Here’s what matters most: Philippine call center outsourcing delivers 40-65% cost savings compared to domestic operations, with rates ranging from $8 to $25 per hour, versus $35-$65 in the U.S. However, there’s a catch—budget-tier providers experience an annual turnover rate of 50-70%, while premium operations maintain a rate of 25-35%.

The key to success? Demanding CEFR B2+ English proficiency, ISO 27001 certification, and contractual attrition penalties before signing anything.

This 2026 update reflects what LeadAdvisors has observed across real Philippine outsourcing engagements where cost savings are achievable, but only when vendor selection, contracts, and governance are structured correctly. Many of the failures we see aren’t operational mistakes; they’re preventable decisions made before contracts are signed.

TL;DR

- Cost savings are real but tiered: Expect 40-65% savings ($8-$25/hr vs. $35-$65 domestic), but budget providers suffer 50-70% annual turnover while premium operations maintain 25-35%—you get what you pay for.

- Demand proof, not promises: Require CEFR B2+ English proficiency with team-specific TOEIC/IELTS scores, ISO 27001 certification with facility audits, and contractual attrition penalties with invoice reductions—most failures are preventable decisions made before contracts are signed.

- Attrition is manageable with the right contracts: Embed turnover thresholds (max 4% monthly), 14-day replacement SLAs, and penalty clauses that make retention the vendor’s problem, not yours—agents leave due to career dead-ends, abusive interactions, and wage stagnation.

- Data security requires active verification: Philippine Data Privacy Act doesn’t satisfy HIPAA/GDPR automatically—conduct unannounced facility audits, verify device controls, demand $2M-$5M cyber liability insurance, and test access termination protocols (should be <2 hours, not “end of day”).

- AI changes everything mid-contract: Conversational AI is reducing tier-1 volume by 15-40%, so build biannual volume reviews and flexible staffing clauses—fixed three-year seat commitments are obsolete when technology eliminates 30% of your call volume in year two.

The Real Advantage of Philippine Call Centers (And What Marketing Won’t Tell You)

English Proficiency: Beyond the “Neutral Accent” Myth

The Philippine call center industry didn’t become a global leader by accident. With over 1.3 million workers serving international markets, English proficiency remains the foundational advantage. But here’s what most vendors won’t clarify upfront: not all English skills are created equal.

CEFR scoring matters more than you think:

- B2 level (upper-intermediate): Handles routine customer service operations with occasional comprehension gaps

- C1 level (advanced): Manages complex technical support services and nuanced customer complaints seamlessly

LeadAdvisors requires CEFR-aligned screening at the team level, not the company level. We validate average TOEIC or IELTS scores for assigned agents and review live call recordings from peak-hour production—not training environments—before approving deployment.

One e-commerce client discovered this the hard way when their customer satisfaction scores dropped 18% after switching to a budget provider. The issue? Their call center agents averaged B1 proficiency instead of the promised B2+. Regional variations add another layer—Manila-based contact centers typically deliver more neutral accents compared to those in Cebu or Davao, although quality providers exist in all major hubs.

What to demand during vendor selection: Request TOEIC or IELTS score averages for your dedicated team, not company-wide statistics. Insist on live call samples from your specific account, recorded during peak hours when fatigue impacts performance.

Cost Structures Decoded: What That $10/Hour Actually Includes

Cost efficiency drives most outsourcing decisions, but understanding the pricing tiers prevents nasty surprises three months into your contract.

| Pricing Tier | Hourly Rate | What You Get | What You Don’t Get |

| Budget | $8-$12 | Shared agents, basic CRM integration, standard business hours | Dedicated teams, advanced technology stack, graveyard shift coverage |

| Mid-Tier | $13-$18 | Dedicated agents, omnichannel support, quality assurance protocols | Premium retention programs, full AI tooling, executive escalation paths |

| Premium | $19-$25 | Strategic partnership, cutting-edge technology, proactive performance optimization | None—this tier competes with domestic operations on everything except price |

LeadAdvisors breaks down total outsourcing cost before onboarding, including attrition backfill, night-shift premiums, and technology licensing. This allows clients to compare providers on fully-loaded cost rather than headline hourly rates that rarely reflect reality.

Hidden fees that inflate your actual costs:

- Recruitment and training backfill: $500-$1,200 per replacement agent

- Technology licensing for specialized tools: 15-30% markup on third-party software

- Graveyard shift premiums: 20-30% additional for U.S. business hours coverage

The business process outsourcing industry in the Philippines operates with razor-thin margins at the budget tier, which directly correlates to the turnover crisis we’ll address next.

Time Zone Realities for U.S. and Australian Markets

Philippine contact centers span 12 time zones of coverage, but night shift work comes with consequences most vendors downplay. Agents working U.S. hours (8 pm-5 am Manila time) experience higher burnout rates and health complications, which research shows increases attrition by 40% compared to day shift roles.

Smart clients build coverage strategies that:

- Rotate teams between day and night shifts quarterly

- Pay 25-35% premiums for sustainable night shift staffing

- Include mandatory health screenings in service level agreements

LeadAdvisors structures night-shift coverage with rotation schedules, health-screening requirements, and premium compensation benchmarks. Sustainable staffing protects service quality and reduces mid-contract disruption caused by burnout-driven attrition.

Australian clients benefit from near-perfect time zone alignment (a 1-3 hour difference), which eliminates these complications while maintaining cost savings.

The Turnover Crisis Destroying Your Customer Experience

Here’s the statistic that should terrify you: a budget call center outsourcing solutions report indicates that 50-70% of agents experience annual attrition. Premium providers achieve 25-35% growth, but even that means replacing one-quarter of your team every year.

