The sales cycle may be why your deals continue to stall or can get close.

You’ve got a solid product. Interest is there. Perhaps there are even a couple of demos on the schedule. Somehow, though, things sputter. I’ve been in that position, and it’s frustrating.

Fundamentally, the sales cycle is a set of repeatable steps that lead someone from uninterested to ready to purchase. When a proven path is clearly mapped out, your salespeople aren’t just winging it.

Side note: If (like most people) you’ve ever confused the sales cycle, sales process, and sales pipeline, you’re definitely not alone. The cycle is the timeline, the process is the playbook, and the pipeline is a tracker that shows where each deal stands.

If you master every stage of your sales cycle, the less friction there will be in your process, the more consistency you will enjoy.

What Is a Sales Cycle? (And Why It’s Not Just a Buzzword)

The sales cycle is not just a buzzword used in sales meetings – it’s the foundation of how deals are actually done.

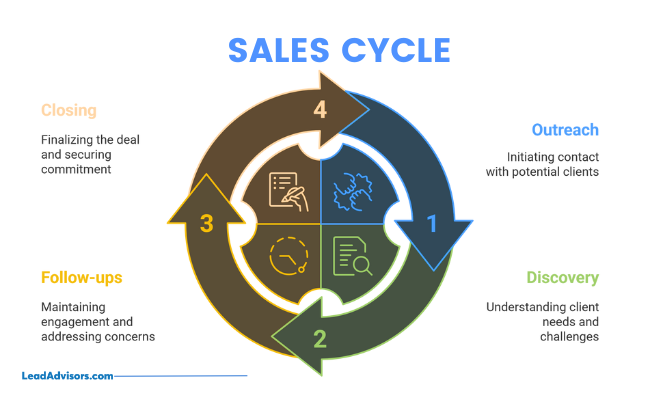

It’s pretty simple, really – it’s the full path your lead follows from the first expressed interest to the moment they sign the contract. Platforms that pros like Salesforce, Zendesk, and Yesware use have figured out how the sales cycle consists of repeatable steps such as outreach, discovery, follow-ups, and making the sale.

What makes it so powerful is how it maps to both sides of the equation:

- The buying process your customer is going through

- The internal actions your sales team takes to move the deal forward

And when you get it right? It helps increase sales velocity, gets your forecasts tighter, and makes coaching more impactful. Instead of wondering why deals are about to stall, you can see exactly where things have stalled out – and correct them before they careen off the tracks. This kind of visibility also helps refine your customer acquisition strategy, ensuring that every touchpoint aligns with what your buyers actually need.

So no, the sales cycle is not fluff. It’s your guide to selling smarter, not harder.

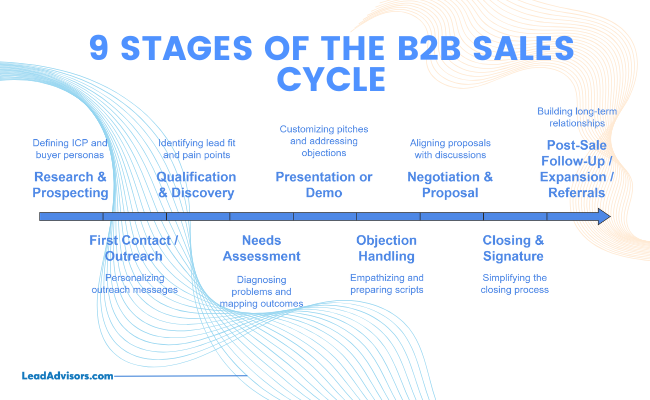

The 9 Common Stages of the B2B Sales Cycle

The B2B sales cycle typically has a similar structure from company to company. The language might vary a bit from platform to platform – Salesforce, Outreach, Zendesk, and Nutshell – but the framework remains almost entirely stable.

Why? Because this structure works. It enables sales teams to move in a goal-directed manner, parallel to the buyer’s buying process and ultimately, to close deals with reduced friction.

Let’s go through each phase and what it means.

