Tax live transfers connect you with IRS debt clients who are ready to talk – right now. These are people dealing with wage garnishments, tax liens, or scary IRS letters, and they need help fast. That urgency makes them far more likely to convert than cold leads.

In this blog, I’ll break down how tax live transfers work, how to qualify and close them, and how to stay compliant while growing your book of high-intent clients.

What Are Tax Live Transfers?

Let’s break it down – tax live transfers are exactly what they sound like: live transfer calls that connect your sales team with pre-qualified prospects who are actively seeking help with IRS debt.

This guide on live transfer leads provides a broader look at how live transfer leads work across industries.

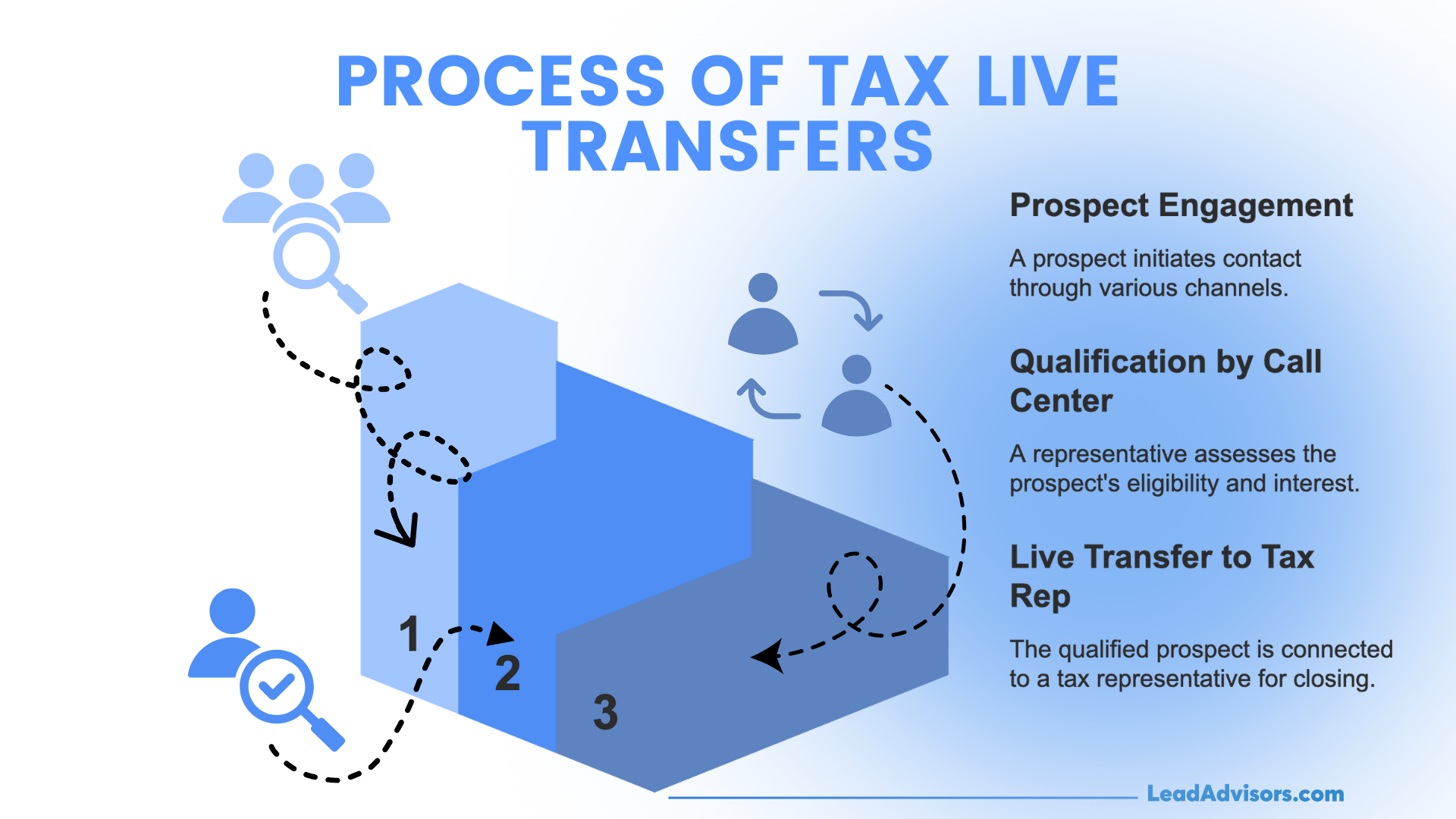

Here’s how it typically works:

- A prospect either calls in or responds to an ad – maybe from TV, a landing page, or a quick scroll through social media.

