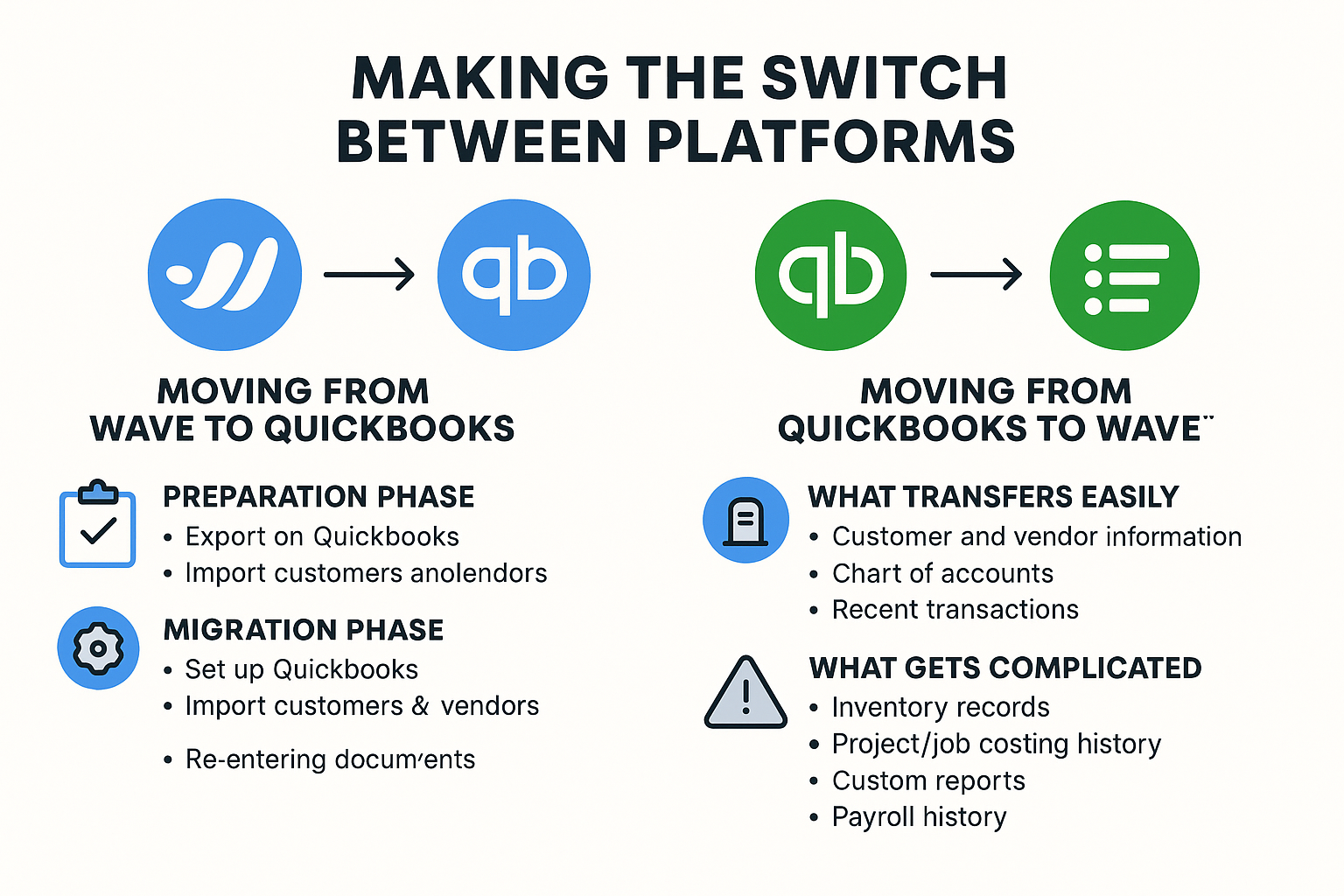

Making the Switch Between Platforms

Moving From Wave to QuickBooks

The transition requires planning but isn’t technically complex:

Preparation Phase:

- Export all data from Wave: customers, vendors, chart of accounts, transaction history

- Clean up your chart of accounts before importing

- Note all outstanding invoices and bills that need to be carried over

- Document your current categorization rules

Migration Phase:

- Set up a QuickBooks account and customize settings

- Import customers and vendors (CSV uploads work smoothly)

- Recreate your chart of accounts structure

- Import historical transactions or start fresh from a specific date

- Manually enter opening balances for all accounts

- Re-enter outstanding invoices and bills

Timeline: Plan for 2-4 hours if you’re comfortable with technology, longer if you have years of historical data or hire help.