Attrition becomes a client problem only when contracts allow it. LeadAdvisors embeds turnover thresholds, replacement SLAs, and invoice penalties into provider agreements so retention accountability stays with the vendor—not the client.

Why Your Call Center Agents Keep Leaving

Exit interview data from Philippine call center operations reveal three primary factors:

- Career dead-ends after 18-24 months — Most center operations offer limited advancement beyond team leader roles, forcing ambitious agents into tech BPO services that pay 25% more for software support positions.

- Abusive customer interactions without adequate support — Healthcare and telecommunications accounts report the highest burnout, with agents handling 40-60 difficult calls daily without sufficient mental health resources.

- Wage stagnation amid inflation — Entry-level call center agent salaries (₱18,000-₱25,000 per month) haven’t kept pace with Manila’s increasing cost of living.

Retention Strategies With Proven Results

One financial services client reduced their turnover from 62% to 34% within 18 months using this four-point program:

The framework that actually worked:

- Educational partnerships: Provider-funded certifications in financial analysis, creating internal promotion pipelines

- Peer recognition systems: Monthly awards with ₱5,000 bonuses, chosen by fellow agents rather than management

- Mental health access: Unlimited counseling sessions with zero stigma policies

- Career pathing transparency: Published promotion criteria with quarterly skill assessments

Gamification typically fails because agents see through superficial point systems. What moves the needle? Tangible career development with financial impact.

Contract Language That Protects Your Operations

Non-negotiable clauses for your call center outsourcing agreement:

ATTRITION PENALTY STRUCTURE

– Monthly turnover exceeding 4%: 10% invoice reduction

– Replacement timeline: Trained agent deployed within 14 calendar days

– Backstop provision: Client may source temporary coverage at vendor expense beyond 21 days

GUARANTEED STAFFING LEVELS

– Minimum 95% of contracted FTE maintained continuously

– Vacation/sick leave: Provider maintains bench strength of 8-10%

– Force majeure exceptions: Natural disasters only, capped at 30 days annually

Beyond initial negotiation, LeadAdvisors monitors staffing, attrition, and SLA performance monthly. Contract protections are enforced continuously, not revisited only when service issues escalate.

This contractual discipline separates professional call center outsourcing services from providers that treat attrition as “normal business.”

Data Security: Learning From Documented Failures

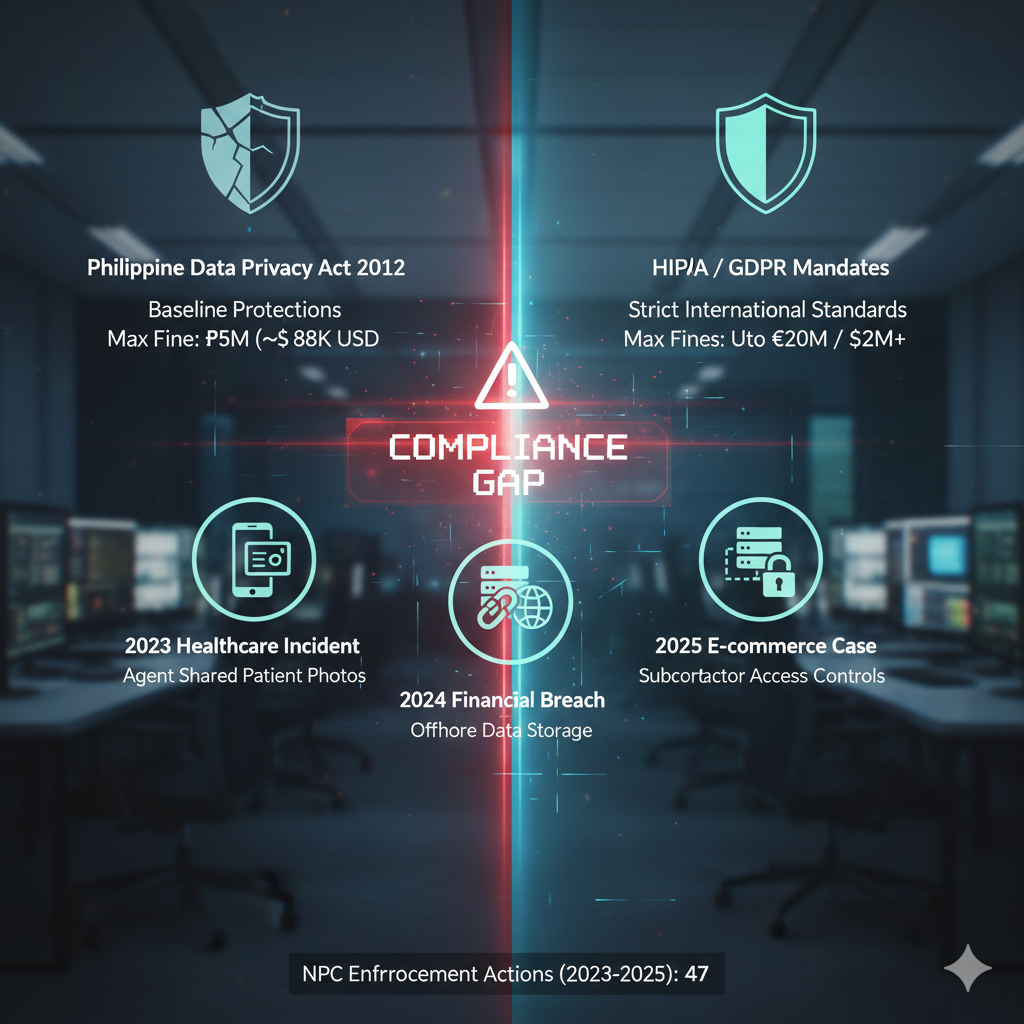

Philippine Data Privacy Act vs. HIPAA/GDPR—The Compliance Gap

The Philippine call center industry operates under the Data Privacy Act of 2012, which establishes baseline protections. However, these standards don’t automatically satisfy HIPAA requirements for healthcare or GDPR mandates for European customer data.