- A call center representative talks with them first, checking key details like how much tax debt they owe, which state they’re in, and whether they’re actually interested in getting help.

- If they meet the criteria, the call is transferred live to your in-house tax rep, ready to close.

No chasing. No endless follow-ups. Just real-time, high-intent leads handed off at the perfect moment in the sales process.

Why Live Transfer Leads Outperform Traditional Tax Leads

I’ve worked with both cold leads and live transfer tax settlement leads – and trust me, there’s no comparison. As soon as you have someone on the phone in the moment, already vetted and eager to discuss solutions, everything changes: the tone and vibration of the interaction, and most importantly, the conversion rate.

Here’s a short jog through how they compare:

| Traditional Tax Leads | Live Transfer Tax Leads |

| Cold calls, delayed response | Real-time, pre-warmed conversations |

| High drop-off rate | Lower attrition and faster close |

| Low conversion (2–5%) | Higher conversion (15–30%) |

| Often unqualified | Pre-screened based on program fit |

In short, traditional leads make you work harder for fewer wins. Live transfers streamline your sales process, save time, and connect you with IRS debt clients when they’re most likely to say yes.

How Tax Relief Live Transfers Are Qualified

Not every lead gets passed along. That’s the beauty of tax relief live transfers – they’re filtered and pre-qualified before they ever reach your phone.

Here’s what makes a lead transfer-worthy:

- More than $10,000 owed to the IRS

- Responding to an actual federal or state tax issue (liens, levies, unfiled returns)

- Lives in the U.S., and matches any state filters your campaign requires

- It is possible to speak with a tax specialist right now.

- Meets your campaign filters – things like call hours, geo-targeting, and daily volume cap

These filters help ensure you’re not wasting time with someone just “curious” – you’re talking to people who are ready to take action.

If you’re interested in the criteria used to filter leads more broadly, this breakdown of Live Transfer Leads by Qualification covers what separates high-quality leads from the rest.

Sample Live Transfer Tax Relief Lead

To give you a clearer picture of what a high-quality tax live transfer looks like, here’s a real-world-style example of a pre-qualified IRS debt lead ready to speak with a tax relief specialist:

Lead Details:

- Date: June 24, 2025

- First Name: John

- Last Name: Smith

- Phone Number: (123) 456-7890

- Email: [email protected]

- City: Los Angeles

- State: CA

- Zip Code: 90001

- Tax Debt Amount: $50,000

- Debt Type: Federal

- Employment Status: Employed (W-2)

- Monthly Income: $4,500

- Current on Tax Payments: No (3 months delinquent)

- Previous Bankruptcy: No

- Currently Working with Another Tax Relief Firm: No

- Interest in Tax Resolution Programs: Yes (seeking Offer in Compromise)

- Best Time to Contact: Afternoons (1 PM – 4 PM PST)

- Consent to Contact: Yes (TCPA compliant)

This is the kind of live transfer lead that puts your sales team in a position to succeed – fully vetted, in the right state, open to solutions, and ready for a real conversation.