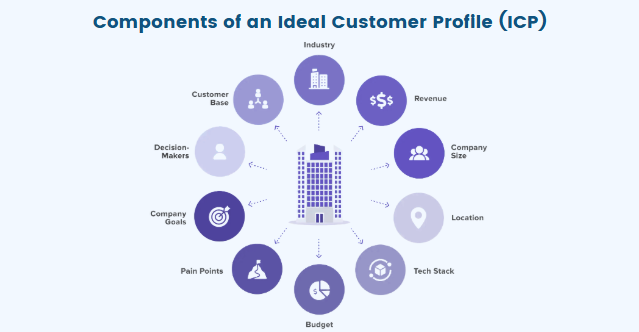

Research & Prospecting

Everything starts here. Before you put pen to paper, you need to know whose ear you’re in. That requires knowing who your target customer is and writing down what that person looks like. This is more than a checklist – it’s the wellspring for every message, pitch, and proposal you’ll make going forward.

I usually use tools like LinkedIn or ZoomInfo for prospecting, paired with my CRM to track activity and conversations. Referrals from existing customers are gold, by the way – they warm up your initial contact and help build trust right out of the gate.

Dock makes a great point: even a 1% improvement at this early stage can make a massive difference later in the sales cycle.

First Contact / Outreach

Now comes the moment of truth – your first touchpoint with a potential customer.

Whether it’s a cold email, a LinkedIn DM, or a well-timed phone call, this outreach needs to feel human. No generic templates here. You want to connect, not just contact.

Using tools like Outreach, Mailshake, or Yesware helps you personalize at scale. Better yet, platforms with conversation intelligence features can help you tailor your message to match the prospect’s behavior and level of awareness. To keep that momentum, implementing lead nurturing automation ensures your prospects stay engaged even when they’re not ready to buy immediately.

The goal? Start strong and keep the door open for real conversation.

Qualification & Discovery

Once you’ve sparked interest, it’s time to qualify. This is where you determine if the lead is truly worth your time – and theirs.

I like BANT or MEDDIC frameworks, but even a custom checklist can work. Ask about budget, timing, authority, and fit. Don’t be afraid to disqualify leads that clearly aren’t aligned with your offer. That’s not a failure – it’s part of smart sales cycle management.

From there, transition into discovery. This is where the listening starts. You’re not pitching yet – you’re uncovering goals, blockers, and real pain points. The best reps go beyond surface questions to learn what’s really driving the buyer’s search for a solution.

Needs Assessment

This stage goes even deeper. It’s not just about qualifying a lead – it’s about diagnosing the problem your product or service will solve.

Here, I use what I call the “Ask, Listen, Repeat” approach. You ask thoughtful, open-ended questions. You listen without jumping in. Then you repeat what you heard to confirm. This small rhythm builds massive trust.