Consideration: Many small business owners choose to start fresh in QuickBooks at the beginning of a fiscal year or quarter, keeping Wave as a read-only archive for historical records.

Moving From QuickBooks to Wave

This migration runs smoothly since you’re moving to a simpler platform, but you’ll lose functionality:

What Transfers Easily:

- Customer and vendor contact information

- Current chart of accounts (simplified)

- Recent transactions for reconciliation

What Gets Complicated:

- Inventory records (Wave can’t import these)

- Project/job costing history (no equivalent feature)

- Custom reports and dashboards (must rebuild from scratch)

- Payroll history (different systems entirely)

Best Practice: If you’re downgrading because QuickBooks is overkill, evaluate whether you actually need all your historical data in the new system. Often, keeping QuickBooks read-only for archives while starting fresh in Wave makes more sense than complex data migration.

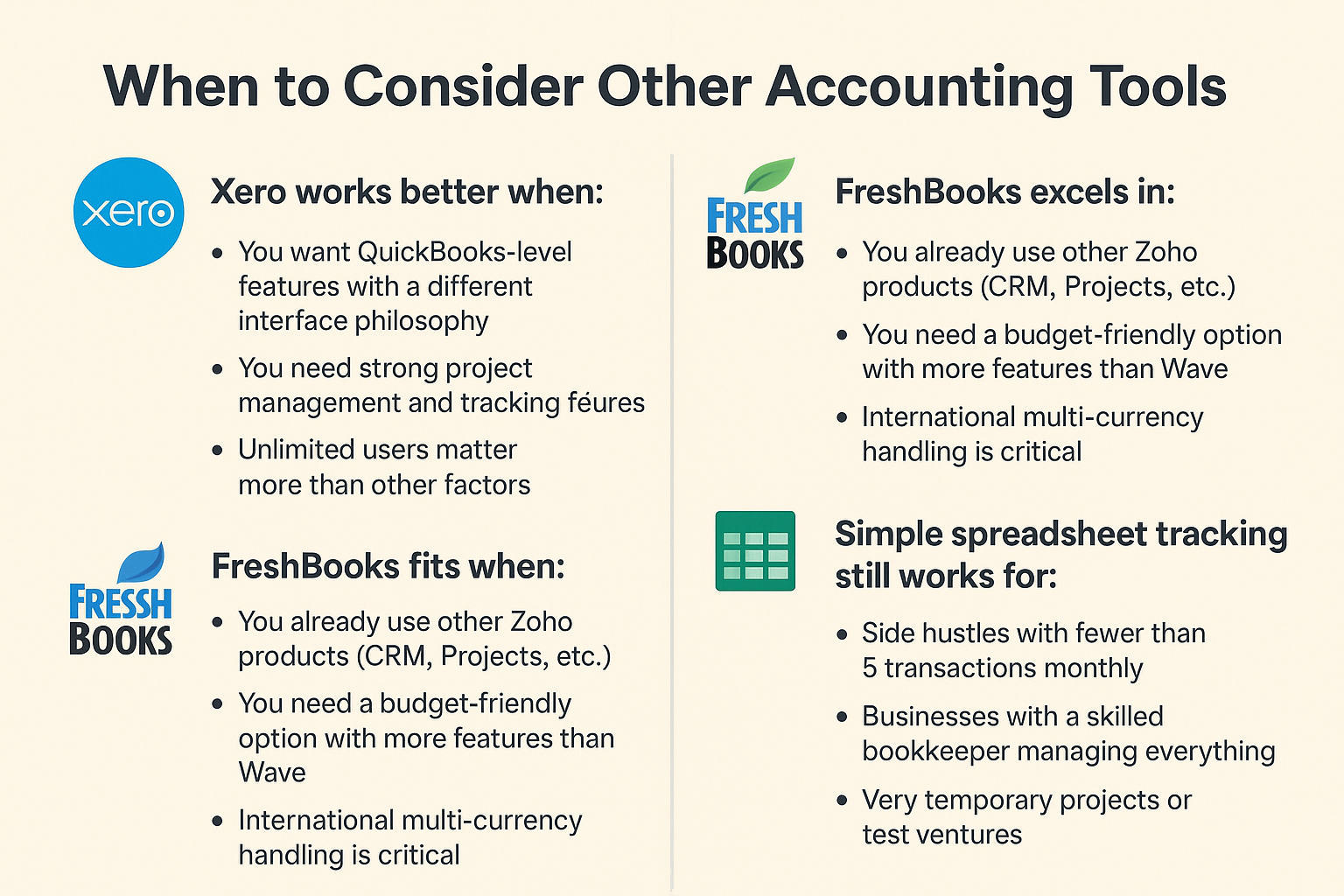

When to Consider Other Accounting Tools

Neither Wave nor QuickBooks might be your best accounting solution if:

Xero works better when:

- You want QuickBooks-level features with a different interface philosophy

- You need strong project management and tracking features

- Unlimited users matter more than other factors

- You’re in Australia, New Zealand, or the UK, where Xero has deep localization

FreshBooks excels in:

- Service businesses bill by the hour

- Agencies needing client collaboration and proposal tools

- Users who prioritize beautiful client-facing documents

- Businesses want time tracking without complex accounting

Zoho Books fits when:

- You already use other Zoho products (CRM, Projects, etc.)

- You need a budget-friendly option with more features than Wave

- International multi-currency handling is critical

- You want lower transaction fees on payment processing

Simple spreadsheet tracking still works for:

- Side hustles with fewer than 5 transactions monthly

- Businesses with a skilled bookkeeper managing everything

- Very temporary projects or test ventures

According to G2 reviews, QuickBooks leads with 9,000+ reviews and 4.0/5 stars, while Wave maintains 230+ reviews at 4.2/5 stars—suggesting satisfied users despite the smaller user base.