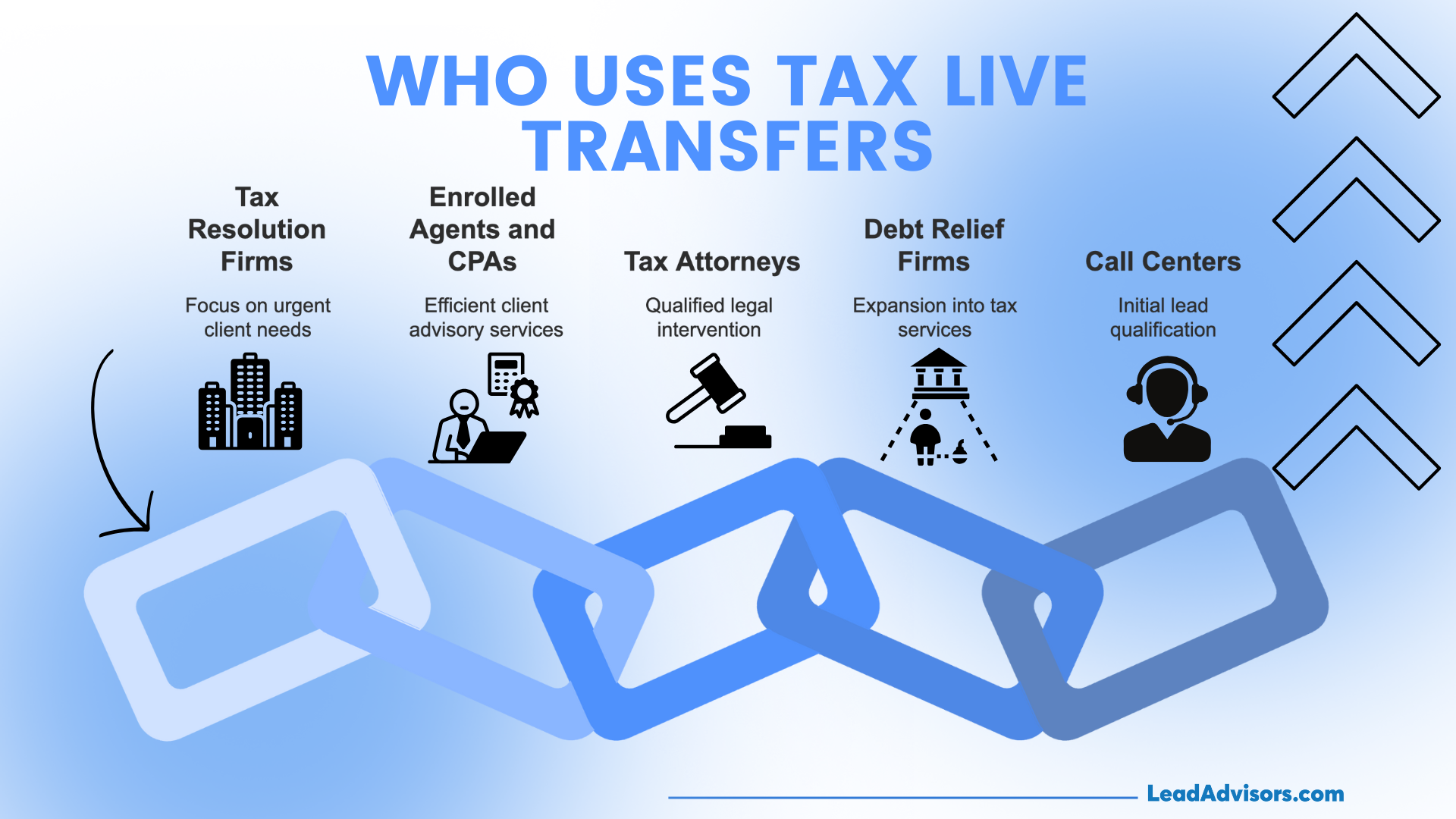

Who Uses Tax Live Transfers (Best Fit Industries)

Tax Resolution Firms and Settlement Companies

These businesses thrive on urgency. When someone’s in a tough spot with the IRS, speed matters. Tax resolution firms use tax live transfers to speak directly with people who are already emotionally invested in finding a solution – people with active liens, garnishments, or several months of delinquency. Instead of chasing cold data leads, they get real-time connections with pre-qualified prospects.

Enrolled Agents (EAs) and CPAs

For licensed professionals offering IRS representation, time is better spent advising, not dialing. Live transfer tax settlement leads make it easier for EAs and CPAs to skip the cold calls and jump right into value-driven conversations with clients who meet the program requirements and want help now.

Tax Attorneys

When legal intervention is required, tax attorneys need serious clients who are ready to move forward. Tax live transfers allow attorneys to focus their time and expertise on qualified individuals – those who’ve already cleared the initial filters and are seeking resolution, not just free advice.