Recent breach incidents (anonymized) reveal common vulnerabilities:

- 2023 healthcare incident: An agent photographed patient records on their personal phone and shared them via social media. Provider lacked device control policies.

- 2024 financial services breach: Offshore data storage on non-compliant servers exposed 18,000 customer records. The contract failed to specify data residency requirements.

- 2025 e-commerce case: Third-party subcontractor handling overflow volume didn’t disclose inadequate access controls until after penetration testing.

All LeadAdvisors-approved partners undergo facility audits, device-control verification, and access-termination testing. ISO certifications are treated as a starting point—not proof of ongoing compliance.

The National Privacy Commission issued 47 enforcement actions against business process outsourcing industry members from 2023-2025, with penalties ranging from ₱500,000 to ₱5 million.

Red Flags During Vendor Facility Audits

What to inspect beyond the polished tour route:

Walk the production floor unannounced and check for:

- USB port availability (should be disabled via hardware controls)

- Personal phone usage at desks (should be prohibited with secure lockers provided)

- Visible screens displaying customer data (privacy filters mandatory)

- Clean desk policies during breaks (documents left unsecured indicate a weak culture)

Data storage architecture questions:

- Where are voice recordings physically stored? (Demand client-region servers)

- Who has administrative access to customer databases? (Should be limited to 2-3 senior staff with full audit logging)

- What happens when agents resign? (Access termination should occur within 2 hours, not “end of day”)

Insurance and Liability Minimums

Coverage requirements by vertical:

| Industry | Cyber Liability Minimum | E&O Insurance | Additional Provisions |

| Healthcare | $5M per occurrence | $3M aggregate | HIPAA breach notification insurance |

| Financial Services | $3M per occurrence | $2M aggregate | Regulatory defense coverage |

| E-Commerce | $2M per occurrence | $1M aggregate | PCI-DSS compliance riders |

| General Customer Service | $1M per occurrence | $500K aggregate | Standard indemnification |

Insist on being named as additional insured on all policies, with 30-day cancellation notice requirements.

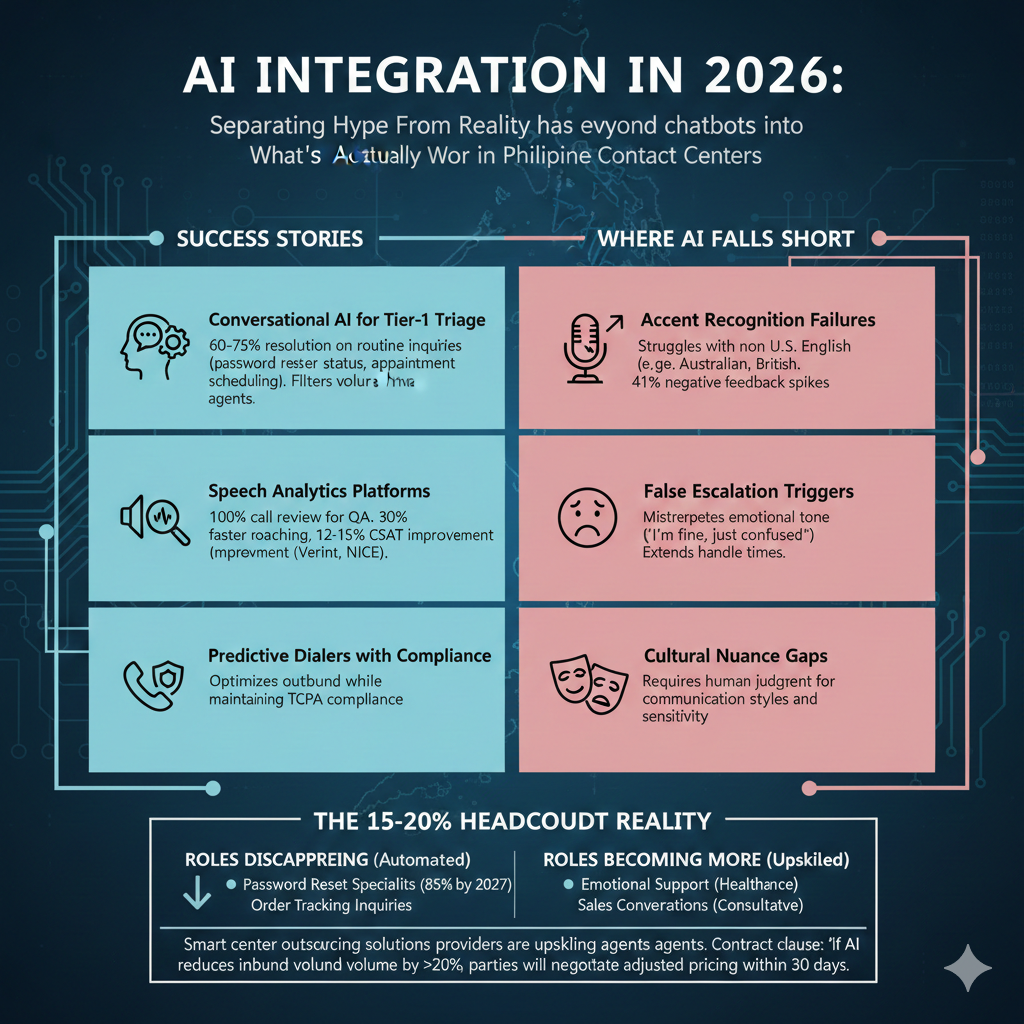

AI Integration in 2026: Separating Hype From Reality

What’s Actually Working in Philippine Contact Centers

The cutting-edge technology story in call center solutions has evolved beyond chatbots into sophisticated automation:

Conversational AI for tier-1 triage achieves 60-75% resolution rates on routine inquiries, including password resets, order status, and appointment scheduling. This isn’t replacing call center services entirely; it’s filtering volume so that human agents can handle complex issues that require empathy and judgment.

Speech analytics platforms now review 100% of calls for quality assurance, replacing the traditional 2-3% random sampling. Providers using tools like Verint or NICE achieve 30% faster coaching interventions and 12-15% improvements in customer satisfaction metrics within six months.

Predictive dialers with compliance guardrails optimize outbound center operations while maintaining TCPA compliance, a critical consideration given recent FCC enforcement actions.

Where AI Falls Short in Live Environments

Accent recognition failures plague non-U.S. English speakers. One insurance provider’s chatbot struggled with Australian and British callers, resulting in a 41% spike in negative feedback before the deployment was abandoned entirely.

False escalation triggers frustrate customers when AI misinterprets emotional tone. A statement like “I’m fine, just confused about the bill” might trigger unnecessary supervisor transfers, extending handle times rather than improving customer experience.

Cultural nuance gaps remain AI’s Achilles heel. Technical support services requiring sensitivity to regional communication styles still demand human judgment that machines can’t replicate.

The 15-20% Headcount Reality

Roles disappearing first in AI-augmented centers:

- Password reset specialists (85% automated by 2027 projections)

- Order tracking inquiries (automated via proactive SMS/email)

- Appointment scheduling (calendar integration handles routine bookings)

Roles becoming more valuable:

- Complex problem resolution requiring multi-system coordination

- Emotional support for distressed customers (healthcare, insurance claims)

- Sales conversations requiring consultative approaches

LeadAdvisors structures agreements to account for automation-driven volume reductions. When AI materially impacts demand, contracts include pricing-adjustment mechanisms rather than locking clients into outdated seat commitments.

Smart center outsourcing solutions providers are upskilling agents into these higher-value functions rather than simply reducing headcount. Your contract should address volume fluctuations: “If AI reduces inbound volume by >20%, parties will negotiate adjusted pricing within 30 days rather than maintaining fixed seat commitments.”

Your 90-Day Vendor Selection Roadmap

Month 1—Internal Alignment and Requirements Definition

Week 1-2: Stakeholder Workshop

Assemble IT, Legal, Operations, and Finance for a structured requirements session. Too many companies let Operations drive vendor selection alone, only to discover IT can’t integrate the chosen platform or Legal flags unacceptable liability terms after contracts are signed.

Many organizations underestimate the complexity of aligning IT, legal, operations, and finance during outsourcing decisions. LeadAdvisors facilitates this process to ensure vendor selection doesn’t stall—or fail—after contracts reach legal review.

Document these specifications:

- Annual call volume with seasonal peaks (±20% accuracy minimum)

- Customer service functions requiring specialized knowledge

- Compliance requirements by customer data type

- Technology integrations (CRM, ticketing, payment systems)

- Growth projections factoring in AI automation impact

Week 3-4: Forecast Refinement

Build volume scenarios: Baseline (current state), Conservative (10% growth), Aggressive (30% growth). Philippine call center operations can scale quickly, but pricing gets more favorable with longer-term commitments. Forecasting accuracy directly impacts your negotiating leverage.

Month 2—RFP Process and Shortlist Development

The 12 questions competitors aren’t asking:

- What was your actual attrition rate for accounts similar to ours over the past 12 months? (Demand data, not marketing claims)

- Provide your last 3 client departures with reasons and transition timelines

- What percentage of your agents hold CEFR C1 vs B2 English proficiency?

- How many data breach incidents has your company reported to the Philippine NPC since 2022?

- What is your AI integration roadmap, and can clients opt out of specific tools?

- How do you handle typhoon-related service disruptions? (Show disaster recovery testing results)

- What’s your median agent tenure on accounts in our industry vertical?

- Describe your last HIPAA/PCI-DSS audit findings and remediation (if applicable)

- What percentage of your leadership has worked in our industry previously?

- How do you measure and report service quality beyond standard call metrics?

- What happens if you fail to meet staffing commitments for 30+ consecutive days?

- Are you using any third-party subcontractors, and what oversight governs them?

Red flag responses that disqualify vendors:

- Refusing to provide attrition data (“proprietary information”)

- Vague disaster recovery descriptions without test documentation

- Claiming zero data security incidents ever (statistically implausible)

- Unable to provide client references in your specific industry

Reference check script for current clients:

When calling provided references, ask: “If you were starting over, what would you negotiate differently in your contract?” This question reveals hidden issues the vendor’s sales team won’t disclose.