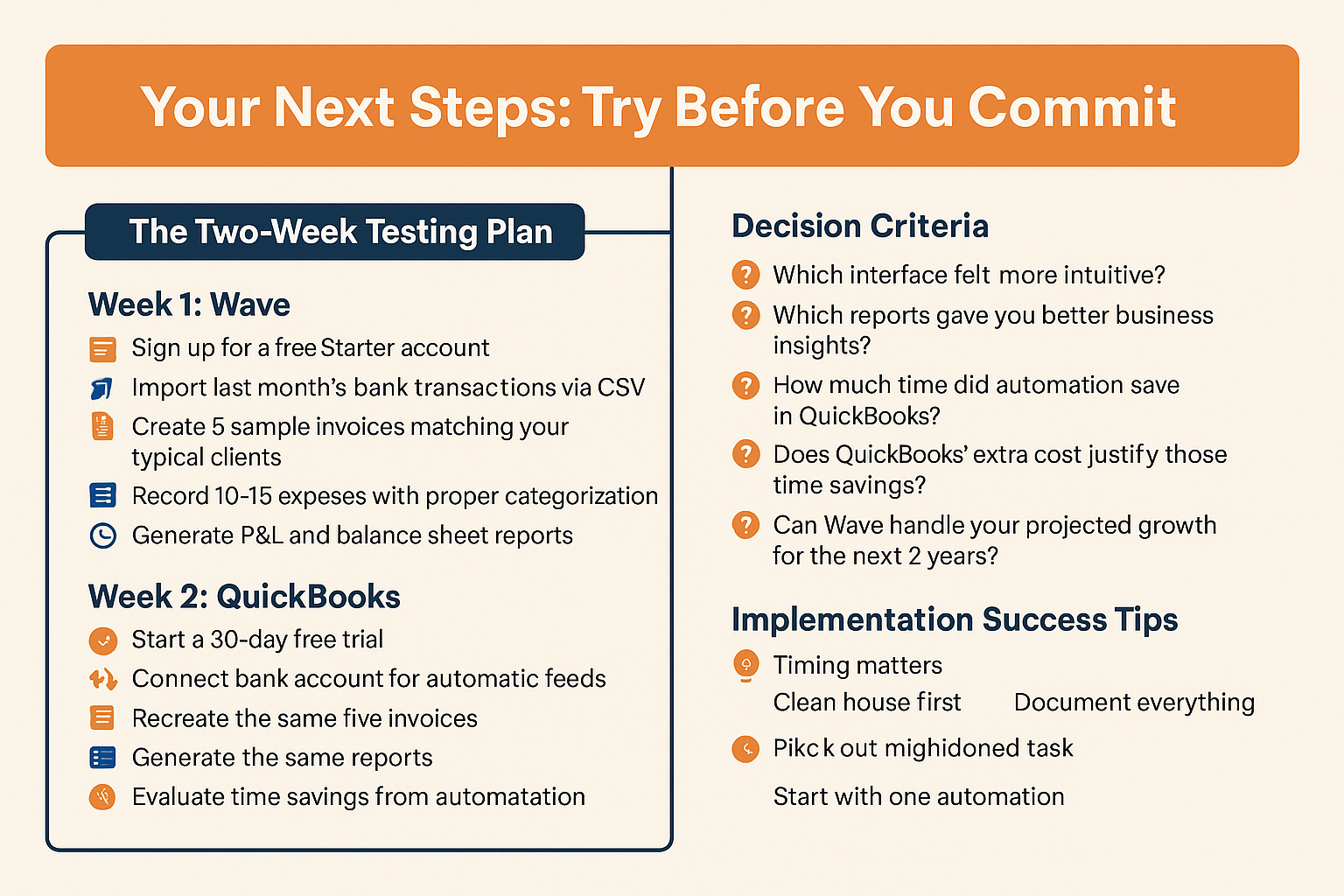

Your Next Steps: Try Before You Commit

The Two-Week Testing Plan

Week 1: Wave

- Sign up for a free Starter account

- Import last month’s bank transactions via CSV

- Create 5 sample invoices matching your typical clients

- Record 10-15 expenses with proper categorization

- Generate P&L and balance sheet reports

- Time yourself on common tasks (creating an invoice, categorizing expenses, running a report)

Week 2: QuickBooks

- Start a 30-day free trial

- Connect bank account for automatic feeds

- Recreate the same five invoices

- Record the same expenses

- Generate the same reports

- Evaluate time savings from automation

- Test any specialized features you need (inventory, projects, time tracking)

Decision Criteria:

- Which interface felt more intuitive?

- Which reports gave you better business insights?

- How much time did automation save in QuickBooks?

- Does QuickBooks’ extra cost justify those time savings?

- Can Wave handle your projected growth for the next 2 years?

- What does your accountant or bookkeeper prefer?

Implementation Success Tips

Timing Matters: If possible, switch accounting software at the start of your fiscal year, or at a minimum, the beginning of a quarter. This simplifies tax reporting and reduces reconciliation headaches.

Clean House First: Before migrating anywhere, clean up your existing chart of accounts. Merge duplicate categories, delete unused accounts, and establish clear naming conventions. This cleanup saves countless hours during and after migration.

Document Everything: Write down your current workflows in simple language. “When I receive payment from a client, I…” Having these documented makes training others easier and helps you spot inefficiencies.

Start With One Automation: Don’t try to automate everything immediately. Pick your highest-volume task (probably bank feeds or payment processing) and get that working smoothly before adding complexity.