Debt Relief Firms Expanding into Tax

If you’re already in the debt resolution industry, adding tax services is a natural next step. Many firms expanding into the tax vertical use live transfers to build momentum quickly, tapping into high-intent tax debt leads without building their pipeline from scratch.

The same strategy is used successfully in other verticals. For comparison, mortgage live transfers guarantee a 100% contact rate.

Call Centers Supporting Tax Professionals

Outbound and inbound call centers often handle the first touch, verifying income, debt type, state eligibility, and interest in resolution programs. Once the lead is warm and qualified, they pass it along via live transfer to a tax pro or closer who can take it from there.

Recommended Sales Qualification Frameworks

When you get live transfer calls, you don’t have much time to build trust, produce pain, create a solution, and direct the conversation. It’s also the reason you need an established sales qualification framework in place that’s been battle-tested more than a few times.

Here are three powerful frameworks that work exceptionally well with tax live transfers:

BANT: A Classic for Speed and Clarity

There’s a reason BANT is a classic: It makes the conversation where you gather basic information that you can use to determine or agree what their need is and how you can meet it efficiently.

- Budget – Ask something like: “Do you have funds set aside to resolve this now?”

- Authority – Confirm if they’re the decision-maker: “Are you the one handling your tax matters?”

- Need – Find out what motivates them: “What problem do you want to solve with the IRS?”

- Timing – Determine urgency: “Do you want to do something right away?”

CHAMP: Lead with Pain, Then Offer Relief

CHAMP flips the order and puts challenges front and center. That’s particularly handy when you’re dealing with emotionally stretched leads who have severe tax troubles on their hands.

Asking, “How has this tax issue affected your income or business?” cracks the door to a more empathetic, high-trust conversation. It’s an excellent fit when you want to position your services as a lifesaver, not just a transaction.