Month 3—Pilot Design and Contract Negotiation

30-60-90 Day Success Metrics

| Period | Operational Metrics | Quality Metrics | Business Metrics |

| Days 1-30 | 90% of agents are trained and taking calls | 75% first-call resolution rate | Baseline customer satisfaction established |

| Days 31-60 | <5% attrition in pilot cohort | 80% FCR, <3% compliance incidents | CSAT within 5% of internal team performance |

| Days 61-90 | Full contracted volume transitioned | 85% FCR, match internal QA scores | CSAT equals or exceeds the internal baseline |

Exit criteria if pilot fails: Build a clause allowing contract termination with 30 days’ notice if Day-90 metrics fall below 80% of targets, with no early termination penalties.

Non-negotiable contract provisions:

PERFORMANCE-BASED PRICING

– Base rate applies when quality scores exceed 85%

– 5% discount applied when scores reach 92%+

– 8% surcharge if scores fall below 80% for two consecutive months

TECHNOLOGY REFRESH COMMITMENTS

– Provider upgrades core platforms within 90 days of vendor releases

– Client may request evaluation of new tools quarterly

– AI tooling deployment requires 60-day notice with opt-out rights

DISASTER RECOVERY SLAs

– Backup site activation within 4 hours of primary site disruption

– 90% of pre-disruption capacity restored within 24 hours

– Typhoon season (June-November): Weekly continuity testing with documented results

Beyond the Philippines: When Alternative Destinations Make Sense

Thailand’s 2026 Emergence as a Competitive Option

Thailand’s business process outsourcing industry has achieved a 100% search interest score in competitive analysis, driven by government incentives and improvements in English proficiency. Cost parity exists ($9-$22/hr comparable ranges), with slightly higher rates justified by lower attrition (20-28% typical).

When to consider Thailand over the Philippines:

- Your company has existing operations in Southeast Asia (synergy advantages)

- You’re serving Japanese or Korean markets (stronger language capabilities)

- Political risk diversification matters to your stakeholders

Trade-offs: A smaller talent pool (400,000 BPO workers vs. 1.3 million in the Philippines), and less mature healthcare and financial services specialization.

India’s AI-Forward Positioning and Technical Depth

Indian contact centers excel in technical support services that require in-depth product knowledge—such as software troubleshooting, IT helpdesk, and SaaS customer success. India’s BPO market reaches $38 billion annually, with substantial investment in AI.

Pricing reality: $10-$28/hr, with premium providers commanding $30-$35/hr for specialized skills.

Best use cases:

- B2B technical support requiring certification-level knowledge

- Back office operations with complex data analysis components

- Organizations already managing offshore teams across time zones

Challenges for U.S. companies: Pacific and Mountain time zones require night shifts in India, eliminating the natural alignment that Philippine operations offer.

Nearshore Americas—When Cultural Alignment Justifies Premium Pricing

Colombia and Mexico deliver stronger cultural alignment for U.S. brands, with agents understanding regional references, sports terminology, and idiomatic expressions that can elude even C1-proficient Philippine agents.

Cost premium: $18-$35/hr (Colombia) and $22-$42/hr (Mexico), representing 40-60% higher costs than the Philippine center outsourcing solutions.

Justification scenarios:

- Brand-sensitive customer service operations where accent neutrality matters less than cultural fluency

- Sales roles requiring nuanced persuasion and relationship building

- Companies with Spanish-language requirements alongside English

LeadAdvisors evaluates outsourcing destinations based on workload complexity, compliance exposure, and customer expectations—not cost alone. In many cases, hybrid models outperform single-country strategies.

One luxury retailer found nearshore premium services worthwhile after Philippine agents struggled with U.S. regional shopping culture references, which impacted their ability to strengthen customer loyalty through personalized recommendations.

Real Client War Stories: Lessons From the Trenches

Healthcare Client—From HIPAA Breach to Bulletproof Compliance

The initial mistake: A 200-physician telehealth network selected a budget provider ($11/hr) without conducting facility audits, relying solely on the vendor’s SOC 2 certification claim.

Timeline of failure:

- Month 3: Patient complained about receiving a marketing call mentioning a specific medical condition

- Month 4: Internal investigation revealed the agent accessed records outside the assigned patient panel

- Month 5: Philippine NPC notification triggered U.S. HHS review

- Month 6: $180,000 HIPAA settlement, $95,000 legal fees, immeasurable reputation damage

Recovery and lessons:

The client terminated the relationship and implemented a rigorous vendor selection process:

- Required providers to maintain dedicated HIPAA-compliant zones with biometric access

- Demanded quarterly penetration testing by client-selected security firms

- Implemented real-time monitoring of data access patterns with AI anomaly detection

- Negotiated $5M cyber liability insurance with the client as the named insured

New provider cost: $23/hr—nearly double the original rate, but delivering zero compliance incidents over 18 months while maintaining 91% patient satisfaction scores.

This scenario reflects challenges LeadAdvisors commonly encounters when onboarding new outsourcing clients after prior vendor failures.

E-Commerce Client—Scaling from 50 to 300 Agents in 90 Days

The opportunity: A direct-to-consumer brand’s viral product launch required 6x call center capacity during the Q4 holiday season.

What worked:

- Workforce availability: Philippine centers deployed 250 trained agents within 75 days

- Technology integration: Shopify and Klaviyo connected in 12 days using pre-built APIs

- Omnichannel readiness: Email, chat, and social media support launched in week one

What failed:

- Quality consistency: Agents from three different training cohorts delivered wildly different customer experiences

- Product knowledge depth: Complex product questions overwhelmed tier-1 agents, creating 45% escalation rates

- Peak hour coverage: Didn’t anticipate Pacific timezone concentration in customer base

Lessons for rapid growth:

- Negotiate quality score hold-harmless periods during ramp-up (60-90 days)

- Require dedicated training teams that scale proportionally with agent hiring

- Build 15-20% capacity buffer for unexpected volume spikes

- Implement tiered support structures from day one, not after problems emerge

Post-holiday optimization: Client reduced to 180 steady-state agents with sophisticated call routing that eliminated most tier-2 escalations, achieving 87% first-call resolution.