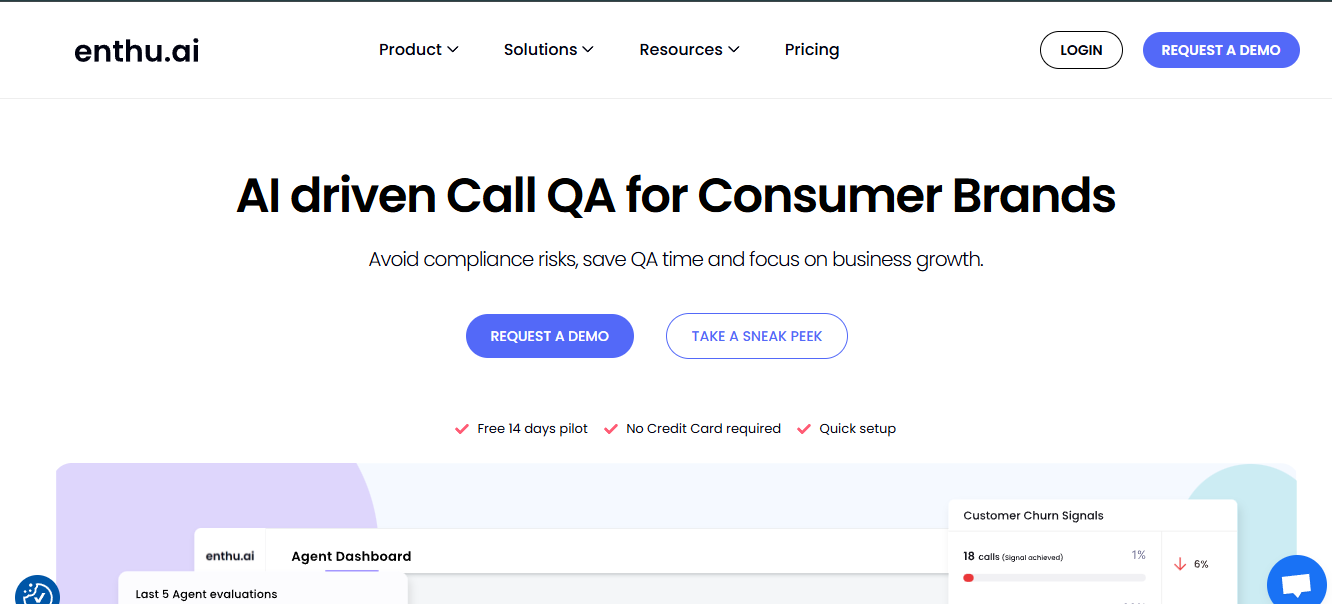

Tools like Enthu.AI can help you analyze call quality and pick up on signals you might miss in real time. What’s most important here is mapping their pain points to outcomes – ones your solution can actually deliver.

Presentation or Demo

Now you’re ready to present – but don’t make it a data dump. This isn’t about listing features. It’s about showing how your product or service solves the exact issues you’ve uncovered.

Every great sales pitch is buyer-centric. Customize your messaging, address key objections before they’re raised, and bring in tools like ROI calculators or tailored visuals. I’ve seen reps win deals simply because their pitch felt personal, relevant, and confident, not canned.

Remember, you’re not just selling software or tools. You’re helping someone solve a problem that matters to them.

Objection Handling

Objections are a natural part of the sales cycle, and they can actually be a good sign – they mean the buyer is engaged and thinking critically.

The key is to stay calm and lean into empathy. Common pushbacks often involve pricing, integration, timing, or internal approval. Rather than reacting defensively, treat each objection as a request for clarity.

Platforms like Zendesk and Nutshell recommend preparing scripts for the most common objections and role-playing with your team to build confidence. With the right tone and approach, many objections actually open the door to deeper commitment.

Negotiation & Proposal

By now, your sales team has built strong momentum, but this is where deals can still fall apart if you’re not careful.

Your proposal should be clear, concise, and aligned with everything discussed so far. Make sure you know who the real decision makers are and get ahead of any internal approval processes that might delay the close.

Some companies use digital sales cycle rooms to keep everything organized and accessible. This is a smart way to prevent last-minute confusion and show your prospects that you’ve got your act together.

Closing & Signature

This is it – the final stretch.

Whether you’re using an assumptive close, a takeaway close, or giving the buyer options to choose from, the most important thing in the sales cycle is to keep it simple. Send over the agreement with clear next steps and use eSign tools to remove any final hurdles.

If you don’t hear back immediately, don’t panic – just follow up. A quick reminder email can rescue deals that might otherwise fall through the cracks.

- Post-Sale Follow-Up / Expansion / Referrals

Here’s where most reps make the mistake of stepping back completely. But if you want to build long-term revenue, this stage is just as important as the others.

After the deal closes, the sales cycle resets with retention, upsells, and referrals. The handoff to your customer success team should be smooth, but it helps if you stay visible, check in, offer support, and keep the relationship warm.

Happy clients become your biggest advocates. They introduce you to potential leads, renew without resistance, and help you grow faster, without starting from scratch every time.

How to Shorten and Optimize Your Sales Cycle

Let’s face it – a long sales cycle can drain your team’s momentum and kill deals that should’ve closed weeks ago. I’ve seen it happen too many times. But the good news? You can absolutely tighten things up without rushing the sales process or sacrificing quality.