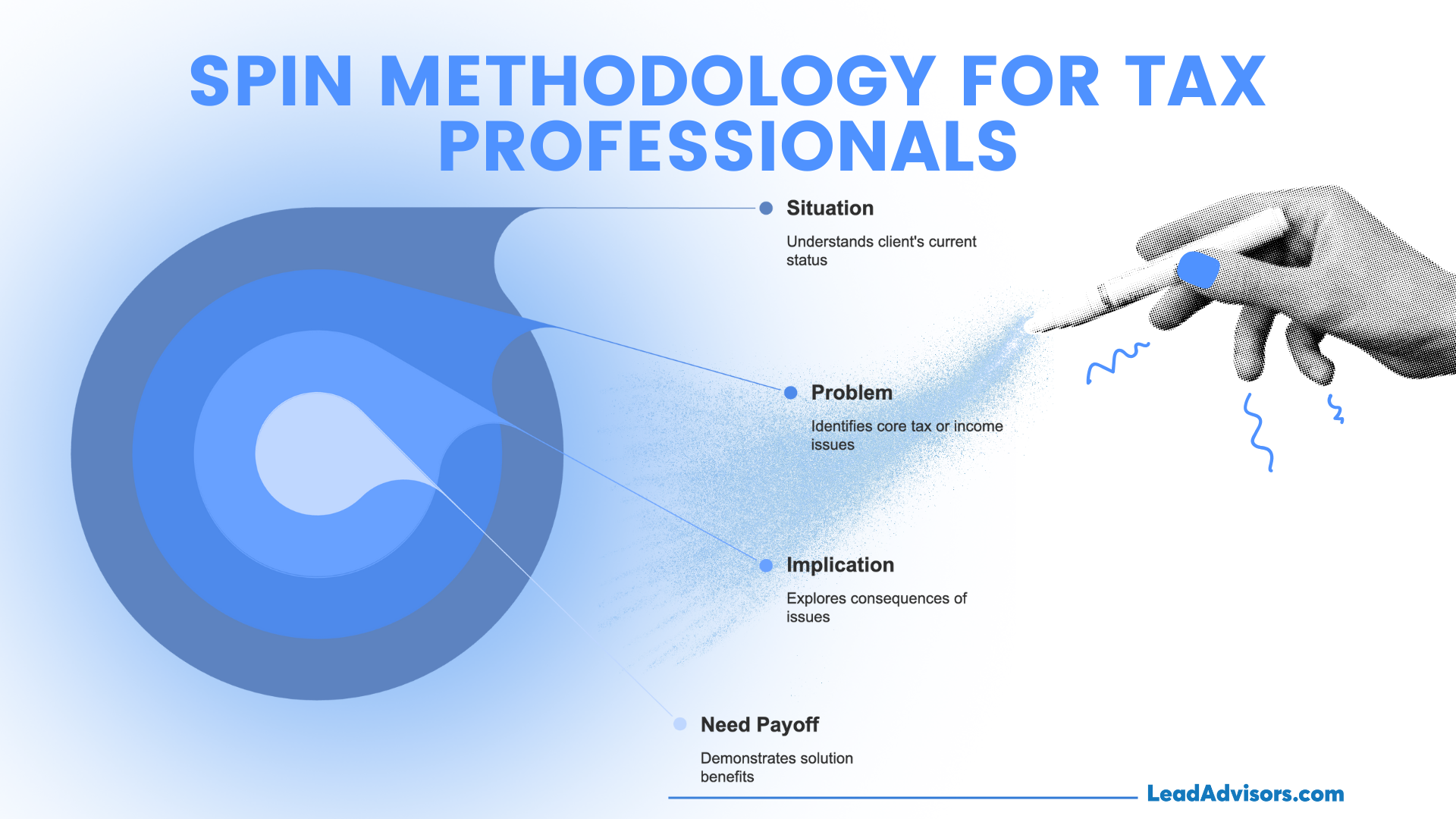

SPIN: Perfect for EAs and CPAs Who Consult

SPIN is a more nuanced approach that works well for professionals who need to build rapport and go deeper, especially Enrolled Agents and CPAs offering IRS representation.

Here’s how it flows:

- Situation – Understand their current status

- Problem – Uncover the core tax or income issue

- Implication – Dig into the real-world consequences, like garnished wages or lost income

- Need Payoff – Demonstrate how your solution will make the pain go away and bring back control.

Both frameworks help you keep your sales process tight, organized, and human, so you’re never left scrambling to determine what to ask next.

QA & Compliance: Protecting Every Call, Boosting Every Close

When you’re working with tax live transfers, staying compliant isn’t just smart – it’s essential. Let’s simplify how to stay protected while keeping your sales process sharp and conversion-ready.

1. Stay TCPA-Compliant, Always

![A side-by-side comparison of the "Do Not Call List Registry Check Lite" tool showing two phone numbers—one marked with a green "OK [12 days]" label indicating it's safe to call, and another with a red "Do Not Call [12 days]" label indicating a restriction. The graphic helps users understand how to interpret compliance status before initiating outbound calls.](https://leadadvisors.com/wp-content/uploads/2025/06/dnc-check-ok-vs-do-not-call-status.png)

Only call leads who’ve opted in with express written consent. Make sure your lead data includes time, date, and IP stamp. Respect Do Not Call lists and always route based on the lead’s time zone. No shortcuts here – just clean, compliant contact.

2. Record and Retain Every Live Transfer

![]()

Recording live transfer calls from start to finish gives you both protection and insights. Use recordings to check for compliance language (no false promises), and securely store them in case of disputes or audits. It also helps train reps on what great conversations sound like.