Build in Buffer Time: Whatever timeline you estimate for getting comfortable with new accounting software, double it. Learning any new system takes longer than expected, and accounting mistakes are more costly than in other areas.

Frequently Asked Questions

Is Wave really free, and what do I pay for?

Is QuickBooks overkill for freelancers?

Can I use Wave outside the US or Canada?

Which is better for payroll, Wave or QuickBooks?

Can I migrate from Wave to QuickBooks or vice versa?

Final Verdict: Choose Based on Your Reality

The best accounting solution isn’t about which platform has more features—it’s about which one actually fits how you work.

Choose Wave if your business is straightforward, you’re comfortable handling your own books, and you’d rather invest money in growing your business than paying for software complexity you don’t need. The free plan legitimately works for thousands of freelancers and microbusinesses, and the Pro upgrade remains affordable even as you scale.

Choose QuickBooks Online if you need inventory tracking, work with an accountant regularly, manage employees or complex projects, or want sophisticated reporting that helps you make better business decisions. Yes, it costs more and takes longer to learn, but the time savings and professional capabilities justify the investment for growing businesses.

Both platforms have earned their user bases. Wave succeeds by keeping accounting simple and accessible. QuickBooks succeeds by handling complexity so you don’t have to. Neither is objectively “better”—they serve different stages of business growth.

The real mistake isn’t choosing the wrong platform today. It’s choosing software that can’t grow with your business or makes day-to-day tasks harder than they need to be. Take the time to test both, talk to your accountant, and make the choice that sets you up for sustainable success