Here’s how I like to break it down:

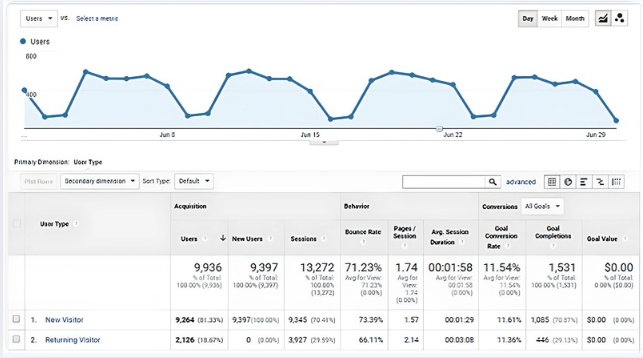

Step 1: Use Data to Spot Bottlenecks

Start by tracking where your deals tend to stall. Are most prospects going quiet after the proposal? Is the discovery stage dragging on too long? Tools like Yesware, Outreach, and Dock are great for visualizing how long each stage takes – and more importantly, where you’re losing traction.

Once you can see the slowdowns, you can adjust how your sales team moves through the sales cycle more strategically.

Step 2: Benchmark Your Sales Cycle Length

Not all deals are created equal. That’s why it helps to compare your average sales cycle length based on ACV (average contract value) and deal complexity.

A fast-moving product-led sale might wrap up in less than a month, while enterprise deals with multiple stakeholders and approval layers naturally take longer. The key is to set the right expectations for each type of deal and coach your sales representatives accordingly.

Step 3: Qualify Leads Better and Earlier

I can’t stress this enough – better lead qualification saves everyone time.

When you clearly define what makes a qualified lead, your team avoids wasting energy on contacts who were never going to buy. This step alone can shave days – or even weeks – off your average cycle length. Frameworks like BANT or MEDDIC help, but what really works is consistency and follow-through.

Step 4: Identify Decision-Makers Early

One reason deals slow down? Surprise guests.

If your sales reps aren’t speaking to buyers from day one, you may have to go back around mid-cycle to explain everything all over again. Ask your team to map out stakeholder roles during discovery and confirm who must be involved in the approval process. A bit of clarity here, and your sales cycle will be a lot more predictable.

Step 5: Automate Smartly

Sales reps shouldn’t waste time on routine tasks like checking in every few days manually.

That’s when automation tools within CRMs like Salesforce or Nutshell come in handy. Platforms like Dripify also deserve a look – our Dripify review explains how it helps automate and personalize LinkedIn outreach at scale. You’ll be able to set up intelligent follow-up sequences, reminders, and even nurture drips for deals that take more time to close.

This is the gas that maintains convo velocity without another high-maintenance staffer babysitting every email thread.

And when prospects go quiet? Perhaps a timely, automated follow-up is all that’s needed to re-engage these readers.

Step 6: Prioritize with AI-Based Lead Scoring

When you have a full pipeline, you may feel like you’re playing a guessing game about who to call first. AI lead scoring flips that on its head.

These technologies evaluate behaviors, firmographics, and historical customer data to show which among your prospects are the most likely to convert so that your team can focus your budget where it really matters. Concentrating on the right potential leads even reduces the length of your sales cycle and improves sales performance overall.

Ultimately, a shorter sales cycle isn’t about taking shortcuts – it’s about being more strategic, efficient, and proactive. With the right enabling tools and structure, you can keep your sales team moving faster, minimize friction, and ensure the momentum keeps going all the way through close.

Sales Cycle Best Practices from Industry Leaders

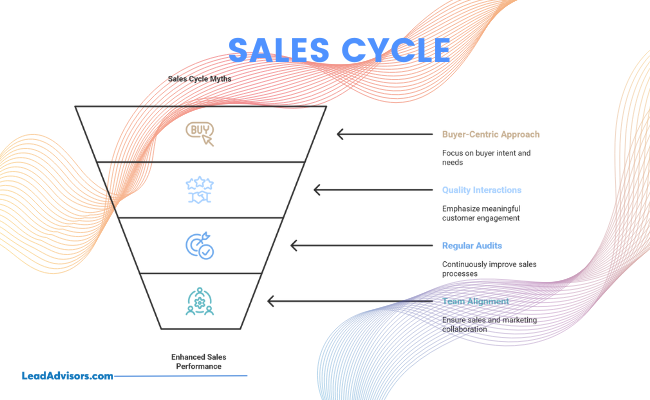

There are a lot of hypotheses out there about what defines a great sales cycle. But if we’ve learned anything from the pros – Outreach, Salesforce, Shopify – it’s that a successful sales strategy is frequently about breaking the mold. So let’s dispel a few myths and get real about what really works.