This scenario reflects challenges LeadAdvisors commonly encounter when onboarding new outsourcing clients after prior vendor failures.

Financial Services Client—AI Disruption and Contract Renegotiation

The plan: A credit union outsourced 120 FTE for member services, collections, and loan processing support.

The disruption: Six months into a three-year contract, the credit union deployed conversational AI that reduced tier-1 volume by 38%, leaving them contractually obligated for 120 agents they no longer needed.

Initial negotiation failure: The provider refused to accept a seat reduction, citing minimum commitment clauses and the training costs they had invested.

The breakthrough: The credit union proposed a hybrid model in which the provider managed the AI platform alongside a reduced human team (75 agents), creating a new revenue stream for the call center company while aligning costs with actual needs.

Results after 12 months:

- AI + human hybrid resolved 82% of inquiries (vs. 71% human-only baseline)

- Member satisfaction increased 16% due to faster resolution times

- The credit union saved 31% versus the original contract, provider maintained 85% of the expected revenue

- Provider gained AI management capabilities to offer other clients

Key contract language added: “Either party may request a biannual volume review if technology changes impact call volume by ≥25%. Parties will negotiate adjusted staffing within 45 days in good faith, with arbitration if agreement isn’t reached.”

This scenario reflects challenges LeadAdvisors commonly encounters when onboarding new outsourcing clients after prior vendor failures.

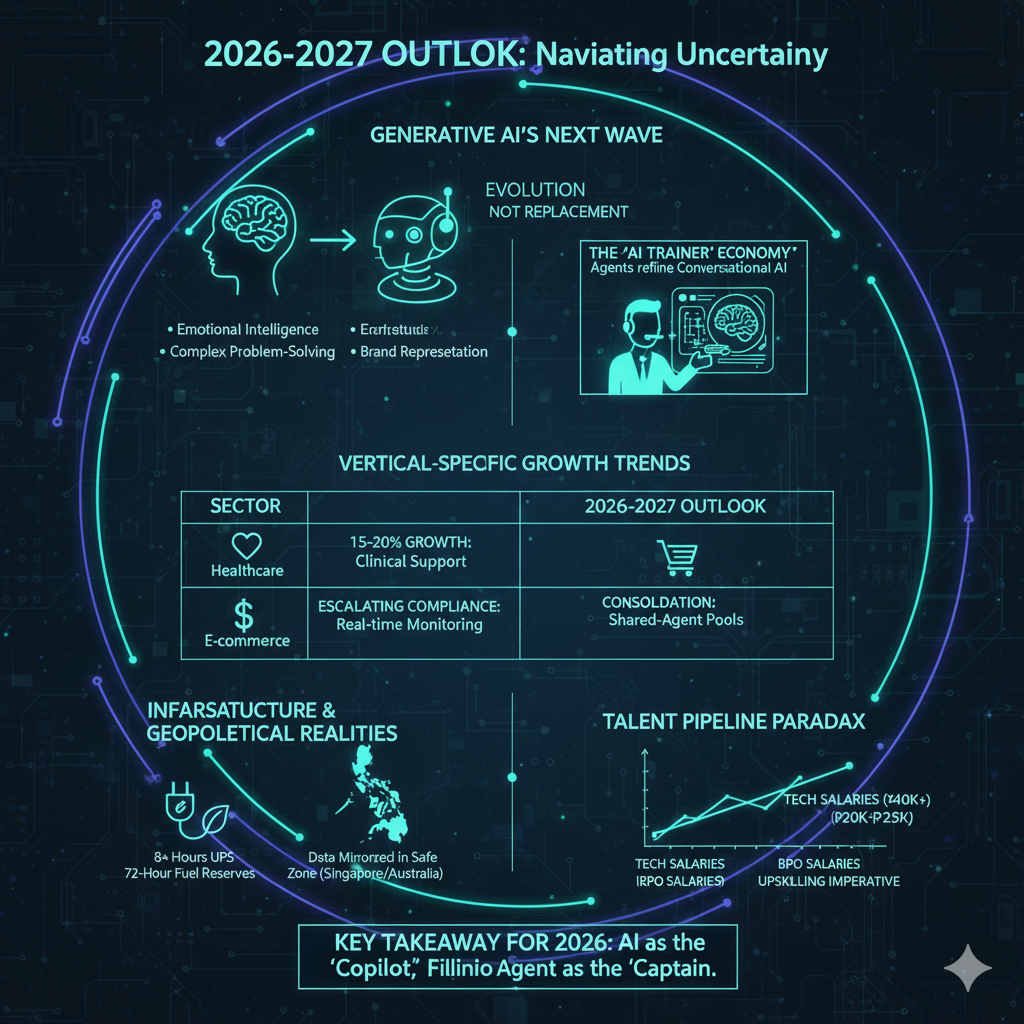

2026-2027 Outlook: Navigating Uncertainty

Generative AI’s Next Wave—Evolution Not Replacement

Will GPT-4+ voice agents eliminate tier-1 call center agents entirely? Industry projections suggest a 30-40% reduction by 2028, not wholesale replacement.