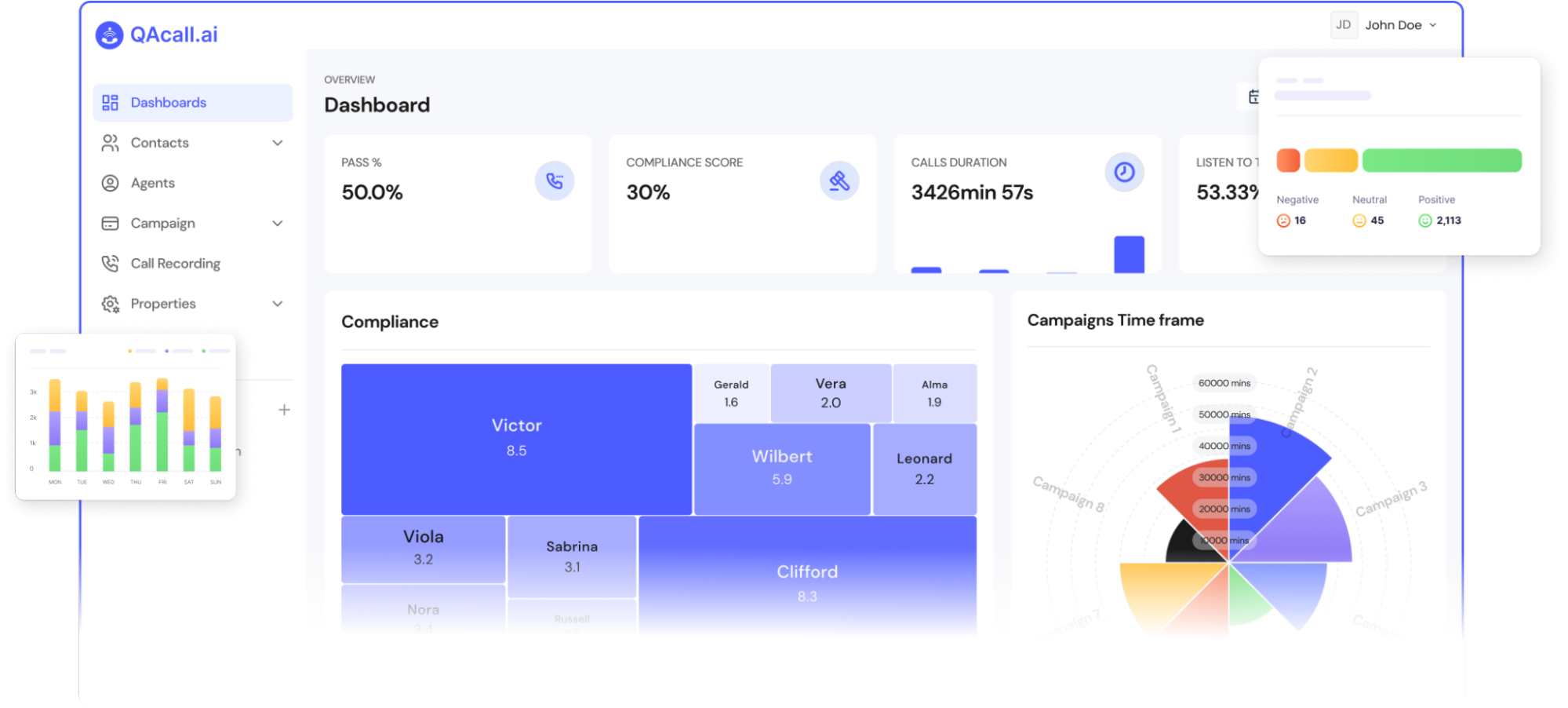

3. Use QAcall to Monitor and Improve

Tools like QAcall.ai help automate the process. With features like call scoring, script adherence tracking, and CRM tagging, you can flag risky calls and highlight top performers. It’s a simple way to stay legally sound while boosting team performance.

Pricing Models & Conversion Benchmarks

If you’ve worked with cold data leads before, you already know the conversion game can feel like a grind. But with tax live transfers, you’re not just paying for data – you’re paying for speed, intent, and real conversations.

What’s the Cost?

Expect to pay anywhere from $35 to $150 per live transfer, depending on your campaign setup. Pricing varies based on things like:

- The minimum tax debt amount you’re targeting

- Which states you’re focused on

- Whether you want exclusive calls or are okay sharing

- Your preferred hours of operation and lead volume

The more specific your filters, the more you pay – and the higher the quality.

How Do They Convert?

That’s where things really shine. While cold leads typically convert at just 3–5%, tax live transfers often see conversion rates between 15–30%, sometimes even higher with experienced transfer reps and a tight sales process in place.

If you’re looking for predictability and scale, this model provides both, especially when paired with smart filtering and a solid closing strategy.