Myth #1: “Your Sales Cycle Should Follow a Fixed Internal Process”

Reality: The most effective sales cycles are designed to meet buyer intent, not what your team wants to do next.

Companies like Outreach start with collaborative Mutual Action Plans (MAPs), where buyers get joint custody of the sales journey. It’s not so much about shoving someone into a funnel as finding someone whose pace and mindset you sync with. That alignment minimizes friction, facilitates better communication, and allows you to close your target market and audience more quickly, while making zero-pressure sales calls.

Myth #2: “More Outreach Means More Wins”

Reality: It’s not about volume – it’s about meaningful prospective customer interactions.

Enthu.AI and Mailshake both say reps should be coached on the quality of their calls, not the quantity. However, listening skills, empathy, and the ability to stop what they are doing also help. A dozen thoughtful calls can outpace a hundred hasty ones – and produce better long-term sales results.

Myth #3: “If It’s Not Broken, Don’t Fix It”

Reality: Even a good sales cycle needs regular checkups.

Salesforce and Shopify constantly audit their sales processes to stay on top of shifting buyer behavior. What sold well last quarter may not work right now. Tools change, preferences change, and a new era of sales technology can streamline obsolete processes. That’s why applying business process improvement principles to your sales operations can uncover hidden inefficiencies and boost long-term productivity.

By reviewing quarterly, you ensure your sales organization is working at full capacity.

Myth #4: “Sales and Marketing Are Separate Functions”

Reality: Alignment is everything.

Potential clients know that your sales and marketing teams are disengaged when they are out of sync. Ambiguity about the message, mixed language, and confused positioning stall the momentum. The best teams build a combined strategy – same-page content, clear handoffs, and two minds (at least) about where the top and bottom of the funnel are headed. It makes it effortless for the buyer and creates great outcomes for everyone.

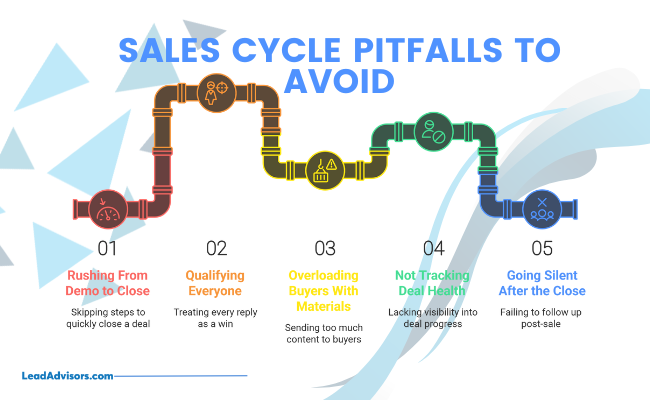

Common Sales Cycle Pitfalls to Avoid

Even with a solid sales cycle, it’s easy to fall into habits that quietly sabotage your deals. I’ve made most of these mistakes myself and watched others do the same. The good news? They’re all fixable once you spot them.

Mistake 1: Rushing From Demo to Close

I get it – you deliver a killer sales pitch, the buyer nods along, and you’re tempted to jump straight to “So, are we ready to sign?”

But skipping steps can backfire. Buyers need time to process, loop in multiple stakeholders, and feel heard. Pushing too fast makes you seem more focused on your pipeline than their priorities.

Fix it: After the demo, slow down just enough to reinforce their key goals, confirm alignment, and address remaining pain points. Then you can close the deal with confidence and fewer surprises.

Mistake 2: Qualifying Everyone (Instead of Qualifying Well)

Trying to sell to everyone feels like casting a wide net, but it usually just clogs your pipeline with poor-fit leads.

When sales reps treat every reply like a win, they waste time on prospects who were never truly qualified leads to begin with.