Why humans remain essential:

- Emotional intelligence during crisis situations (medical emergencies, financial distress, service failures)

- Complex problem-solving requiring coordination across multiple systems and departments

- Brand representation where customer relationships drive lifetime value

The Philippine call center industry is adapting through “AI trainer” programs where agents help refine conversational AI responses, creating new roles even as traditional positions decline. Forward-thinking centers outsourcing services now include AI quality monitoring in their offerings.

Your strategic response: Build contracts with annual volume reviews and flexible staffing commitments. Fixed three-year seat commitments make no sense in this environment.

Geopolitical and Infrastructure Wildcards

South China Sea tensions: While unlikely to directly impact call center operations, clients with strict data sovereignty requirements should verify backup data centers exist outside potential conflict zones. Tier 1 providers maintain multi-country facilities; Tier 2-3 providers often don’t.

Renewable energy transition: Philippine grid stability has improved, with typhoon-related outages averaging 4-6 hours annually in major BPO hubs (down from 12-18 hours in 2018). Providers should demonstrate:

- Uninterruptible power supply (UPS) systems supporting 8+ hours

- Generator backup with 72-hour fuel reserves

- Quarterly power failure drills with documented results

Talent pipeline sustainability: Philippine college enrollment in communication-related programs remains strong, with 180,000+ annual graduates entering the workforce. However, tech industry competition intensifies—software development roles start at ₱35,000-₱45,000 monthly, compared to ₱18,000-₱25,000 for entry-level call center positions.

What this means for you: Premium providers that invest in career development and competitive compensation will maintain high service quality. Budget providers will face accelerating turnover as talent shifts to higher-paying sectors.

Vertical-Specific Predictions Through 2027

Healthcare expansion continues: Regulatory telehealth expansion and aging populations drive 15-20% annual growth in medical call center services. Expect increasing specialization—not just HIPAA compliance, but subspecialty clinical knowledge (oncology, behavioral health, chronic disease management).

E-commerce consolidation pressures: As smaller DTC brands struggle with acquisition costs, demand for customer service operations may plateau. Winners will be providers offering flexible, outcome-based pricing rather than fixed seat commitments.

Financial services compliance escalation: Enhanced data protection regulations and AI governance requirements create opportunities for providers with robust operational efficiency and compliance infrastructure. Expect 10-15% premium pricing for truly compliant operations versus budget alternatives.

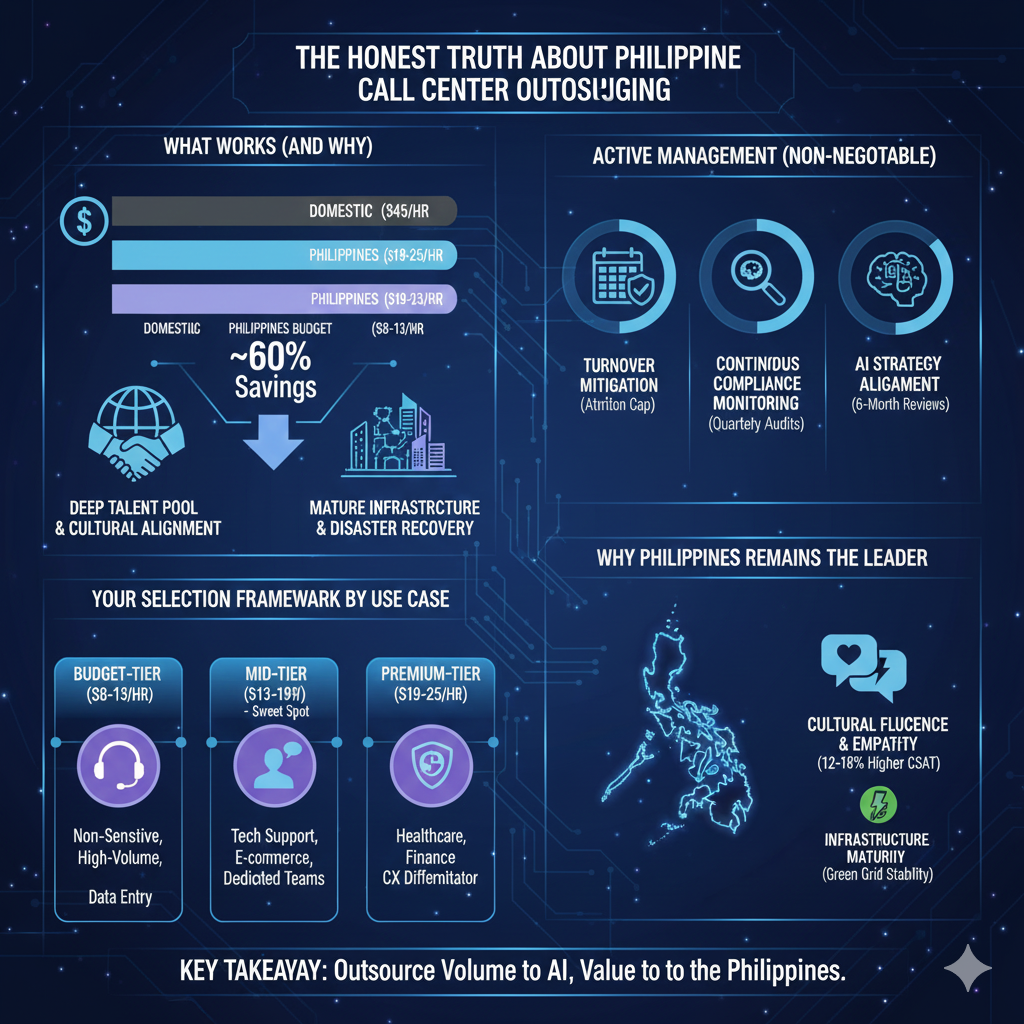

The Honest Truth About Philippine Call Center Outsourcing

What Works (And Why)

Cost savings of 40-65% remain real when you compare apples-to-apples: equivalent quality, similar technology, and comparable customer experience outcomes. That $15/hr Philippine agent delivers what a $45/hr domestic agent provides—if you choose the right provider tier.