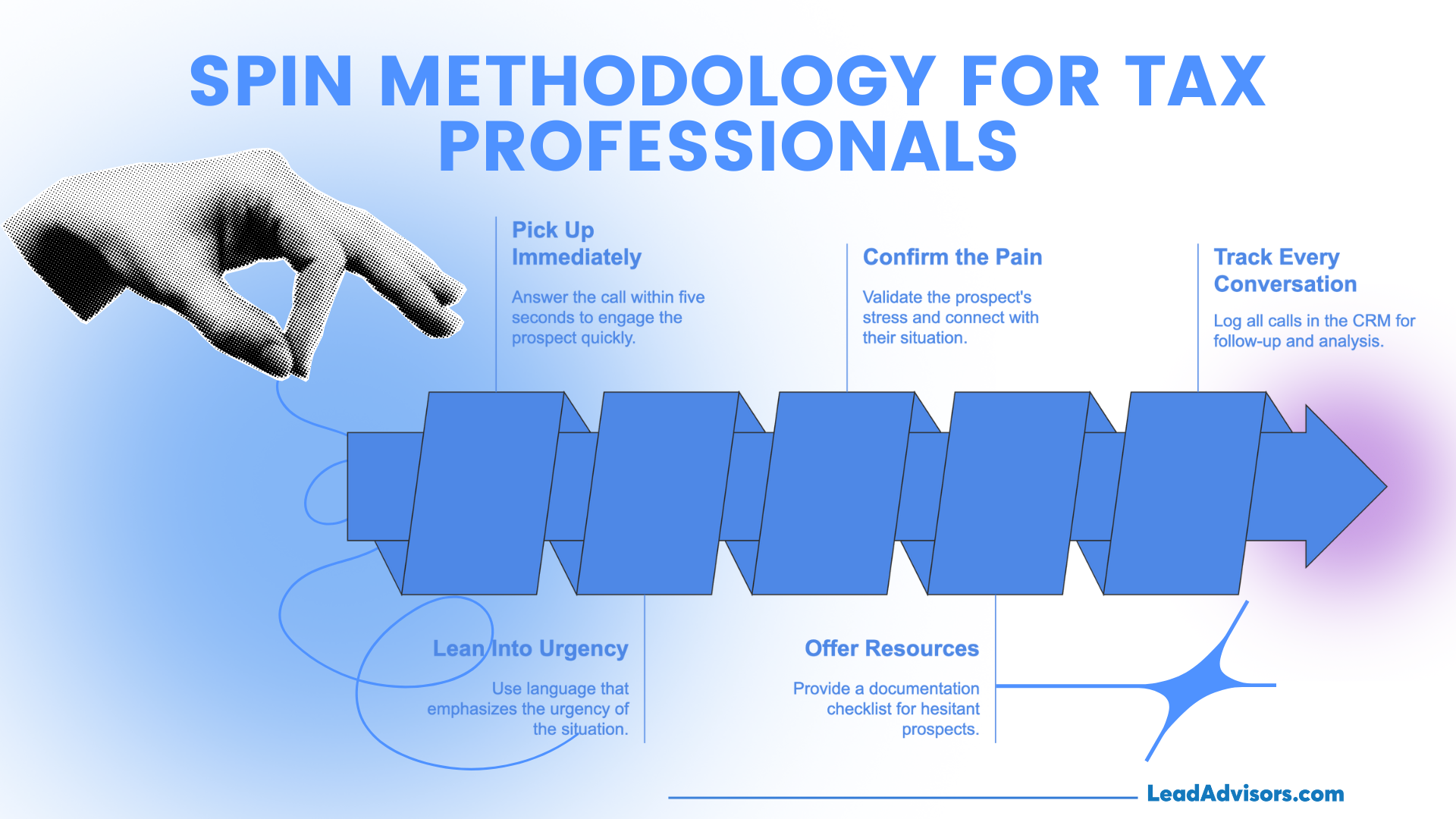

Tips to Close More Tax Relief Clients Over the Phone

With tax live transfers, the difference between a closed deal and a missed opportunity often comes down to the first few seconds. Here’s how to make every call count.