Fix it: Get sharper in your lead qualification. Use frameworks like BANT or MEDDIC to assess budget, timeline, authority, and actual need. It’s okay to disqualify a lead politely. In fact, it’s one of the best ways to speed up your sales cycle and improve focus.

Mistake 3: Overloading Buyers With PDFs, Links, and Decks

It’s tempting to “educate” buyers by sending many follow-up materials. But too much content becomes noise, especially when multiple people are involved in the decision.

Dock refers to this as “the dark funnel,” where stakeholders review shared documents in silos, form their own conclusions, and disappear without warning.

Fix it: Streamline your follow-up materials. Use one centralized resource (like a digital sales room) and guide your buyer through it instead of dumping everything at once. Less overwhelm, more clarity.

Mistake 4: Not Tracking Deal Health by Stage

Without visibility into how deals progress through each sales cycle stage, your team is working blind. You can’t improve what you’re not measuring.

Fix it: Review your CRM weekly to see where deals are grouped. Are they stuck in discovery? Drifting after the proposal? Tracking deal health by stage helps you coach reps more effectively and pinpoint where sales process improvements are needed.

Mistake 5: Going Silent After the Close

The contract is signed, the deal is done… and then nothing.

This is a missed opportunity. Happy clients are often the best source of customer referrals, future upsells, and repeat business – but only if you stay connected.

Fix it: Build a follow-up process post-sale. Schedule check-ins. Celebrate wins. Ask for referrals at the right time. The sales cycle doesn’t really end – it loops back through customer success and relationship building.

Avoiding these common pitfalls will not only make your sales team more efficient but also make your buyers feel more understood, respected, and supported. That’s what makes a sales cycle truly effective.

Tools That Power an Efficient Sales Cycle

A strong sales cycle is only as efficient as the tools backing it. The right platform at the right stage helps you save time, stay organized, and close smarter, not harder.

Here’s a quick look at the tools top teams use at each stage of the cycle:

Sales Cycle Stage | Tool Category | Examples | What It Helps With |

Prospecting | Lead Intelligence | ZoomInfo, Clearbit | Identify high-fit potential leads with enriched customer data. |

Outreach | Sales Engagement | Yesware, Outreach, Mailshake | Automate personalized outreach and track engagement across channels. |

Qualification | CRM + Call Intelligence | Salesforce, Enthu.AI, Nutshell | Manage lead qualification, log activity, and coach reps using real call insights. |

Demo / Presentation | Enablement + MAPs | Dock, Outreach | Create buyer-centric demos with Mutual Action Plans and tailored content. |

Close | Proposal + eSignature | PandaDoc, DocuSign | Streamline proposals and agreements to help close deals faster. |

Follow-Up / Post-Sale | CS + Marketing Automation | HubSpot, Intercom, Zendesk | Automate follow-up, onboard new clients, and strengthen customer success. |

These tools aren’t just “nice to have” – they’re part of how high-performing teams keep every stage of the sales cycle running smoothly, from initial contact to long-term loyalty.

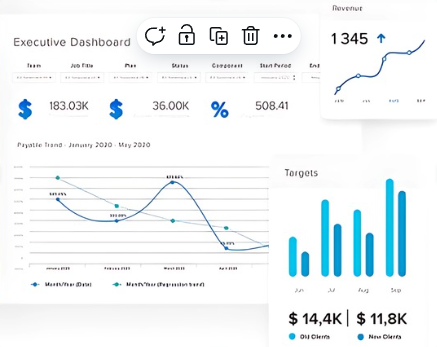

Sales Cycle KPIs to Track (and Why They Matter)

![]()

You can’t improve what you don’t measure – and when it comes to the sales cycle, that couldn’t be truer. Whether you’re trying to close faster, coach smarter, or scale bigger, keeping an eye on the right KPIs makes all the difference.

Here are the core metrics I track (and recommend you do too):

1. Average Sales Cycle Length

What it is: The number of days from initial contact to close.

Why it matters: Tracking your average sales cycle helps you spot where deals slow down. You’ll want to break this down by product or service, deal size (ACV), and even buyer segment. A small business sale shouldn’t take as long as an enterprise one with multiple stakeholders.