A deep talent pool with cultural alignment gives the Philippine call center industry a sustainable competitive advantage over emerging competitors. Over 20 years of serving Western markets have created a workforce with an understanding of customer expectations that Thailand and Vietnam are still developing.

Mature infrastructure in major hubs means you’re not pioneering—you’re leveraging established BPO services ecosystems with proven disaster recovery, compliance frameworks, and technology integrations.

What Requires Active Management (Non-Negotiable)

Turnover mitigation through contractual discipline: Accept that some attrition is inevitable, but refuse to accept 60%+ annual rates as “normal.” Your contract language determines whether turnover becomes your problem or your provider’s problem.

Continuous compliance monitoring: ISO certifications and HIPAA attestations represent point-in-time assessments. Quarterly audits, surprise facility visits, and ongoing security testing should be contractual requirements, not optional extras.

AI strategy alignment every 6 months: Technology evolves faster than three-year contracts. Build review periods where you and your provider reassess volume, staffing, and tool deployment based on actual performance data.

Your Selection Framework By Use Case

Budget-tier providers ($8-$13/hr): Only appropriate for non-sensitive, high-volume transactional work where customer relationships don’t drive business value. Think: appointment confirmations, basic order status inquiries, simple data entry.

Mid-tier operations ($13-$19/hr): The sweet spot for most enterprises willing to invest in genuine partnership. You’ll get dedicated teams, reasonable attrition rates, and responsive management that treats your account as a significant revenue stream, not just another client ID.

Premium providers ($19-$25/hr): Essential for healthcare, financial services, or any brand where customer experience is a competitive differentiator. Yes, you’ll pay 60% of domestic costs instead of 25%, but you’ll get 90% of domestic quality—a trade-off that makes mathematical sense.

Frequently Asked Questions: Call Center Outsourcing Philippines

1. How do Philippine call centers handle multilingual support beyond English?

Many centers offer Spanish, Mandarin, Japanese, and Korean, but agents typically achieve B1-B2 proficiency rather than native fluency. Expect 15-25% premiums over English-only rates. Always request language certifications (DELE, JLPT) instead of self-reported skills. For native-level support, use hybrid models where Philippine centers handle English while nearshore partners manage other languages.

2. What happens during typhoon season, and how should I prepare?

Peak typhoon activity runs June-November with ~20 tropical cyclones annually. Require: geographically dispersed backup facilities (200+ km apart), SLA exemptions limited to documented weather events, and work-from-home capabilities for 30% of your team. Demand documented monthly disaster recovery drill results from premium providers.

3. How do I prevent agent poaching by competitors?

Protect your investment with: non-solicitation clauses preventing agent reassignment to competitors for 12-24 months, retention bonuses for agents completing 18+ months, and proprietary training material protection. You can’t stop agents from leaving the industry, but you can make it costly for providers to facilitate competitor moves.

4. What’s the real timeline for switching providers?

Vendors promise 45-60 days, but realistic timelines run 75-120 days. Weeks 1-3: knowledge transfer. Weeks 4-8: recruitment and training (where 60% of delays happen). Weeks 9-12: shadowing and calibration. Insist on 30-day overlap periods with both providers operating simultaneously to avoid service gaps.

5. How do I measure cultural fit beyond facility tours?

Join team huddles unannounced to see real interactions. Interview 5-10 agents with 2+ years tenure about why they stayed. Review Glassdoor/JobStreet for management patterns. Request internal employee satisfaction results, not just client metrics. Ask about handling ethical dilemmas—answers reveal if “culture” is real or marketing.

Frequently Asked Questions

What are the payment terms and currency considerations when contracting with Philippine providers?

How do Philippine labor laws and holidays affect staffing and operational continuity?

Can I transition my Philippine call center team in-house, and what are the legal implications?

What performance metrics beyond FCR and CSAT should I track for Philippine operations?

How do I handle intellectual property protection and confidentiality beyond standard NDAs?

Your Next Steps

The Philippine call center outsourcing decision isn’t whether to pursue it—the economics are too compelling. The decision is which provider tier matches your risk tolerance and quality requirements.

Start with the 90-day roadmap outlined above. Take month one seriously—most vendor selection failures stem from inadequate requirements definition and a lack of stakeholder alignment.

During month two, ask the 12 questions your competitors aren’t asking. Pay attention to what vendors won’t answer as much as what they will.

In month three, negotiate contracts that protect you from the two biggest risks: catastrophic attrition and inflexible volume commitments in an AI-disrupted environment.

The contact centers in the Philippines that will serve you best are already in place. You just need the right framework to identify them, the right contract language to protect yourself, and the right expectations to build a genuine partnership that delivers cost efficiency without sacrificing the customer satisfaction that drives your business forward.

LeadAdvisors supports organizations that treat outsourcing as a strategic function—not a cost-cutting experiment. If your business handles sensitive data, expects AI-driven volume shifts, or cannot afford service disruption, expert vendor governance becomes essential.