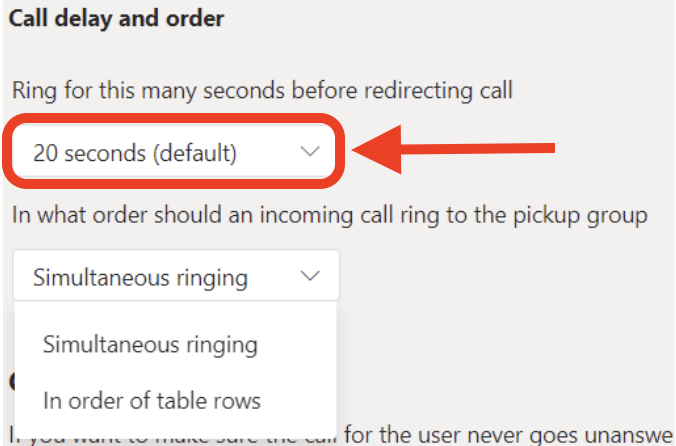

Pick Up Immediately

Answer the call within five seconds. The longer you wait, the colder the lead gets. These are high-intent prospects in urgent situations – they expect a tax specialist on the line, not hold music.

Lean Into Urgency

Speak to them by taking advantage of what they’re already experiencing: pressure. Phrases such as ‘The IRS deadline won’t wait’ or ‘Delays result in penalties or garnishments’ demonstrate you get it – and that now is the time for action.

Confirm the Pain, Then Offer Relief

Don’t rush the pitch. First, validate their stress: “We’ve helped others in your exact situation – same debt amount, same IRS issue.” Once you’ve made that connection, walk them through the following steps clearly and confidently.

Offer Resources for the Hesitant

Not everyone will say yes immediately. That’s okay. Have a documentation checklist ready to send for those who need to “think about it” but are still interested. It shows you’re helpful, not pushy, and keeps the door open.

Track Every Conversation

![]()

Log every call in your CRM or QA platform. Win or lose, work detailed notes that your sales team can use for follow-up, re-engagement, and keeping them from slipping through the cracks.

Tips to Close More Tax Relief Clients Over the Phone

Problem: Lost Momentum Kills Deals

Tax live transfers are hot leads – but only if you act fast. Every second you wait to pick up the phone diminishes their urgency. If your team isn’t prepared to handle the call right away, conversions drop.

Strategy: Answer within 5 seconds. Always.

Build a system that routes calls instantly to an available rep. You have someone ready to engage immediately – the faster you can engage, the more emotionally and financially invested the lead is.

Problem: Uncertainty Slows Decisions

IRS debt is scary – but it’s also confusing. If your lead doesn’t fully understand their options, they’ll hesitate.

Strategy: Use urgency and clarity.

Explain consequences quickly and clearly: “The IRS isn’t waiting, and interest is stacking.” Then present your solution as the fastest, most trustworthy next step.

Problem: Not All Leads Close on the First Call

Even the best prospects can use a little push. You’d be losing money on the table if you don’t provide follow-up service.

Strategy: Offer a checklist and follow through.

Send a short documentation checklist to slower-moving leads. This will keep them in your funnel and give you a valid reason to reconnect.

Problem: No Follow-Up, No Second Chance

If calls aren’t tracked, your team is flying blind. You can’t repair what you don’t see.

Strategy: Log everything into your CRM or QA platform.

Track every live transfer call – what was said, where it went right, and where it went silent. It’s your blueprint for follow-up and optimization.

Frequently Asked Questions

Are tax live transfers exclusive or shared across multiple firms?

Can I filter tax live transfers by state or employment status?

How long does it take to launch a live transfer campaign?

What happens if a transferred lead doesn’t answer or drops the call?

Are tax live transfers compliant with federal marketing laws?

Start Your Tax Live Transfer Campaign Today

If you’re looking for a better way to reach real people with real IRS debt, tax live transfers are it.

You get pre-qualified leads who are already open to help. You skip the cold calls and start conversations at the peak of urgency. And the greatest part is that it’s a scalable, compliant, profitable system for closers.

Ready to take the next step

Contact us for a free consultation about pricing, filters, and your company’s live transfer lead availability.

Are you not quite ready to jump in? You can also request sample leads or ask for a custom campaign volume estimate to see if it’s the right fit.

For inspiration on how to structure your own campaign, explore examples of the Best Live Transfer Campaigns here.