If your average cycle length gets longer without explanation, it’s time to investigate your sales cycle stages for friction points.

2. Conversion Rates by Stage

What it is: The percentage of deals that move from one sales cycle stage to the next.

Why it matters: High top-of-funnel activity is great, but only if it leads somewhere. This KPI shows you where you’re losing people, whether it’s during lead qualification, demos, or negotiation.

Use it to diagnose leaky parts of your sales funnel and guide coaching or content fixes.

3. Win Rate vs. Qualified Leads

What it is: The percentage of qualified leads that turn into closed deals.

Why it matters: This tells you two things: how solid your lead qualification sales process is, and how well your sales team executes after that. A low win rate with a high number of qualified leads might mean your messaging needs work, or you’re not aligning well with customer expectations.

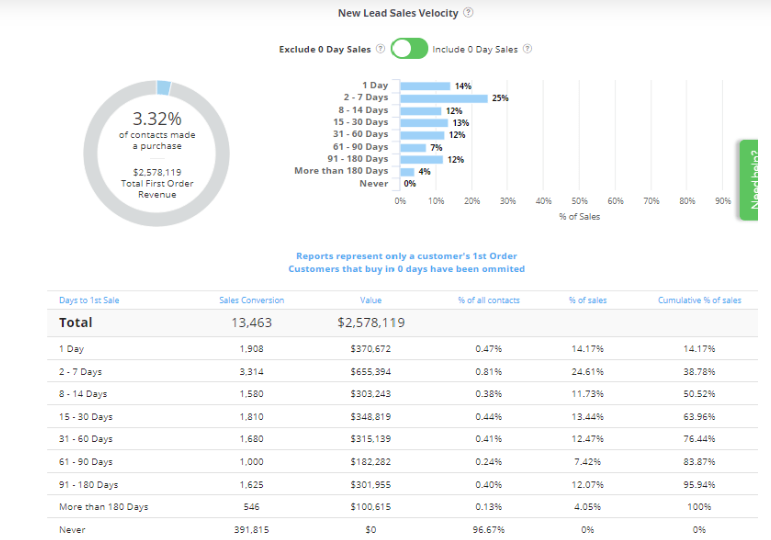

4. Sales Velocity

What it is: A formula that measures how quickly your sales team generates revenue.

Why it matters: It is a comprehensive measure that takes into account deal size, win rate, number of opportunities, and the length of the sales cycle, making it a single robust metric. This can be quite useful, for example, when predicting or standardizing rep performance across roles or regions.

In short, it tells you how fast your sales team is moving – and whether your pipeline is healthy.

5. Sales Rep Performance by Stage

What it is: A look at how individual reps perform across the stages of the sales cycle.

Why it matters: While one rep may excel in discovery calls, they find the negotiation process less than straightforward. Another may be great at demos but struggle with the follow-up sales process. Being able to break down performance stage by stage means you can coach more effectively and help everyone work on their weak spots.

For consistent evaluation, a structured performance review template can help you measure reps against clear, cycle-specific criteria.

When it comes to counting correctly, you’re doing more than counting – you’re making smarter moves. Monitoring KPIs will affect the numbers because your whole sales organization can work with greater clarity, focus, and confidence.

Frequently Asked Questions

What’s the difference between a short sales cycle and a long sales cycle?

How does company size affect the sales cycle?

What role does customer feedback play in improving the sales cycle?

How do sales teams handle deals that stall mid-cycle?

How does sales cycle management help with forecasting?

Final Thoughts: Don’t Just Map the Sales Cycle - Master It

At the end of the day, your sales cycle isn’t simply a to-do list – it’s your team’s engine for generating revenue. When it’s done well, it provides order, clarity, and consistency to every deal that you touch.

But true wizardry is achieved by remaining malleable. Buyers change, tools change, and what worked in Q4 might not work today. The best teams think of their sales cycle as a living organism – one that is constantly being tuned, tweaked, and refined.

So, try to sketch out your existing flow a bit. Where are the slow spots? What needs tweaking? Small changes can lead to quicker closes, better conversations, and bigger wins.

You don’t just want to know your sales cycle. You want to own it.